Underwhelming: Russia's Proposed Cross Border DLT System for BRICS+ Dedollarization

Youtubers proclaiming a gold backed BRICS+ currency get it very wrong!

Russia’s Ministry of Finance released its proposed new cross-border payment infrastructure for next week's BRICS Summit in Kazan, and it underwhelms.

First, let me quash the wreckless rumors from YouTube and Crypto websites that predicted both a gold-backed BRICS currency.

Nothing in this document supports this assertion, and there never has been a credible claim that such a system was in the works—shame on them for promoting falsehoods that get a million views.

Russia proposes a new distributed ledger (DLT) cross-border payment infrastructure that is more cost-efficient and faster than SWIFT that is designed to foster mutual dependency that ring-fences participants from sanctions.

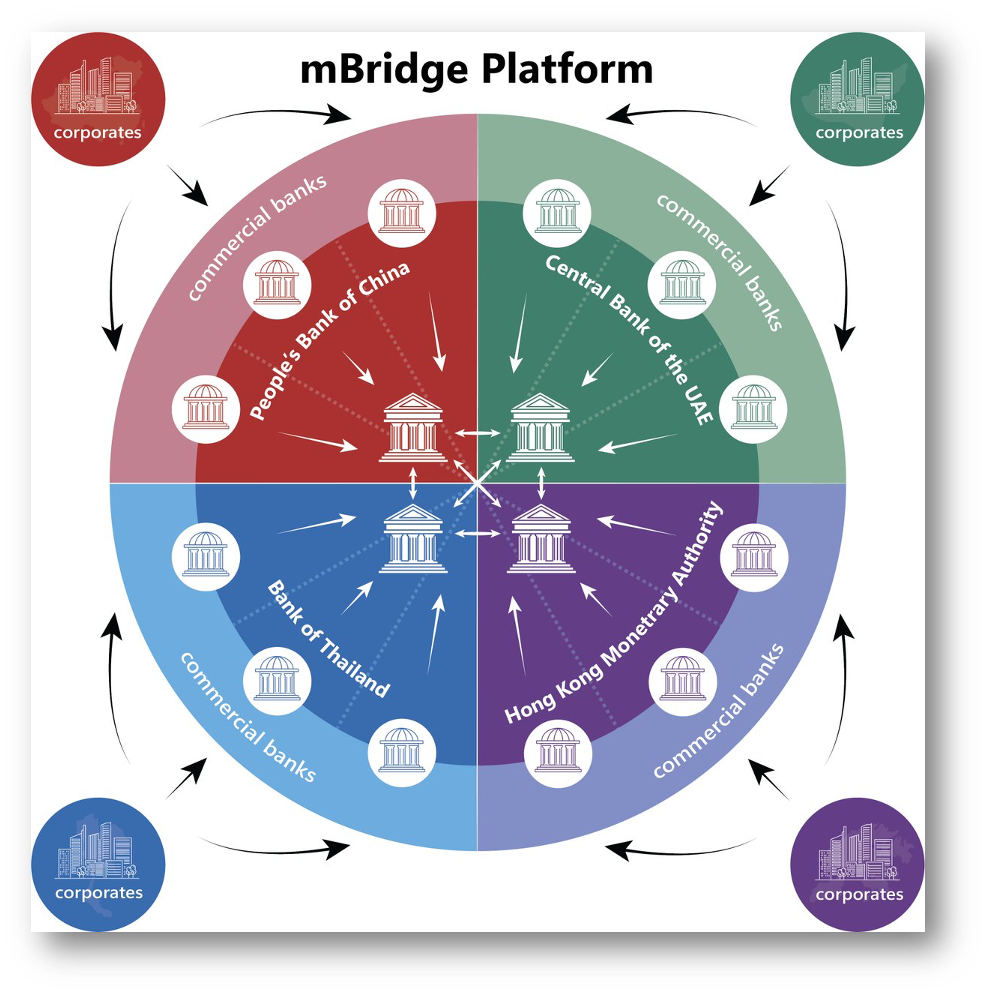

The reality is that Russia is proposing a new version of the mBridge developed by the BIS and other central banks in Hong Kong, and it will be tough to convince BRICS+ users why they would need yet another sanction-resistant cross-border system.

