UBS says “We’re seeing a gradual erosion of the dollar,” while the Fed declares “nothing can rival the dollar.” You decide, but my take is don’t be fooled!

54% of central bank reserve managers are increasing RMB allocations.

All graphs are from the UBS “Annual Reserve manager Survey 2022.”

Fed quotes are from its report: “The US Dollar’s Global Roles: Revisiting Where Things Stand”

Both reports can be downloaded: Here

The Fed in denial

The Fed is in denial as though a gradual change, like a slow leak of gasoline from your car’s tank, is something that can readily be ignored. It can’t!

The UBS report author says it best: “The picture that emerges is one of a multipolar currency system.”

The Fed acknowledges the decline in dollar use from 71 to 59% in the last 20 years as shown by the IMF below. Its response is simply to state that the dollar “remains by far the dominant currency.” In essence saying: ‘there’s nothing to see here.’

I disagree with the Fed’s assessment and so do the IMF and the new UBS survey which clearly shows the coming changes that the dollar will face due to sanctions.

The IMF report “ The Stealth Erosion of Dollar Dominance” shows the gradual shift out of the US dollar over the past 20 years. The shift out of the dollar has been “one quarter a shift into the Chinese renminbi and three quarters a shift into other nontraditional reserve currencies.”

UBS Survey

The most stunning reveal from the UBS survey is that reserve managers now have a long-term RMB target allocation of 5.8% which is a doubling from the 2.9% they currently hold! While this isn’t a wholesale rejection of the dollar it shows that despite its flaws the RMB is taking on new users.

