Worldpay Report: Global Shift To Digital Wallets Triggers Decline of Cash and Cards

People have made their choice and cards and cash are on the way out.

Worldpay’s Global Payment Report shows just how quickly the world is giving up cash and cards to switch to digital wallets.

What I find amusing is that Asia’s love of digital wallets isn’t unique. When given the choice, people around the world are making the same migrations to digital wallets.

Even in the EU and US, where cards have ruled for ages, the growth in digital wallets is rising at 24% and 36% CAGR, respectively!

Let’s face it: if cards are fighting a losing battle in their strongest and oldest markets, the writing is on the wall.

That said, don’t count cards out because the West’s leading wallets, Apple and Google, are credit card pass-through wallets, which means they are simply a way to use a card.

This is unlike wallets in other nations like China, India, Brazil, or Singapore, where digital wallets use account-to-account (A2A) payments.

What Worldpay can’t answer is what will happen to card pass-through wallets when the digital euro launches or when FedNow gains traction in the US.

That’s when things will get interesting for cards!

👉TAKEAWAYS

Digital wallets are the people’s payment choice: In 2023, wallets accounted for 50% of global e-com spend (> $3.1T) and 30% of global POS spend (> $10.8T) and were the fastest-growing payment method.

Cards show strength inside and outside digital wallets: Consumer attraction to digital wallets isn’t a turn away from cards. In card-dominated markets, card spend is simply shifting to digital wallets like Apple Pay, Google Pay, and PayPal

Global e-com growth outpaces POS by > 2-1: Global e-commerce surpassed $6.1 trillion in 2023 and is growing at more than twice the rate of global POS value.