👉TAKEAWAYS

The current International Monetary and Financial System (IMFS) has reached its peak and needs improvements to better serve the evolving global economy.

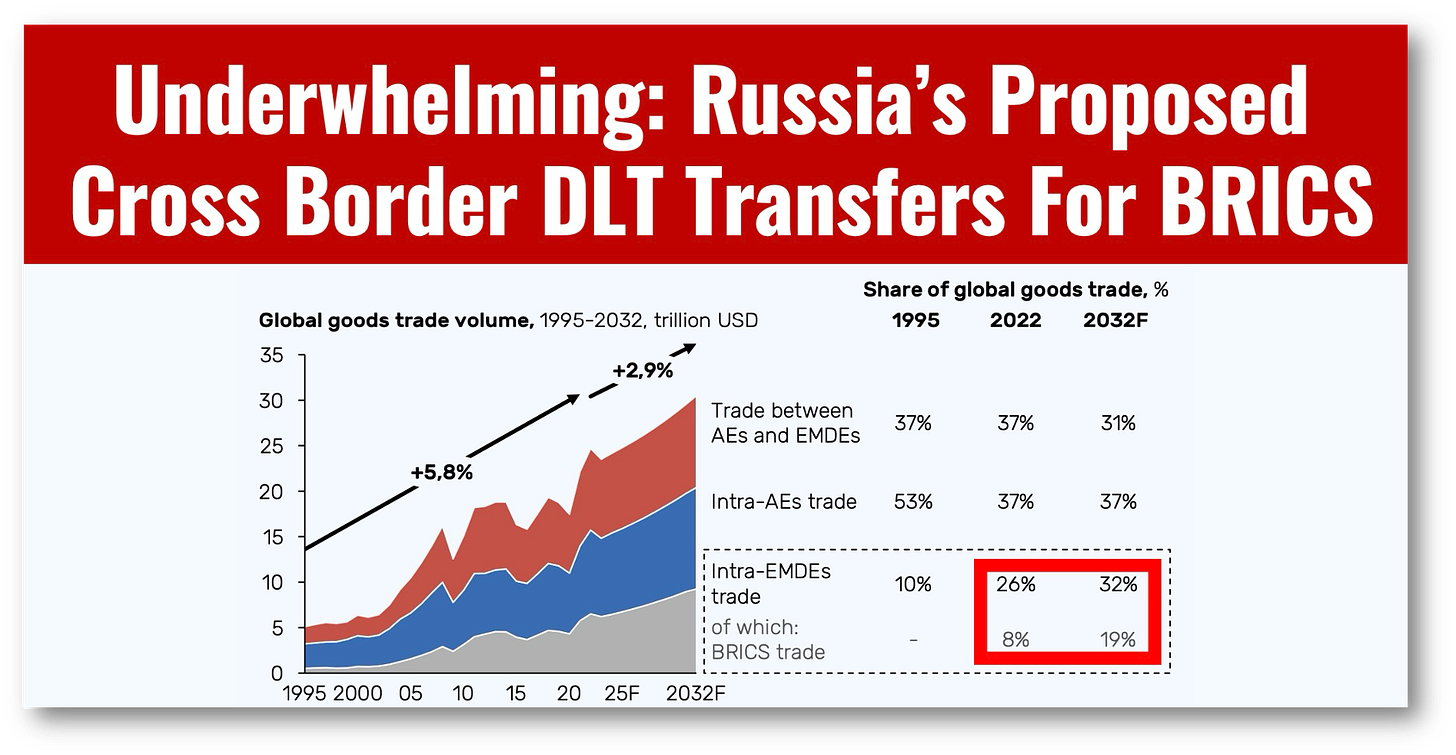

Global volumes of cross-border trade are increasingly tilting towards EMDEs; this dynamic, however, is not directly reflected in the sphere of cross-border investments.

