Web3 spinning straw (NFTs) into gold, APAC's emerging giants, Credit cards lose ground to digital wallets

The ECB is making great progress on the digital euro!

1. APAC’s “emerging giants” push the fintech center of gravity East

2. Web3 spinning straw (NFTs) into gold

3. Credit cards losing ground to digital wallets!

4. The ECB is making great progress on the digital euro

Gustave Courbet (1819–1877), The Sleeping Spinner (1853), oil on canvas, 90.5 x 117 cm, Musée Fabre, Montpellier, France. Wikimedia Commons.

Like the spinner, Web3 seems asleep on the job and unwilling to confront real problems.

1. APAC’s “emerging giants” push the fintech center of gravity East

I always say that “The fintech center of gravity is moving East," and this APAC “emerging giants” report shows just how fast digital is transforming the region.

Watch China and India’s “emerging giants!” APAC is spawning these companies at a surprising rate, and it should come as no surprise that fintechs are on the top of the list of prominent industry sectors. KPMG & HSBC Report “Emerging Giants in Asia Pacific can be downloaded: here

The KPMG and HSBC report is a fun read! They studied over 6,472 technology-focused start-ups with valuations of up to US$500 million across 12 markets, then break them out by individual markets.

Asia Pacific is now the world’s fastest fintech adopter, attracting major investments and prompting governments to make major improvements in digital infrastructure.

In fact, somewhat surprisingly, the top two industry subsectors in APAC were NFT’s and DeFi taking No 1 and 2 slots. Note that APAC 's payment fintechs are mostly far beyond the “emerging giant” valuation limits.

How big is fintech? A quick look at the “Leading 20 Emerging Giants” for each country will show that a majority or near majority are fintech, it’s shocking.

The six key trends for Asia Pacific are:

1. Region-wide growth of technology-driven businesses:

While China remains the leading ecosystem in Asia Pacific for new economy start-ups, India is catching up as a source of digital innovation, and Southeast Asia is establishing itself as a key market.

2. B2C now; B2B soon

B2C companies, such as e-commerce and payments, are attracting the majority of investment in emerging markets, but more attention is shifting to B2B in areas such as enterprise productivity, education, healthcare and clean-tech.

3. Demographic drivers

A rising middle class and digital-savvy Gen Z consumers are driving digital economies across the region; with aging populations spurring innovation in markets like Japan.

4. Localized business models

The region’s distinctive societies, economies and regulatory environments are all contributing to the rise of “hyperlocal” business models in Asia Pacific.

5. Manufacturing spill-over

Robotics and automation are transforming factories, allowing companies in Asia Pacific to improve efficiency, traceability and transparency across their supply chains.

6. ESG on the rise

Increasing adoption of carbon emissions tracking, alternative and renewable energy and green finance solutions will create new opportunities for start-ups.

Reports of the death of tech in China are highly exaggerated! In 2021 China added 50 unicorns bringing its total to more than 300. But China cannot rest, India is coming on strong with its 100th unicorn in 2022. That said, China's total VC deal value for 2021 was roughly 3x that of India (pg 9).

What this means for you:

🔹Stop thinking of APAC as an “also ran.”

🔹APAC is going to hit the West hard with mobile-first tech that is simply going to change the world.

2. Web3 spinning straw (NFTs) into gold

The Brothers Grim, Rumpelstiltskin:

Good evening, mistress miller, why are you crying so?"

"Alas," answered the girl, "I have to spin straw into gold, and I do not know how to do it."

The little man took the necklace, seated himself in front of the wheel, and whirr, whirr, whirr, three turns, and the reel was full, then he put another on, and whirr, whirr, whirr, three times round, and the second was full too. And so it went on until the morning, when all the straw was spun, and all the reels were full of gold.

Web3 is like the story of Rumpelstiltskin, in that we are being asked to spin straw, in the form of NFTs, faulty DeFi bridges and crypto into gold. Maybe someone out there has the magic skills to do it but the reality is that much of the foundational technology upon which Web3 is being built is still severely flawed. That doesn’t mean that the tech can’t get better, it most certainly will, but the hype surrounding Web3 seems to exceed the reality and the time needed for this tech to mature.

