Visa goes “all-in” for DeFi in Asia, as the UN says crypto will not help developing nations

The ECB says CBDCs are the "only" solution for the digital age.

1. Visa goes “all-in” for DeFi in Asia

2. The UN says “no” to crypto in developing nations

3. ECB says CBDCs are the only solution for the digital age

“Chonggu Temple” located at the foot of the snowy peak of Xiannai in Yading national park. Situated at 3,900 m above sea level, the temple is a Yellow Sect (Gelug), of Tibetan Buddhism. Joseph Rock, the Austrian American botanist, stayed three days in the monastery (1920’s) on one of his southwestern China Expeditions, which made many believe that Yading Reserve is "Shangri-La".

1. Visa goes “all-in” for DeFi in Asia

Visa goes all in for #DeFi in the Asia Pacific region claiming 38% of Asia Pacific consumers are likely to use DeFi services in the next six months.

Download the Visa report: here

At first, it may be hard to square Visa’s enthusiasm for DeFi when Chainalysis estimates that $2 billion in cryptocurrency has been stolen across 13 separate DeFi cross-chain bridge hacks, so far this year. (Chainalysis article here)

Still, as I’m fond of saying it is important not to “throw the baby out with the bath water.” That Visa deems DeFi worthy of further analysis shows just how important DeFi’s commercial application will be despite these losses.

Visa claims that 21% of Asia Pacific consumers have used DeFi services and with crypto leaders like India, Thailand, Indonesia, and Vietnam in the total it seems likely.

Visa sees three key trends:

1️⃣ The acceleration of decentralized services:

Visa has both good and bad takes on DeFi’s adoption. For the good, it boldly proclaims that “as DeFi use cases are developed and consolidated, the integration of end-to-end solutions will be possible for financial institutions.” This shows how Visa believes that DeFi will transcend crypto and work its way into the norm, I think they’re right.

For the bad Visa boldly proclaims that DeFi will expand into the underbanked. In fact, the report leads with this claim. Why on earth would APAC underbanked populations use DeFi before using any of the digital wallets that are now common throughout the region? Visa is straining credibility but as digital wallets are Visa’s mortal enemy who can blame them?

2️⃣ Redefining financial business models

“With emerging DeFi use cases, business models for financial services will likely evolve to meet consumer expectations for lower fees and higher yield. While the overall impact of these new models remains to be evaluated, financial players can expect to see both benefits and challenges to accompany the shift.”

Here Visa nails it! If DeFi can bring about lower fees or higher yields to markets that are price sensitive then they’ll have a winner! This is exactly why I think DeFi has a big future.

3️⃣ A multi-party approach

Visa now goes in for the kill, putting DeFi not in the hands of the crypto community, but instead, in the hands of incumbent financial institutions.

“Financial institutions, being established leaders in risk management, compliance and fraud mitigation, have the opportunity to leverage their expertise to provide safe bridges for consumers to transact in DeFi.”

Institutions are unlikely to use traditional Ethereum based DeFi and will tend to use “permissioned DeFi” also known as “Institutional DeFi” or “CeDeFi”. For more on this please check out this great article on WTFi: “Permissioned DeFi: The Evolution of DeFi”

Takeaways

Visa’s plans for DeFi are clear, they don’t believe it’s a tool that will remain solely within crypto. Their plan is for banks and insurers to move in to create a new “safe and secure ecosystem.”

Despite the hacks and loss of billions of dollars on DeFi bridges it is important to see the real potential in DeFi when put in the hands of incumbent financial institutions.

Frankly, I think that this is exciting tech and it wouldn’t surprise me if DeFi, used by incumbents, takes off in APAC before the West.

2. The UN says “no” to crypto in developing nations

The UN drops a bomb on crypto’s use in developing nations slamming their "social risks and costs" in shocking clarity.

Download all three UNCTAD policy briefs: here

Not a day goes by when I don’t read how crypto will be the savior of developing nations by “crypto bros” who have likely never left the comfort of their mother’s basement. Here we have the UN slamming crypto and warning developing nations that “all that glitters is not gold.”

What makes the UN’s warning so important is that it is a neutral party when compared with the IMF, BIS, or entity with ties to the banking system. If crypto did help, the UN would be strong advocates, but they’re not. Let that sink in.

🔹Paper 100 “All that glitters is not gold” is a guide to diminishing crypto use:

• Require the mandatory registration of crypto exchanges and digital wallets and make the use of cryptocurrencies less attractive.

• Ban regulated financial institutions from holding stablecoins and cryptocurrencies or offering related products to clients.

• Regulate decentralized finance (such finance may, in fact, not be fully decentralized).

• Restricting or prohibiting the advertisement of crypto exchanges and digital wallets in public spaces and on social media.

🔹Paper 101 “Public payment systems in the digital era” shows why CBDC is the answer!

• To ensure that payment systems function as a public good, monetary authorities should carefully consider the implementation of a central bank digital currency.

• Authorities could alternatively create a fast retail payment system.

• Moreover, given the risk of accentuating the digital divide in developing countries, authorities should maintain the issuance and distribution of cash.

• A fast retail payment system operated by a profit-seeking private institution carries considerable risk unless it is strictly supervised.

🔹Paper 102: “The cost of doing too little too late” shows how crypto undermines developing countries!

• Financing for development requires that developing countries staunch leakages of financial resources, including leakages through a new channel – cryptocurrencies.

