Why Banks and Big Tech Won't Crack the Superapp Code

Superapps require a degree of openness that banks and big tech can't offer.

The number of reports on superapps that all miss the main point astounds me, and while this one from Deloitte gets certain pieces, it drops the ball as they all do.

This is why I find it amusing that everyone from Amazon to Revolut and even your incumbent bank is trying for a superapp, and without question, virtually all of them will fail.

That isn’t to say they can’t enhance their apps with other services and make them more useful, but that’s a long way from being super.

That’s why I’m on a rant today and will say that only the most ignorant, who have no clue what makes an app “super,” would even dare say that they want to make their company’s app super.

Open The Platform

Superapps were invented in China by Alipay and WeChat Pay. These competitors launched their superapps on the back of their existing payment apps.

While payments were critical to making these apps go super, they were not the sole reason they went super. What made them go super was a fundamental difference in how Alipay and WeChat viewed access to their platforms.

The key was that Alipay and WeChat opened their platforms to EVERYONE! In the early days, the target users weren’t financial services but local small shops and businesses—the smaller, the better. This incredible degree of openness, which excluded no one, no matter how small, made the apps go super.

Most people don’t understand that there were virtually no gatekeepers regarding who could launch a service on their platforms through their mini-app system.

The platforms were more open than anyone gives them credit for, and this is the key to going super, which is why it is so hard to repeat.

Banks will NEVER have SuperApps

So think about this level of openness and ask yourself, will a bank app, whether from an incumbent or a neobank, ever allow free, unfettered access to their platform?

The mere thought of this should have made you laugh! Of course not! Banks are gatekeepers and want to protect their users from harm. So, how can a bank app with low levels of openness ever become super? Would they allow a wonton shop on their platform?

What about Amazon? They are open to people selling on the platform, but they aren’t open to people selling on their platform, but nothing else, unlike the superapps.

This mentality is so foreign to Western businesses that I don’t see anyone save for a radical move by Elon Musk and X as building a possible superapp.

This is also why they’re mostly in Asia!

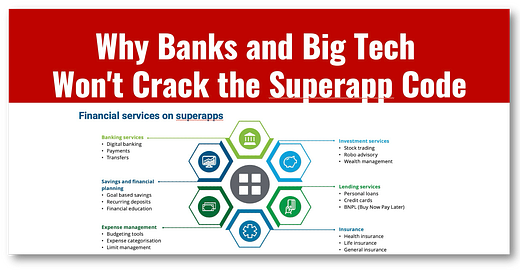

Financial Services Don’t Make Apps Super

Banking and financial services weren’t early entrants on the superapps. They came far later after your local wonton shop.

Digital banks MYbank and WeBank didn’t launch until about three years after WeChat and Alipay were successful. The rest of the financial world took around five years after launch to discover the power of the superapps.

This is where most people talking about superapps get it so wrong. They see financial services as critical to superapps. They are not; they were an afterthought!

What is more critical to making a superapp is getting your local coffee or wonton shop using it than getting banking on it!

And that’s what the bankers and other “posers” talking about superapps don’t get; superapps are all about people first and finance second.

That’s a tough message for most in finance to understand.

Please share on Substack with a restack!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!