Today I go “once more into the breach” and risk being called a Luddite or heretic by calling out Web3s flaws in this two-part BLOCKBUSTER.

Part 1: NFTs convey zero ownership rights

🔥“NFTs today convey exactly zero ownership rights for the underlying artwork to their token holders.”🔥 Surprised? Don’t be this is crypto where hucksters rule!

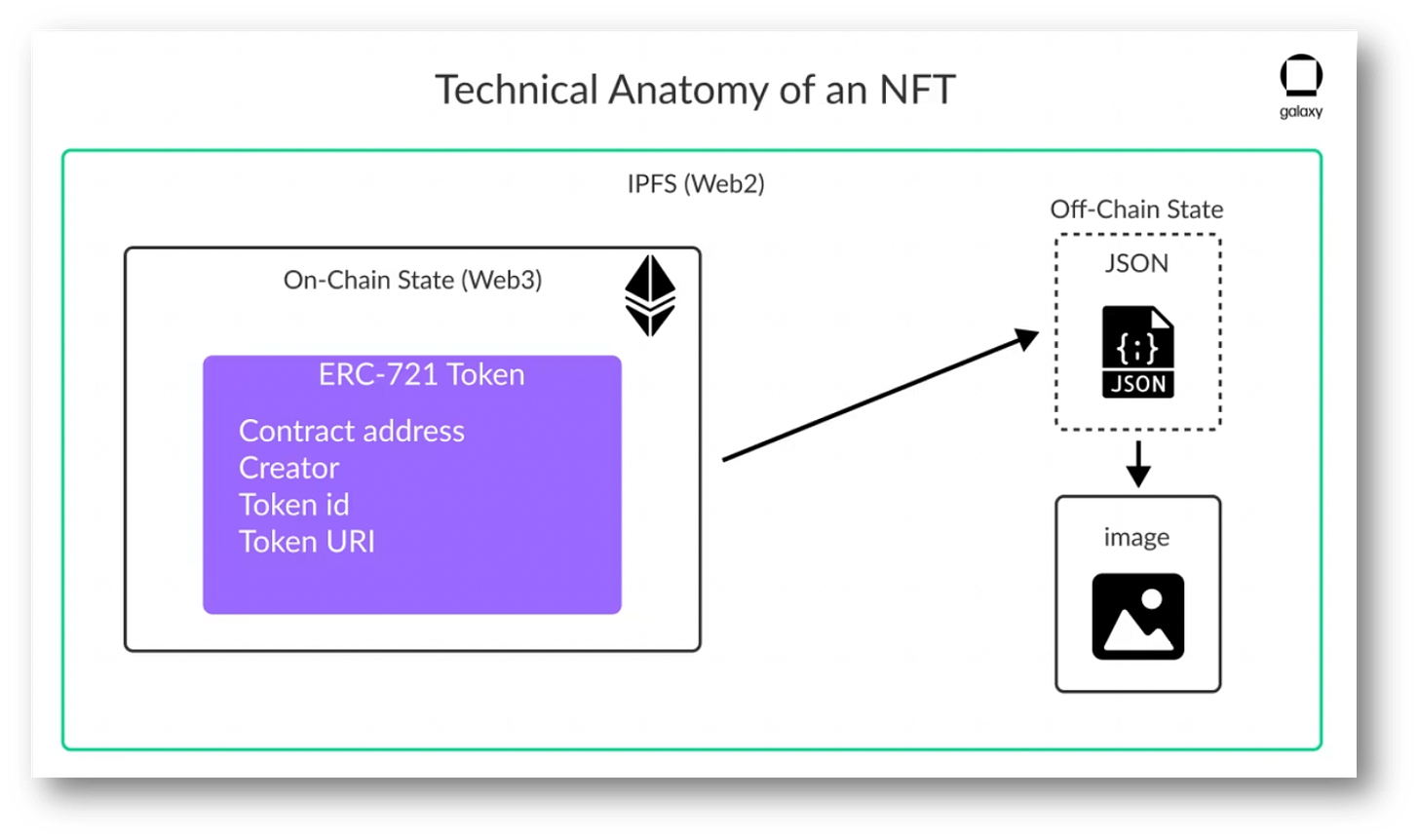

NFTs are composed of two parts, a digital token and a license which governs rights to an off-chain digital asset. It comes as a surprise to many that token ownership does not convey rights to the digital asset and that access to the digital asset is by no means guaranteed by token ownership. Download the Galaxy report, “A Survey of NFT Licenses: Facts & Fictions” and a second article “Can you truly own anything in the metaverse?”: here

