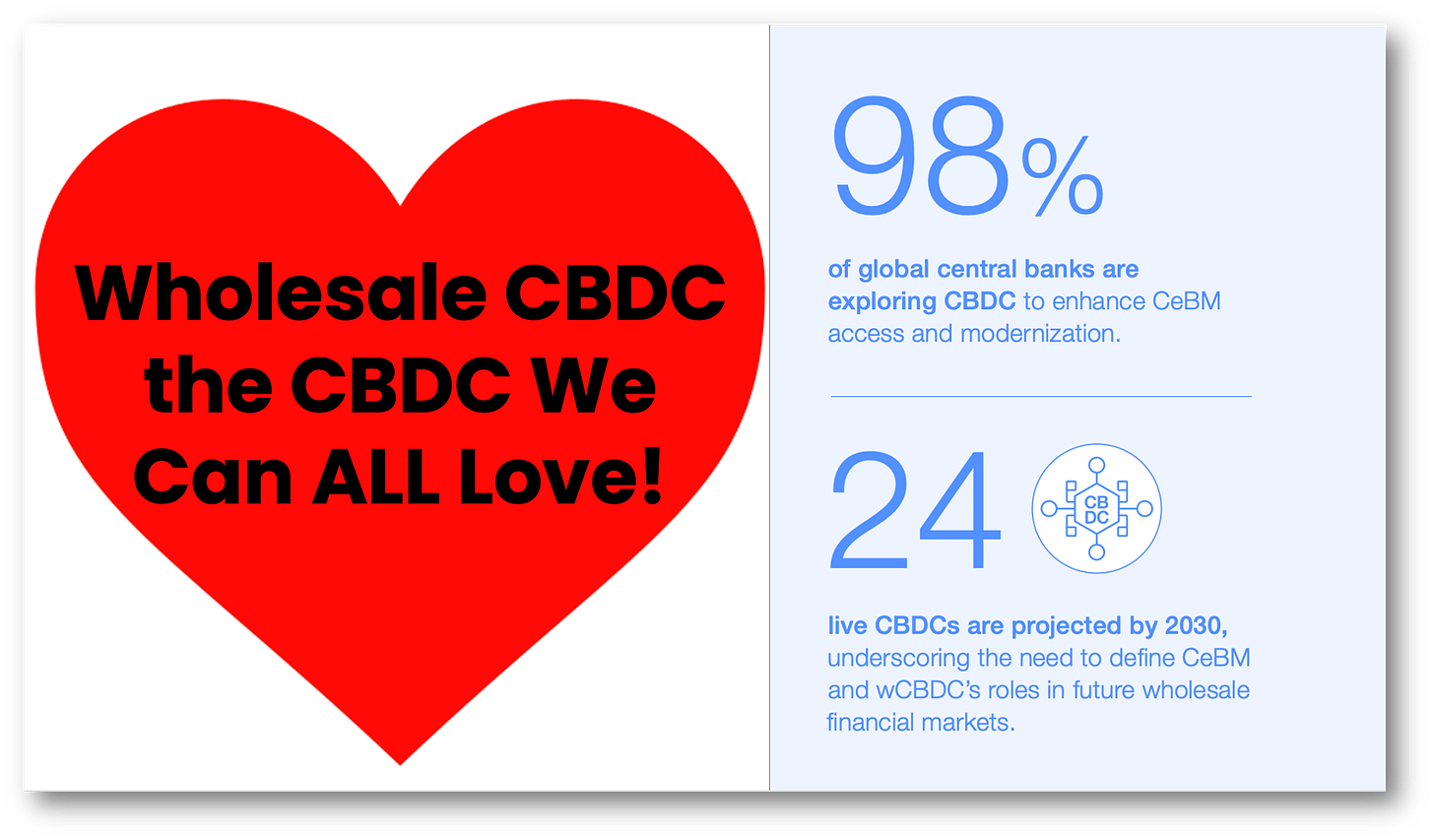

Wholesale CBDC the CBDC We Can ALL Love!

WCBDC lacks the privacy concerns of its retail cousin.

This is a FABULOUS READ on wholesale CBDCs that covers all of the terminology and will bring you up to speed with the latest developments. Kudos to WEF.

WCBDCs are the CBDCs everyone should love because they have tremendous potential to rewire our aging and expensive financial systems. That’s why 98% of the global economy's central banks are researching, piloting, or deploying them!

The “wholesale” part of these CBDCs restricts their use to interbank transactions and avoids the controversy surrounding its close cousin, the “retail” CBDC, and its ongoing privacy debate.

The important thing to understand is that wCBDC impacts not just cash settlement but securities settlement, a massive market.

👉TAKEAWAYS: HOW WE USE wCBDC!

Interbank payments:

Domestic payments:

Settle payment obligations between banks and other FIs within a jurisdiction, whether a single payment leg (P) or two payment legs (PvP).

Cross-border payments via nostro accounts:

Settle cross-border payments between central banks, banks and other FIs located in different jurisdictions (P, PvP).

Cross-border payments via central bank accounts:

Provide currency liquidity across jurisdictions using central bank infrastructure arranged by a market maker or dealer to fund crossborder payments (PvP).

Securities transactions:

DvP for securities settlement

Settle securities trade activities involving equities and fixed-income instruments domestically and cross-border, including tokenized securities (DvP).

Collateral and liquidity management

Serve as a payment instrument to be posted as collateral or used to purchase or acquire intraday liquidity (PvP, DvP).

Post-trade operations

Facilitate post-trade settlement and operations for securities, which is a core subsequent process to DvP for securities settlement (PvP, DvP).

👊STRAIGHT TALK, OPINION👊

Wholesale CBDCs will be an essential part of our future financial infrastructure.

They are coming sooner than you think and have tremendous potential to modernize our creaky and expensive payment systems.

There is no reason to fear wCBDCs as they are not used by private citizens but by financial institutions.

Still, as this is a WEF publication, I expect to read comments about how Klaus Schwab and wCBDCs will “Take over your life.” An actual headline!

What matters most for you is that we are transitioning from a world where waiting for money is the norm, to a new world of “atomic settlement” where smart contracts make payments nearly immediately.

This is a revolution, and all readers would do well to consider its importance not only to cash markets but also to securities settlement.

While wCBDC pilots are ongoing, it will be another three years before limited cash or security pathways switch to wCBDC.

Note that wCBDCs have a brisk tailwind! They have the support of the banking community, unlike retail CBDCs, which banks loathe due to their impact on payment profits.

Thoughts?