Visa's e-HKD Collaboration: Innovation or Eternal Fees?

Visa looks at tokenization and finds a way to make you pay Visa forever.

Visa’s collaboration with HSBC and Hang Seng Bank in Hong Kong shows how tokenized deposits and the digital Hong Kong dollar (e-HKD) can save time and money in payments, but there’s a BIG catch!

First, even though I do not like this solution, it shows how Hong Kong continuously pushes the boundaries of fintech innovation. So, hat’s off to Hong Kong and, more begrudgingly, to Visa for focusing on a tokenized future.

So what’s the catch?

Visa, being Visa, designed a centralized system that routes every tokenized transaction through its platform so that it can take a cut of each.

This should sound a lot like Visa’s current credit card business model, in which all transactions go through its systems, and it takes a percentage.

So, while the trial successfully saved time and money, reduced settlement fees, and had 24/7 availability, it also ensures that we’ll be paying Visa for an eternity!

👉TAKEAWAYS

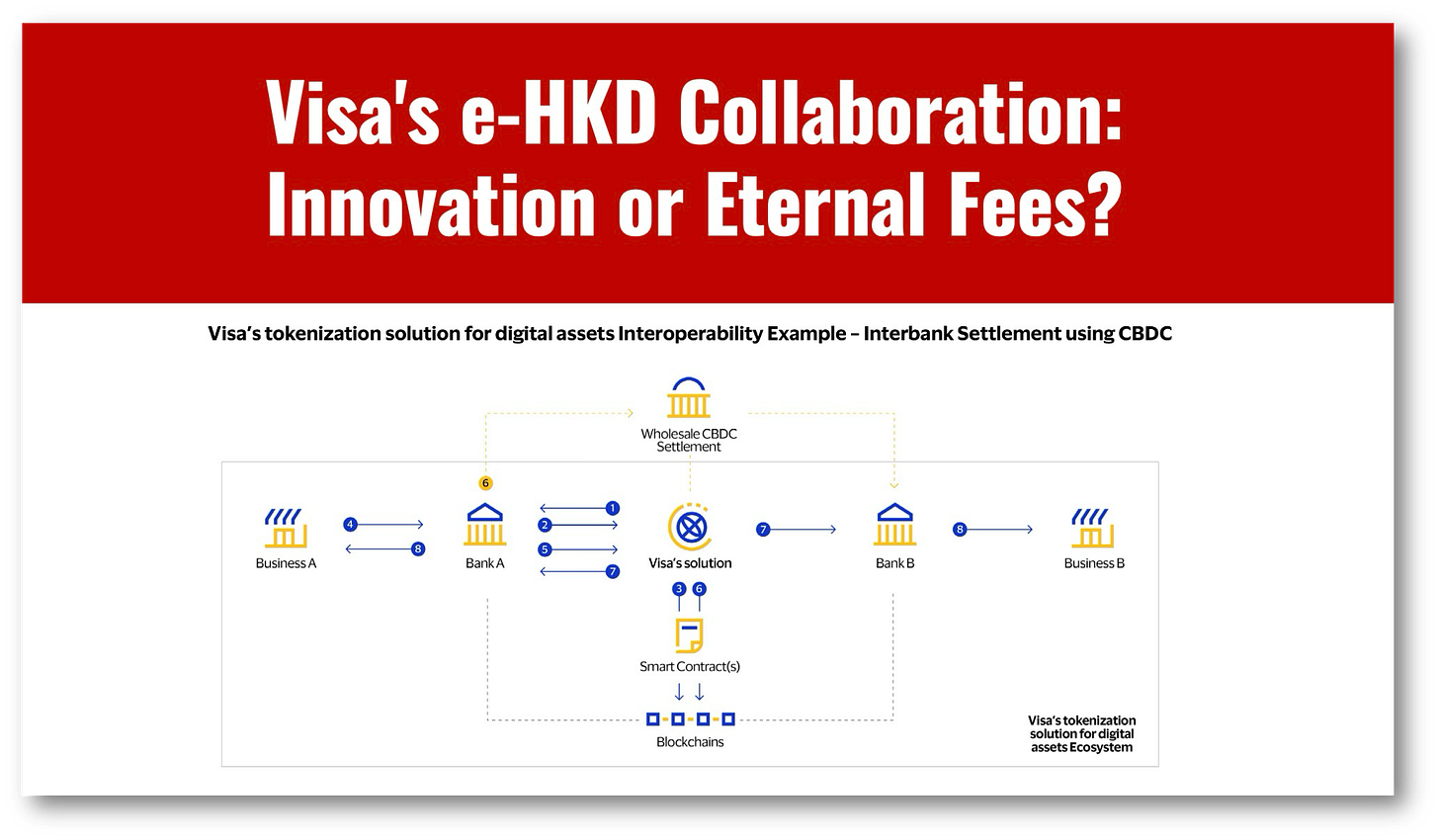

🔹 Visa’s system requires four critical components: minting, burning, e-HKD, and Visa’s centralized tokenization solution.

🔹 Minting: This process involves creating new tokens that represent real deposit values in a bank’s system. When a bank customer makes a deposit, the Visa tokenization solution for digital assets generates an equivalent amount of digital tokens, effectively “minting” new tokens.

🔹 Burning: This refers to the process of permanently removing digital tokens from circulation. It occurs when tokens are redeemed or withdrawn by the bank customer. The equivalent value of the tokens is returned to the bank customer in their chosen form (e.g., transferred to a traditional bank account), and the corresponding tokens are “burned.”

🔹 Upon a payment occurring from a customer at Bank A to a customer at Bank B, (see diagram above) the Visa tokenization solution for digital assets simultaneously burns the original customer’s deposit, mints a new deposit for the receiving customer, as well as moves the wholesale CBDC between Bank A and Bank B to accomplish final settlement.

🔹 In this system, tokens are not transferring actual value so much as numerically changing account balances (not the same thing). The e-HKD is used to transfer the actual value for “final settlement.”

👊STRAIGHT TALK👊

Do you want to pay Visa forever?

Visa has solid technology, but there is a mismatch between Visa’s desire to own the network and the capabilities of tokenization technology.

There is nothing wrong with Visa participating in tokenization technology, but building itself into the central clearing party for tokenized transactions is undoubtedly not a good use of tokenization technology.

What makes Visa’s design so odd is that it treats deposit tokens very differently from how most envision them. Typically, deposit tokens are bearer instruments, meaning that once received, they count as payment. They are actual money.

In Visa’s design, the token is a record of an account, which means that when a token is transferred, it is recorded to keep accounts, but it does not count as payment. Payment between institutions must be carried out separately by the e-HKD.

In my view, this seems unnecessarily complex, but I get why Visa did this.

In addition to Visa getting a lifelong lock on payments, these flows mirror those in existing bank systems, potentially making the transition easier for banks.

This system works. It brings “atomic transfers” and smart contracts to money transfers, but we need to sell our souls to Visa to get these benefits with this system.

I think we can do better.

What do you think?

Join our community by subscribing. You’ll be joining an exciting journey down the rabbit hole to our shared digital future—and you’ll be glad you did!

Subscribing is free, but I am increasingly honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

If you like what I write, and this newsletter has created value for you, and want to support my independent writing with a paid subscription, you have my heartfelt thanks!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!