This dynamite report by Galaxy directly contradicts the narrative that NFTs will be the building block for Web3, and the future of IP.

Don't blame yourself if you thought NFTs were the future, with so much hype by hucksters and crypto billionaires it's not your fault.

Some may recall that Galaxy is owned by Mike Novogratz the billionaire who got a Luna tattoo on his shoulder. He pumped now failed Terra to an unsuspecting public while his firm Galaxy was dumping its Terra holdings! True to form, Mike now pumps NFTs while his firm shorts!

Key takeaways:

🔹 The vast majority of NFTs convey zero intellectual property ownership of their underlying content (artwork, media, etc.)

🔹 Many issuers, including the largest Yuga Labs (Bored Ape Yacht Club), appear to have misled NFT purchasers as to the intellectual property rights for the content they sell.

🔹 Only one NFT collection in the top 25 by market capitalization even attempts to confer intellectual property rights to the purchasers of their NFTs (World of Women).

🔹 The Creative Commons license, while seen as a solution to the restrictive licenses used by most projects, renders NFT ownership obsolete from a legal perspective as it moves the intellectual property fully into the public domain, making it impossible for NFT holders to defend their ownership in court.

🔹 Without improvements in the on-chain representation and transfer of intellectual property rights from NFT issuers to NFT token holders, the expansive vision of Web3 will remain unrealized.

Now look at the second article which analyzes the law:

🔹 NFTs purchased and the digital goods received are almost never one and the same. NFTs exist on the blockchain. The land, goods and characters in the metaverse, exist on private servers with inaccessible databases.

🔹 Terms of service allow platforms to legally delete or give your items away by delinking the digital assets from their original NFT identification codes.

🔹 Even though you may own the NFT that came with your digital purchase, you do not legally own or possess the digital assets themselves.

🔹 Many NFT and metaverse platforms – reserve the right at its sole discretion to terminate your ability to use or even access your purchased digital assets.

What matters to you:

NFTs in their current state are not fit for Web3 or the metaverse and it's not just me saying this!

“The lack of IP rights undermines grand pronunciations by NFT and Web3 promoters that this technology will revolutionize digital ownership.”

Part 2: Cutting through the Web3 hype

🔥 MUST READ🔥 This irreverent, funny, and beautifully illustrated take on Web3 is the best I’ve ever seen, cutting through the hype and “self-referential BS”!

Brian P. Christie and the team from Brainsy, Inc. wrote the definitive skeptics guide to Web3. It is a masterpiece and a MUST-READ. According to Brian: “The format was "inspired" by the 56 page a16z "State of Crypto" report which throws around techno jargon but does a poor job of defining "Web3." Download the Brainsy report “Web 3 defined:” here

Not a day goes by when I don’t read about the near-mystical powers of Web 3. If I believed everything I read, Web3 is not only going to disrupt everything but maybe even cure cancer along the way.

“My take is that the hype for web3 makes the blockchain hype of 2017 seem tame by comparison.”

Follow the money. Web3 is now so big that according to CB Insights, in the blockchain space “57% of all new funding went to web3 startups.” “Funding shifted away from centralized crypto exchanges and wallets toward non-fungible tokens (NFTs), gaming, decentralized finance (DeFi), and DApp infrastructure and development.”

Into this feeding frenzy wades Brian P. Christie and the team from Brainsy, Inc. with this irreverent take on Web3 that provides a perfect counterpoint to the hype.

