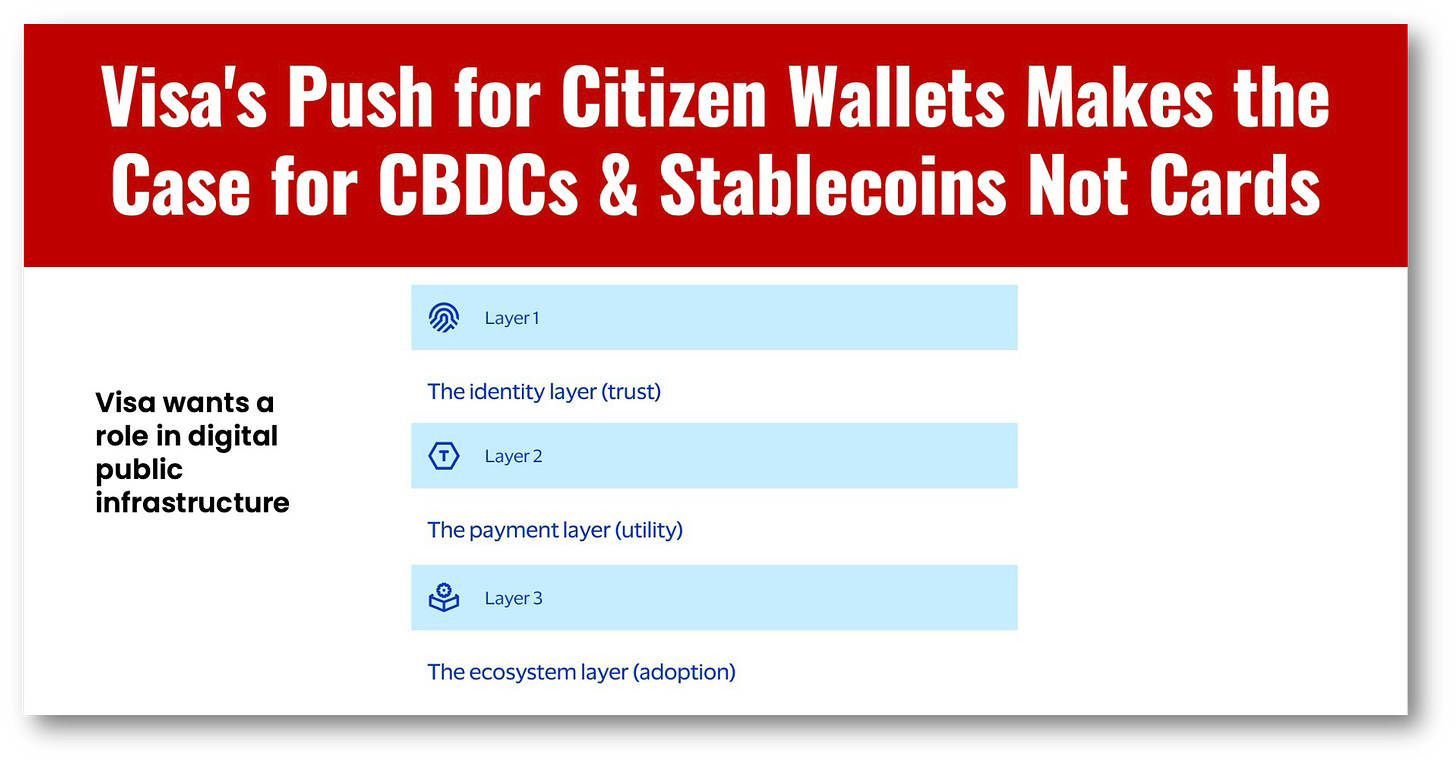

Visa's Push for Citizen Wallets Makes the Case for CBDCs & Stablecoins Not Cards

Thank you Visa for making the best case ever for CBDC and stablecoins!

This is my daily post. I write daily, but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

Visa makes the case that a “citizen wallet” and digital ID are foundational tools for modern government, and I couldn’t agree more, but think the wallet should have CBDC and stablecoins in it, not Visa!

Visa wants in on all tax payments and any spending to and from your government, and I agree with Visa that these payments should all go digital.

As Visa makes its case, however, they unknowingly make the best case ever for going digital with the digital euro in Europe, or stablecoins in the US!

Why should governments hand over trillions in payments to Visa so that they can shave a percentage off of every dollar or euro that gets transferred to and from governments on their network?

Let’s look at the US’s use of Visa and MC cards for unemployment benefits in a few US states through a program called “Reliacard.”

Total benefits are estimated to be in the tens of billions, while Visa/Mastercard’s share (assessments + interchange portion) is estimated to be tens to hundreds of millions.

Does it make sense why Visa wants in on government spending?

The US also runs a food assistance program that uses cards, but without Visa or Mastercard. In this program, card processors pull in an estimated $4-600 million annually on $120 billion in benefits.

Don’t think “Visa” for government payments, think instead of why we need free and immediate digital payments through CBDCs and stablecoins, both of which are superior solutions to Visa.

What I do like is that Visa recognizes the need for digital ID to secure the payments, and CBDCs and stablecoins both need this additional security.

At least on this, I agree with Visa. Not much else!

👉Citizen’s Wallet:

The EU digital ID and digital euro wallet will do all of these things!

🔹 Verify identity securely

The wallet allows citizens to prove their identity online or in person without revealing unnecessary information. For example, they can prove they are over 18 without showing their date of birth. This streamlines access while enhancing privacy and reducing identity fraud.

🔹 Access and share official credentials

The wallet could hold digital versions of medical prescriptions, driver’s licenses, educational diplomas or other official documents. A citizen can then share a verified credential with a third party — like a potential employer or landlord — with explicit consent, eliminating the need for physical copies and manual verification

🔹 Provide legal digital signatures

The wallet can facilitate legally binding digital signatures, allowing citizens to sign contracts or applications remotely. This can accelerate complex processes that have historically required in-person appointments.

🔹 Use case: disbursements

Disbursing social benefits, tax refunds or emergency relief via physical cheques can be slow, expensive, and prone to fraud. By incorporating digital payment capabilities in citizen wallets, authorities can expand opportunities to use fast, secure and fully auditable disbursement methods.

🔹 Use case: revenue collection

Collecting taxes and fees through manual processes creates administrative burdens and can lead to errors and delays. By enabling citizens to pay the government through their wallet with a single tap, agencies can take steps to improve compliance and streamline reconciliation through integrated payment systems.

HAND CURATED FOR YOU

🚀 Every week I scan thousands of articles to find only the best and most valuable for you. Subscribe to get my expertly curated news straight to your inbox each week. Free is good but paid is better.