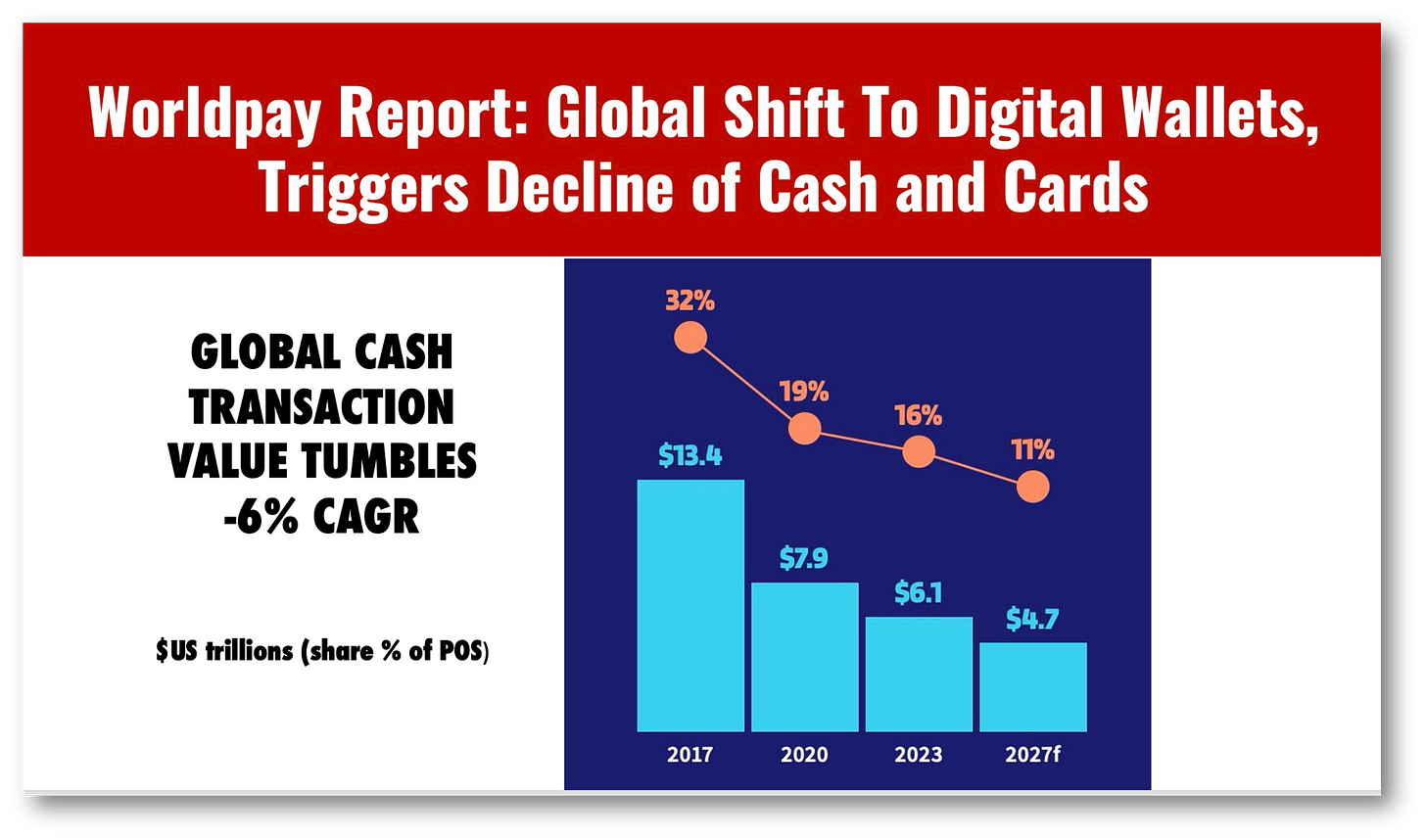

Cash remains relevant amid economic uncertainty: Globally, cash fell -8% in 2023, and is expected to decline at -6% CAGR through 2027. In 2023, cash accounted for 16% ($6 trillion) of global transaction value.

China continues to lead all global markets in digital wallet adoption: Wallets represented an estimated 82% of e-com transaction value in 2023 or nearly $1.8 trillion and nearly 66% of POS spend.

India’s UPI is rapidly displacing cash: Prior to the COVID-19 pandemic, cash was the leading in-person payment method, with a 71% share of POS value. By 2023, that had fallen to just 18%.

Cash in Europe: Cash use across Europe has dropped by half since prior to the pandemic. Cash accounted for approximately 20% of POS transaction value across the 14 European markets covered, half of the 40% in 2019.

European consumers overwhelmingly prefer debit cards: Debit cards accounted for 41% of POS transaction value across Europe in 2023

Digital wallets in North America are growing fast: In e-commerce payments in 2023, digital wallets grew 23% YoY to reach 37% of regional transaction value. For comparison, debit and credit cards still account for 51% of the market but have negative growth rates.

Digital wallets have been slower to catch on at POS North America: Digital wallets' potential is finally being realized as North American consumers begin to catch up to their counterparts across APAC. POS wallets saw 36% year-over-year growth in 2023, claiming 15% of regional POS spend.

Thanks for reading!

If you’re interested in this topic take a look at this article that shows how local payment methods brought by digital wallets are hammering cards:

Digital Wallets Are Cards' Worst Nightmare Come True in E-Commerce

Thanks for reading. Subscribe, you’ll be glad you did! Another great way to say thanks is a restack and a heart!

Join our community by subscribing. You’ll be joining an exciting journey down the rabbit hole to our shared digital future—you’ll be glad you did!

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

What’s in it for you if you subscribe?

Don’t get left behind: Get expert insight that focuses on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion, all delivered directly to your inbox weekly;

See the future: Profit from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing us the future.

Be independent: My message doesn’t follow corporate diktats it’s a message that’s often controversial and does not conform with mainstream outlets;

Prepare: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Understand: In-depth analysis of how our AI revolution impacts finance and will change how we interact with financial services.

Trust: My writing is trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics & open-minded crypto-holders daily!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!