IMFS must be adapted to better address challenges posed by the fragmentation of world trade.

The existing cross-border payments infrastructure lacks competition and,

therefore, the ability to adapt to its participants’ demands.

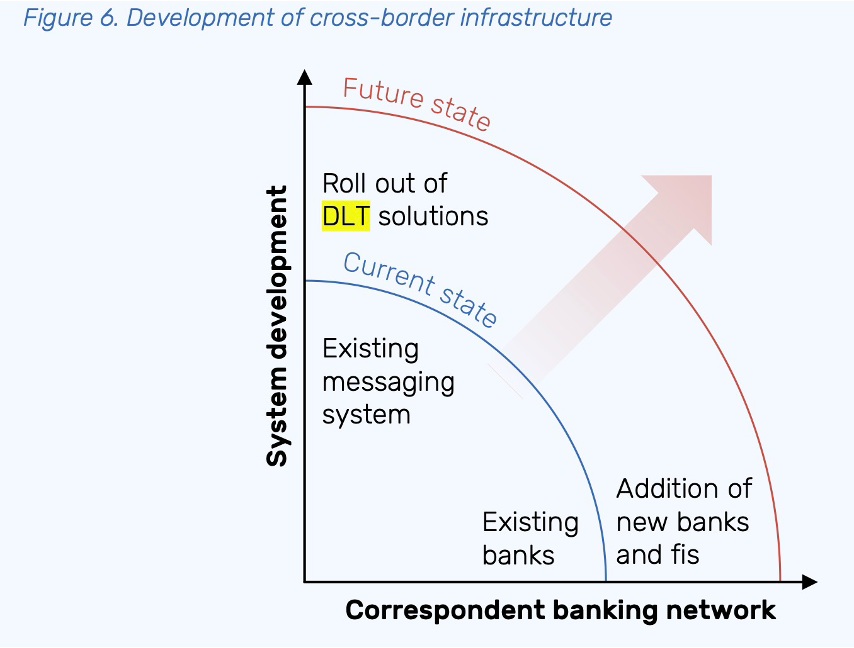

The future cross-border payments infrastructure could be developed along two

dimensions – the messaging system, and the network with a focus on settlement

in national currencies and in line with the proposed core principles.

Payments system could be protected from external influence by putting central

banks in the middle of transactions.

BRICS Cross-Border Payment Initiative (BCBPI) project offers a potential option

for cross border settlement.

To stimulate cross-border investment flow among EMDEs, efforts must be

directed towards exploring the possibility of creating an architecture that, due to

its size and depth, is able to effectively compete with the existing set up.

High concentration of US dollars as a component of sovereign reserves needs to

be reassessed on a sovereign level.

The current development funding model, predominantly utilized by EMDEs, puts them in a vulnerable position and must be reviewed.

👊STRAIGHT TALK👊

The best part of this document are the great statistics showing how BRICS nations will soon account for some one-third of global trade volume for goods and other statistics showing capital market flows.

Russia correctly states that the current IMFS does not fully serve BRICS nations. If you read through the report and ignore the harsh tone, some of the arguments are compelling.

Oddly, the paper does not mention mBridge, the BIS’s DLT cross-border payment system in Hong Kong that will go online in 2025.

While many readers may know mBridge as a CBDC transfer platform, it allows connections by central banks running “Real Time Gross Settlement” systems with instant payments. MBridge is also sanction-resistant.

Why would India or China, Russia’s leading trading partners, be compelled to use Russia’s proposed BRICS system in lieu of the nearly complete mBridge?

Russia’s proposal for an mBridge competitor is underwhelming, and it will likely receive lukewarm, face-saving support at the coming BRICS summit.

De-dollarization is real, but this won’t be the way forward.

Please restack!

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!

Share