For the record, I don’t hate Web 3, NFTs, the Metaverse, Crypto, DeFi, or Blockchain. All of these technologies have their time and place and when used properly will be important elements of our digital future.

I do, however, hate the hype that has gotten out of hand, especially in light of the recent crypto crash which showed systemic corruption. This is so much an issue that I’ve been presenting a fair amount of content that some view as overtly negative.

My writing on NFT’s (above) is a prime example. NFTs are a building block of web3 that are demonstrably not yet fit for purpose. I presented this on LinkedIn with the goal of dialing back the hype so that we all face the reality that many of these new technologies are not yet fit for their stated purpose of "disrupting society."

Many of these technologies likely will someday transform our world, but for now, most are experiments. The sad part is that these experiments have real human guinea pigs who as we’ve seen with Terra can lose their life savings.

What matters to you:

Brian and team with one of the most succinct and useful definitions of Web3 yet:

“Web3 is an equitable version of the web built on the pursuit of three core principles including:

🔹 direct rewards for participants,

🔹 democratic governance, and

🔹 shared ownership in an initiative or enterprise.”

Note that these principals do not have crypto or blockchain in them. Not that these technologies are bad, they most certainly aren't, but if Web3’s principal task is to promote crypto I think we’re short-changing ourselves, and society.

When building Web3, it is important to understand that crypto, blockchain, and NFTs must all serve these core principles, not not the other way around.

