Why Nations With Fast Payments Still Need A CBDC!

CBDCs are monopoly killers, bringing competition and resilience to payments

The IMF shows why retail CBDC is more than another way to buy coffee as it answers the most asked question about CBDCs:

Do central banks need a CBDC if they already have faster payment systems?

The IMF says yes while maintaining the politically balanced answer that there is no single answer for all nations:

“FPSs and e-money systems may fall short of what CBDC systems can be expected to achieve. There are unique objectives where a CBDC provides benefits, such as access to central bank money and monetary sovereignty because of its nature first and foremost as public money.”

The IMF’s assessment is backed up by nations with excellent “Fast Payment Systems” (FPSs), like India, China, and Brazil, which are technically sophisticated and see the benefit of building CBDCs.

👉TAKEAWAYS

Why CBDC?

Efficiency

All three systems can enhance payments efficiency through speed. To the extent that CBDC is designed as “digital cash” and replicates more features of cash, it could be more effective in reducing the cost of cash management.

Competition

➣ The existence of multiple payment solutions is beneficial for competition and innovation. A CBDC system can increase competition by serving as a platform that lowers the barriers to entry for nonbank PSPs.

➣ By providing a public (market-neutral) infrastructure and scheme, market entry can become easier by lowering investment costs and ensure a level playing field for market participants.

➣ Private FPSs can in some cases limit competition as they might restrict market participation. Concerns of this type have underpinned recent decisions by the central banks in the euro area, Sweden, and the United States to have an active role in the operation of their FPS .

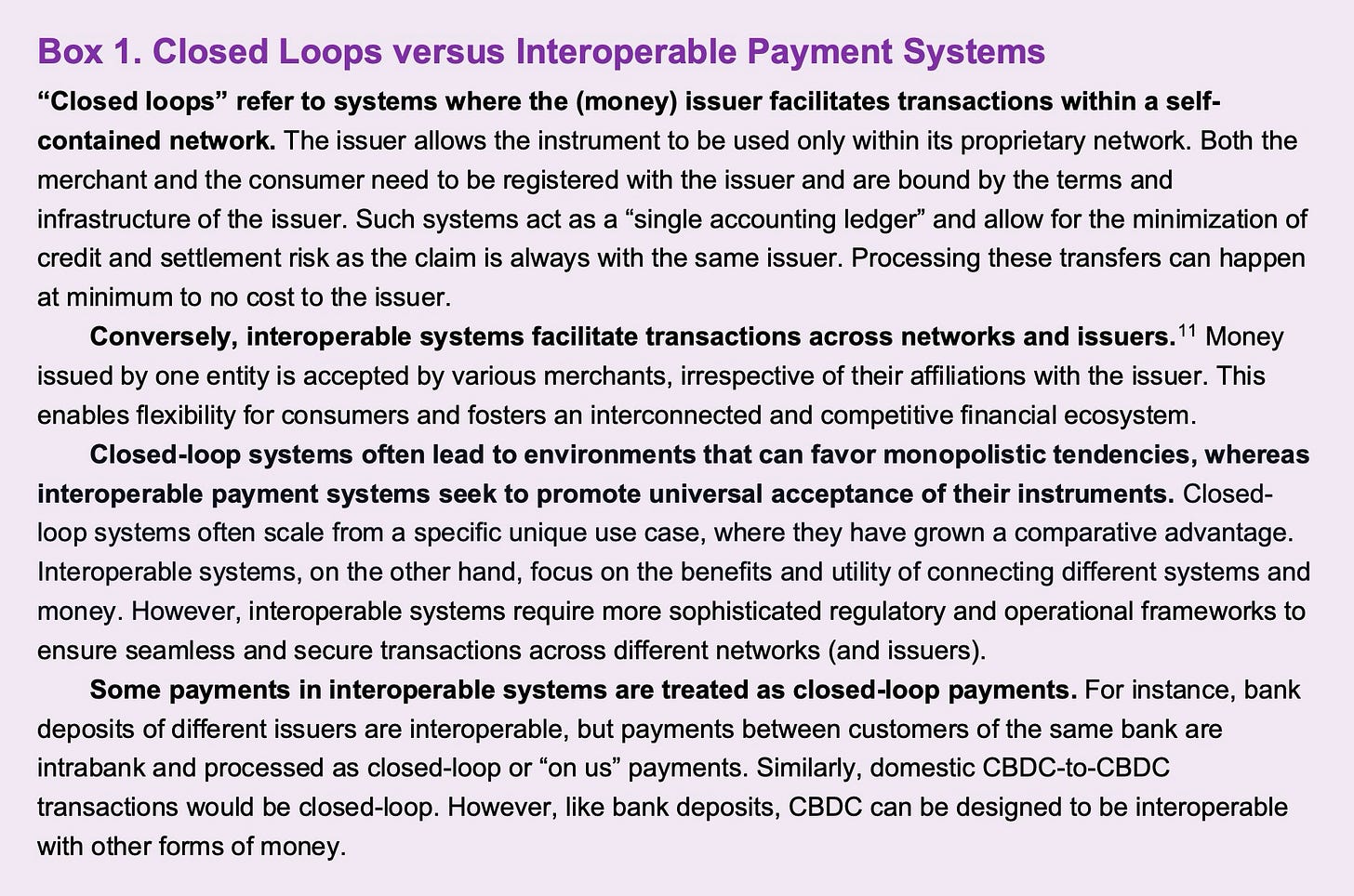

➣ E-money can serve as a competitor and alternative to commercial bank deposits, but when operated only as closed loops, they can become monopolistic. In many jurisdictions, the e-money market is very concentrated, often resulting in limited competition.

🔹 Resilience

While each system itself should have resilience measures, the resilience of the wider payment landscape can be improved from having alternatives.24 The presence of several payment alternatives may enhance resilience through redundancy.

🔹 Public Access to Central Bank Money

FPSs and e-money networks cannot meet objectives around public access to central bank money. Access to central bank money provides individuals and businesses with an alternative to privately issued money. A relevant form of retail public money is important as it provides an ever-present check on the private sector by allowing people to move their money in and out as desired.

🔹 Access to central bank money is closely linked to preserving monetary sovereignty—a nation’s ability to independently control its own currency and monetary policy.

Central banks’ ability to control monetary policy and provide services as lender of last resort can be challenged if alternative digital money—issued by private sector entities or foreign governments—were to become widely used as an alternative to domestic currency.

👊STRAIGHT TALK👊

The IMF does a great job of showing why CBDCs bring far more to national payments than e-money or fast payment systems.

So, do nations need a CBDC? Yes, most do, even if they have faster payment systems, but not all.

CBDCs shine by bringing increased competition and resistance to payment systems, and the IMF does a great job of highlighting the dangers of payment monopolies. (see below)

The IMF clearly states that some nations lack the skills to implement CBDC, and FPS systems may be more appropriate for achieving the short-term benefits of instant payments.

This limitation applies to a small group of nations, and most others would profit from CBDC.

CBDCs are digital public infrastructure and, as such, provide equal access to payment for all without the “walled gardens” of most commercial “closed loop” FPS systems.

So, do nations need a CBDC?

Yes, most will benefit from them!

Read this fantastic analysis by the IMF on why “closed loops” or what are commonly called “walled gardens” favor payment monopolies

Readers like you make my work possible! Subscribing is free, and I operate by what is called the “PBS model.” Like public broadcasting, everything I write is free, but if you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!

Thanks for reading Cashless: Fintech, CBDC and AI at the speed of Asia! Subscribe for free to receive new posts and support my work.