• Although cryptocurrencies may facilitate remittances, given the negative socioeconomic impact these private digital currencies bring about, countries should consider imposing higher taxes on them.

• Countries should redesign their capital controls to include flows channeled through cryptocurrencies to maintain their effectiveness.

Takeaways

The crypto world will rail against the UN’s conclusions but the UN has a lot more experience with the world’s poor than crypto bros!

This is the UN’s second warning about crypto, the first by the UNDP was even more scathing! Link to my LinkedIn post on this paper: here

Whom you choose to believe is up to you.

3. ECB says CBDCs are the only solution for the digital age

ECB report sees CBDCs as the only solution to guarantee a smooth continuation of the current monetary system in the digital age.

Cash use is declining in the EU, even in Germany, the most stauch supporter of paper money. So what comes next? Download ECB report: here

Credit cards offer one solution, but handing card fees totaling 1.4% of EU GDP to the credit card duopoly for an eternity seems expensive!

The left figure (A) depicts the evolution of card payments and ATM withdrawals per capita for the euro area over the period 2002‐2021. The right figure (B) plots the share of retail payments paid in cash, based on data from retail payment diaries in Germany and the Netherlands.

This ECB report on CBDC research makes for an interesting read. What I enjoyed most was that it clearly sets out why many of the claimed risks of CBDC issuance are overstated by the banking community. (see section 4.2)

4 Motives for CBDC introduction:

1️⃣ Public money as monetary anchor in a digital world

“Our current monetary system is based on the co‐existence of public money (“cash”) and private commercial bank money. ...In the euro area, overnight bank deposits currently account for more than 85% of total money supply. However, public money is crucial to the functioning of the two‐layer monetary system. Due to its nature as a central bank liability, it is the safest form of money, and thus acts as an anchor for the monetary system.”

2️⃣ Retaining monetary sovereignty

“The loss of monetary sovereignty can entail significant costs. First, it limits the effective conduct of monetary policy. Monetary policy transmits to the economy because prices are sticky in terms of the domestic currency. This is crucial for a monetary expansion to generate an increase in output rather than just a bout of inflation. ” (A topic crypto never addresses.)

3️⃣ Preserving privacy

"The proliferation of personal data as lubricant of the digital economy gives rise to privacy concerns. The results from the Eurosystem’s public consultation on a digital euro suggest that consumers have become sensitive to the use of data derived from digital payments.

The so‐called “privacy paradox” raises additional concerns. While consumers tend to attribute a high importance to privacy in surveys, they tend to give away their data for free, or in exchange for very small rewards in practice."

4️⃣ CBDC as a tool to address market imperfections

"A CBDC could address frictions in financial intermediation. CBDC reduces the effective market power of banks in deposit markets by providing an outside option to depositors. This forces banks to compete and raise deposit rates."

Takeaways

The ECB’s CBDC research will of course not assuage crypto aficionados who want to challenge monetary sovereignty and see fiat currencies as doomed. Given the absurd levels of debt issuance and overprinting who can blame them?

Still to say that crypto should take over the financial system and states should “let go” is delusionary, particularly in light of the recent crypto crash. I do acknowledge that regulated stablecoins will definitely be a useful alternative to CBDC and think the ECB is a bit dismissive of their potential impact.

I agree with the ECB that CBDC is the only way forward. Crypto will coexist with CBDC but expecting a government to give up its anchor currency and monetary sovereignty is absurd.

Thank you for reading!

More of my writing, podcasts, and media appearances here on RichTurrin.com

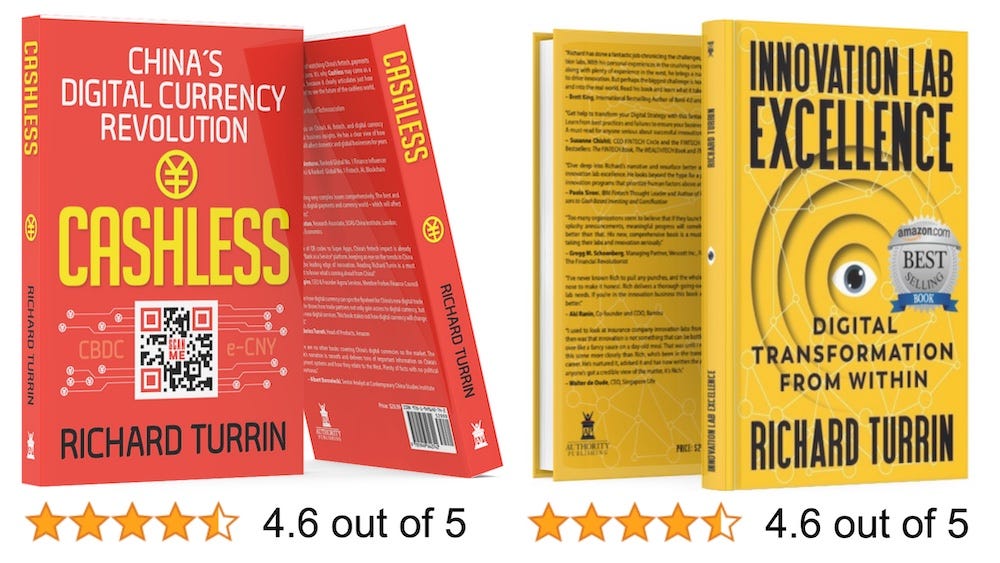

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Very clear and insightful as usual, Richard. Thank you

Great read,thank you!