Top 15 Tech Trends to Watch in 2025

CB Insights annual tech trend report puts AI front and center!

CBInsights' tech trends report for 2025 is here and always a welcome read!

The report makes four big predictions in finance and four for AI that are on target and great reads that you won’t want to miss.

Below is my breakdown of the eight trends in finance and in AI. Go to the report for the other seven, which are all great reads.

My personal favorite is about AI Agents being readied for true machine-to-machine payments. This is precisely what CBDC is needed for!

👉TAKEAWAYS

𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗦𝗲𝗿𝘃𝗶𝗰𝗲𝘀

🔹 The cyborg wealth advisor

One of wealth management firms’ biggest opportunities with AI is to bring scale and speed to the ‘human element’ of advisory. Personalized client engagement is one of the most mature AI use cases in wealth management, where AI can augment financial advisors’ capabilities at every point of the wealth value chain. Wealth managers are cautious about AI outside the largest and most well-resourced firms.

🔹 AI agents are given money to spend

Agent-to-agent spending is now a reality, and crypto emerges as the first AI payment rail. Early movers Skyfire and Coinbase target agent-to-agent transactions to circumvent human identity verification required for bank accounts and credit cards. Agent trust layers will emerge as the first big market opportunity making machine-to- machine payments the norm.

🔹 Crypto takes more baby steps toward the mainstream

Crypto has returned to the conversation for executives, and stablecoins are a bright spot, highlighted by Stripe’s $1.1B acquisition of stablecoin payments platform Bridge. Despite the activity, the broader sector remains immature.

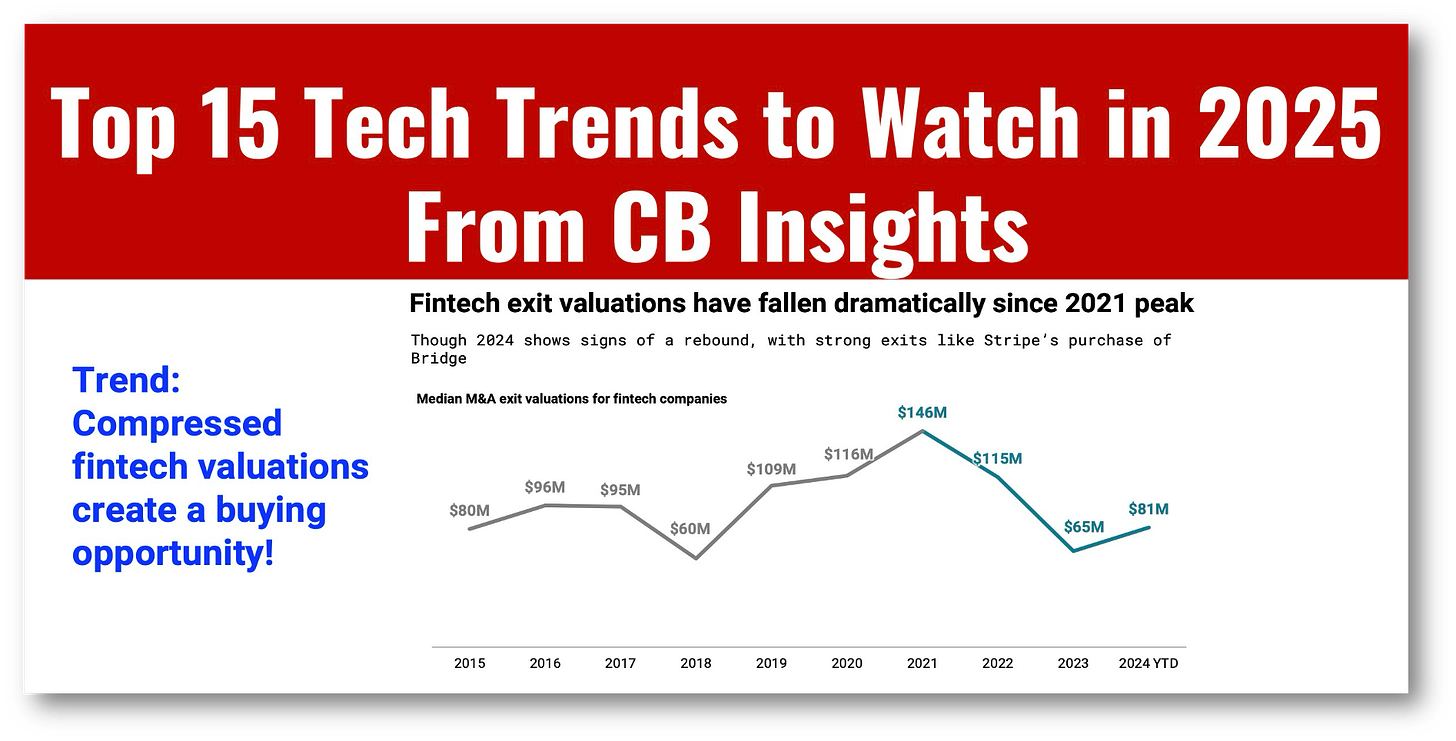

🔹 Compressed fintech valuations create opportunities for acquirers

Across VC, exit valuations on a per-employee basis have deflated since 2021. This isn’t just a market correction — it’s a shakeout of different tech types. 2024 acquisitions point to opportunistic consolidation as startups burn cash.

Artificial Intelligence

🔹 AI M&A fuels the next wave of corporate strategy

AI’s share of corporate tech M&A has doubled since 2020. Tech incumbents like Nvidia, Salesforce, and Snowflake, as well as consultancies like Accenture, are rapidly acquiring AI startups to tap into enterprise demand.

🔹 LLMs’ explainability moment

AI has a “black box” problem. Researchers are actively investigating techniques to understand why LLMs say what they say — and how we might better control them. Explaining model behavior is important for earning users’ trust — and critical for regulated industries.

🔹 Open-source cedes top LLMs but dominates smaller models

High compute costs, limited moats, and big tech competition have created a market ripe for a shake-up. Performance gaps are converging thanks to big tech efforts, though closed models maintain their lead. Proprietary models become more cost-effective for enterprise use. (see below)

🔹 The US is leading the AI arms race — for now

The US is running away with AI funding and AI talent is concentrated in the country, spurring a potential innovation gap between the US and everywhere else. China is the only global power likely to rival the US’ dominance in LLMs, especially on the open-source front. As nations prioritize AI investment to remain competitive, infrastructure providers like Nvidia will only grow in power.

My favorite chart showing how companies will soon build their own AI:

Please restack!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!