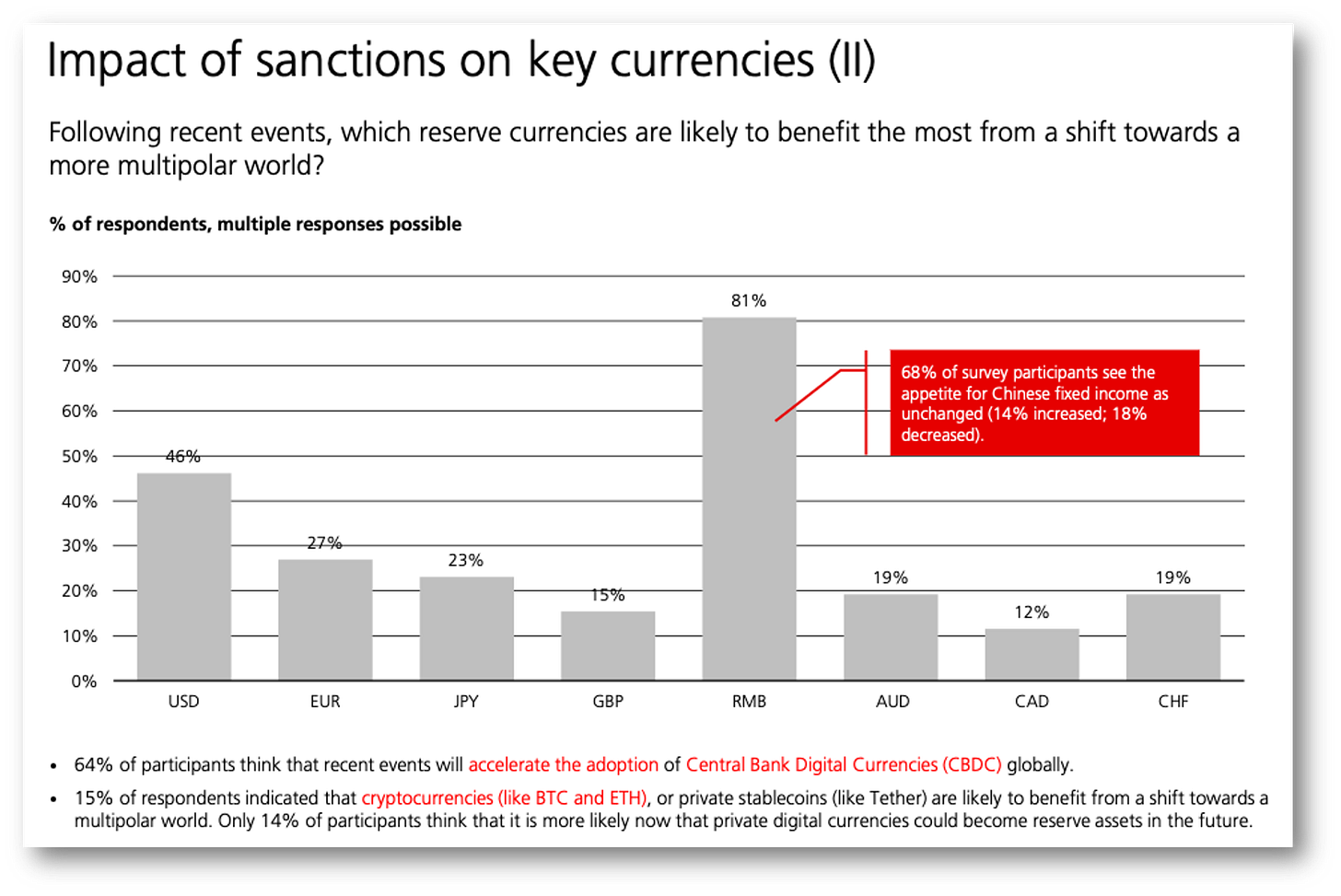

When asked which reserve currencies are likely to benefit the most from a shift towards a more multipolar world following recent events, 81% think that the RMB will benefit, and 46% the US dollar. (below)

Sanctions are having an impact on the perception that the dollar is “risk free.” Sanctions making dollar holding unusable is a new risk that has to be factored in to reserve holdings and pushes reserves into alternative currencies.

🔹Meanwhile, UBS reports that USD holdings were down from 69% to 63%. UBS explains that this is in part but not all due to sampling.

🔹 With 85% of survey respondents answered that they are invested, or consider investing, in the RMB, an increase from 81% in the previous year.

🔹 With the outlook strong for the future, 53% of reserve managers think that diversification to RMB is expected to continue.

Taking the UBS report as both real and credible, the Fed is either blind or disingenuous in ignoring the change in attitude toward the dollar. I think the latter.

Multipolar world

To show how the multipolar world is developing look at the changes in reserve managers' allocations.

A group of central banks is rotating out of dollars and into RMB: 62% were increasing dollar holdings while 31% were reducing them while 54% were increasing RMB allocations. (top graph on this page)

Now if you think the 31% reducing dollar holdings don't matter note how close it is to the 27% of central banks that fear that they could be affected by sanctions comparable in severity to those imposed on the Russian central bank!

This 27% group is hard to ignore and sees the dollar as a risky asset due to the possibility that their reserves might be sanctioned. The implications are that sanctions will decrease dollar use and increase RMB use. (Below)

37% of managers surved believe that the decline of the share of the USD in global reserves will accelerate. 40% believe that the share of the RMB in global reserves will rise faster than before sanctions.

CBDCs

CBDCs? 64% say sanctions will speed CBDC development! While the Fed, in a section clearly aimed at the digital yuan, says there will be no impact!

The Fed claims: “As stores of value, CBDCs don’t necessarily increase the attractiveness of their usage vis-à-vis the U.S. dollar.” I refute this claim made by many traditional currency analysts and their limited view of the benefits of CBDCs in my book"Cashless.”

From Cashless:

“With all due respect, this is where traditional currency analysts are getting it wrong. They see the digital RMB as nothing more than a repackaging of the RMB, without recognizing the digital ecosystem’s associated benefits.”

What the Fed is ignoring is that China’s CBDC was designed to add new functionality to the yuan through digitization. China’s CBDC ushers in not just a currency but an entirely new trade ecosystem that includes access to digital logistics and trade systems that will do for China what Alibaba did with mobile payment and e-commerce sales. As I say in “Cashless”: “Digital currencies don’t follow the rules. They make new ones.”

Time will tell, but what is clear is that the Fed is now forced to respond to the perceived threat of China’s digital yuan. CBDC!

Takeaways

None of this foreshadows a precipitous drop in dollar use so much as a slow leak.

I am not making a claim of dollar demise but agree with UBS which sees a multipolar currency world with dollar alternatives that are equally dangerous.

The Fed is ignoring the existing decline in dollar use clearly shown by the IMF and the impact of sanctions which are hastening the use of the yuan despite its obvious shortcomings.

The Fed is of course motivated to ignore these changes by self-interest, but that doesn’t mean you should.

In ignoring declining dollar use the Fed is essentially ignoring a slow leak of gasoline from its tank, just as it ignored inflation. There will be hell to pay with a blazing fire at a later date.

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my best sellers on Amazon: