Unstoppable: The Future Of FinTech In APAC

APAC's FinTech revolution started in China with WeChat and Alipay and won't stop.

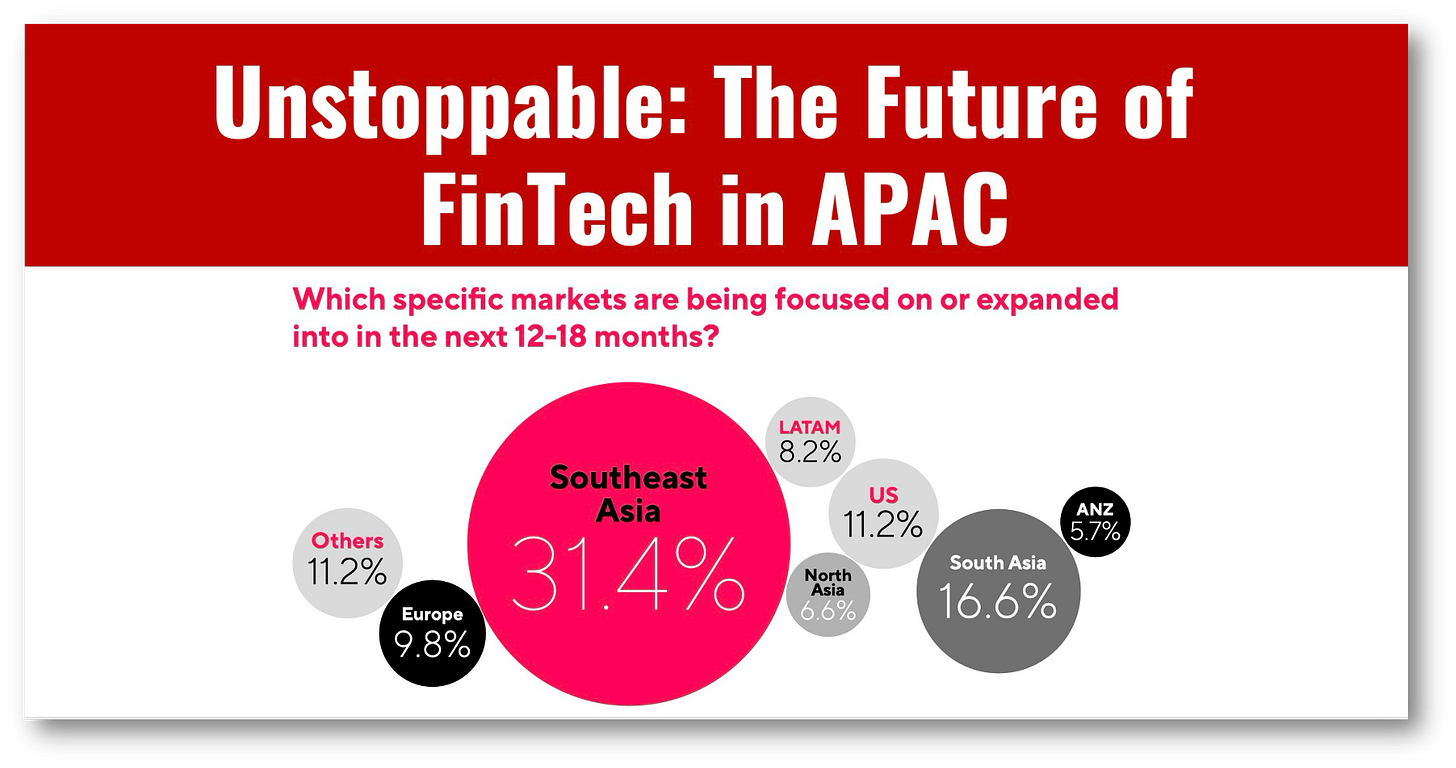

Money 20/20 looks at APAC and sees a remarkable transformation, driven by collaborative innovation.

That’s a fair assessment, which is why fintech in APAC is leading the world.

Still, the problem with all reports that discuss APAC as a region is that while the macro view may be wonderful, could the micro view of individual nations be more different?

Take Vietnam, Singapore, and Fiji as examples.

That is why one of the biggest challenges for fintech in the region is regulatory fragmentation, and viewing APAC in macro gives a distorted view.

If you enjoy this article, subscribe!

A payment solution like Grab, which works in Indonesia, is not guaranteed to work in Australia or Vietnam, nor is it guaranteed to be a superapp.

Despite these differences, one thing the region shares is low financial inclusion, which is driving regulators to collaborate with fintechs to close the gap and spur growth.

The best example of this collaboration is payments. APAC is the land of the QR code and is one of the fastest-growing regions for non-cash payments, with a 20.4% year-on-year growth in 2024, outpacing Europe (15.5%) and North America (6.4%).

Payments are just one example of collaboration helping to spur APAC’s fintech revolution, all of which started with China’s WeChat and Alipay back in 2014.

👉Hot Topics in APAC

Strategic partnerships driving payments innovation: Collaboration between FinTechs and traditional banks is reshaping payment solutions to meet the ever-evolving demands of consumers and businesses.

AI-driven credit scoring and financial inclusion: AI-powered credit scoring is unlocking lending opportunities for underserved populations, helping to drive financial inclusion and economic growth. Alipay invented this now it’s going pan-APAC!

Embedded finance and consumer accessibility: Embedded finance seamlessly integrates financial products into everyday platforms, offering greater convenience and increasing access to financial services. Can you say superapp?

Regulators supporting innovation in Asia’s fintech ecosystem: Regulators are adopting flexible frameworks and regulatory sandboxes to foster innovation, especially in digital assets and DeFi. Yes, because Singapore and Hong Kong’s futures increasingly depend on digital assets.

Hyper-personalisation in banking: Banks are leveraging data and AI to create tailored customer experiences, transforming loyalty and satisfaction in the financial sector. Where is this not a trend?