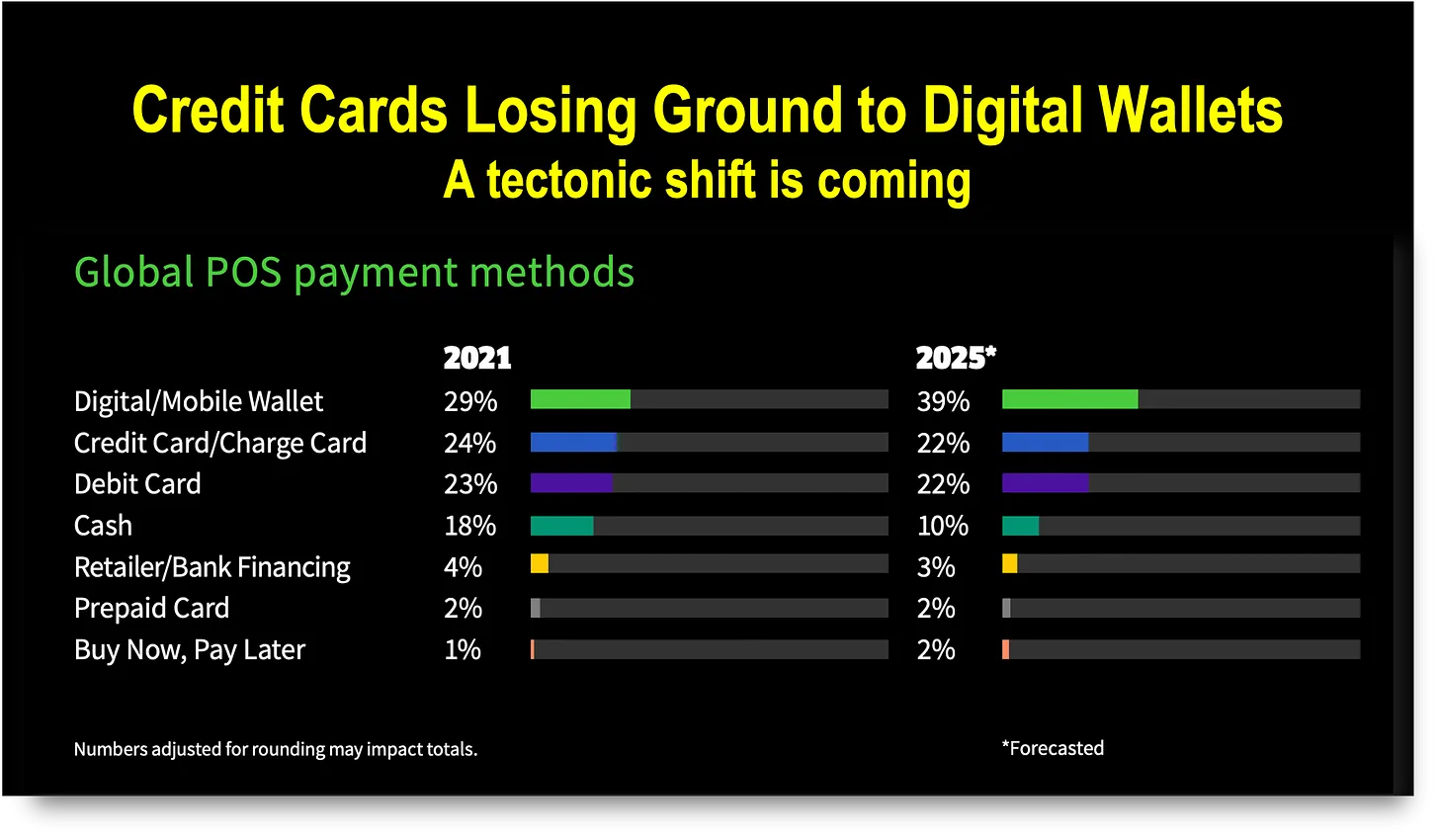

3. Credit cards losing ground to digital wallets!

Summertime and the livin' is easy, but not for the credit card duopoly!

A major change in how we pay is coming that will hit credit card fees hard, card companies should brace for the impact, because the glory days of the card duopoly are over.

Long-form article!

4. The ECB is making great progress on the digital euro

The ECB is making great progress on the digital euro and some of the features are starting to become clear, though no tech details on privacy just yet!

Download the ECB’s “Policy panel on CBDCs”, Information session for front-end prototype providers,” and the latest ECB speech “The digital euro and the evolution of the financial system” all in one PDF: here

I’ve put together three different ECB documents to try to give you a broad overview of what the digital euro is likely to look like. While details are missing, it's starting to come into focus!

1️⃣ ECB Policy Panel

Why the ECB is issuing a digital euro:

Digital public money: the monetary anchor in a digital world: natural evolution to guarantee that the two-layer monetary system remains viable.

Safeguarding monetary sovereignty: Global stablecoins issued by big tech firms could become dominant and threaten public control over the unit of account.

Enhancing competition and efficiency in payments: A digital euro could increase competition by ensuring universal access to an efficient digital means of payment that is not motivated by profit and by allowing intermediaries to offer services on top (“digital euro inside”).

A digital euro would also improve the euro area’s strategic autonomy by reducing reliance on foreign entities. No US big tech or cards wanted!

2️⃣ Information Session for Front End Prototype

Digital Euro project timeline (pg 5) shows Q3-2023 to start work. This is not launch but to build!

Off line P2P transfers (pg 9) are being de-emphasized and if the ECB is not prioritizing them in the prototype they are likely off-the-table for now.

The digital euro to have accounts? On page 20 we see that the prototype will “leverage PSD2-logic” with accounts, balances and limits.

That the prototype is not being asked to handle tokens shows that the ECB is leaning toward an account-based system. A big decision, and likely why offline transfers are off the table!

3️⃣ The digital euro and the evolution of the finance system

Clear limits of 3 -4,000 euro per person.

A “waterfall functionality” which would allow users to receive payments in digital euro above the holding limit by linking a digital euro account to a commercial bank account. Same as China!

Interest bearing CBDC! The ECB states that digital euro "remuneration" should be tiered with interest rates applicable to holdings are differentiated.

Clear intent to use a two-tier CBDC: “By distributing digital euro, intermediaries will play a key role.”

What matters for you:

The ECB has specified the “why” and some of the conditions for “how,” what they’re missing is the technical means of preserving privacy.

That the ECB is silent on privacy, other than to say that we’ll have some is not an oversight. Instead, it is a political move to first assuage banks’ fear of the digital euro and then work on people’s privacy concerns.

Kudos to the ECB the digital euro is taking shape!

Thank you for reading!

Hey did I mention that subscribing is a great way to say thanks? Every new subscriber helps me get my message out to more people!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: