AI will revolutionize payments and make the bank of the future💥 DeFi works for foreign exchange of CBDC😱 How to manage generative AI....or it will manage you! 🚀

1. AI to revolutionize payments!

2. DeFi works for CBDC FX transfers!

3. How to manage Generative AI

Today’s art: Pink Dorid Nudibranch, Length 4cm, Richard Turrin, Siladen Island, Indonesia 2023

The bottom-dwelling, jelly-bodied nudibranch (NEW-dih-bronk) might seem an unlikely canvas for Mother Nature to express her wildest indulgences of color and form. But these shell-less mollusks, part of the sea slug family, bear some of the most fascinating shapes, sumptuous hues, and intricate patterns of any animal.

There are more than 2,000 known species of nudibranch, and are found throughout the world's oceans, but are most abundant in shallow, tropical waters. Their scientific name, Nudibranchia, means naked gills, and describes the feathery gills and horns that most wear on their backs.

Nudibranchs can be thick or flattened, long or short, ornately colored or drab to match their surroundings. They can grow as small as 0.25 inches or as large as 12 inches long.

They are carnivores that slowly ply their range grazing on algae, sponges, anemones, corals, barnacles, and even other nudibranchs. Some species can produce a distasteful noxious secretion to deter potential predators, such as fish. (Source: National Geographic)

1. AI to revolutionize payment in JPM’s “Payments Unbound”

JP Morgan’s “Payments Unbound” has a crystal ball to the future and sees AI revolutionizing the sector!

“Payments Unbound “ is a great read and has something for everyone! Enjoy

👉TAKEAWAYS: three articles caught my eye!

🔴 Building a Smart Grid, pg 5: {Note the emphasis on digital ID!}

• The more invisible a payment is, the smarter it is.

• A key focus for the future of payments is proving identity.

• Shift from credential-based payments (card numbers) to ID-based (who makes the payment.)

• Blockchain could allow financial institutions to securely share ID information with each other

🔴 Smart Money, pg 32: Artificial intelligence is revolutionizing tech—and payments with it

• “When you overlay AI on payments, it makes for a very exciting future.”

• Payment data that talks back with virtual assistants

• Bringing the synthetic fight to fraud: AI used to fight theft which AI is increasing at an “industrial pace” You do see the irony in this right?:

🔴 The Race to Rewire Cross Border Payments, pg 41: Money needs to keep moving—and the blockchain could be the way to achieve it

• The race to real-time payment: RTPs are expected to generate $173 billion in additional economic output by 2026

• Blockchain technology has the potential to help financial institutions to leapfrog to an infrastructure that is able to support RTP and automate complexity

• A crucial element of a private blockchain is that it enables institutions to retain sovereignty.

• Smart contracts can enable transactions to automatically execute based on real-time data.

👊STRAIGHT TALK👊

By now, we’ve all read at least 20 articles on how AI will revolutionize payments, and I think we all get that changes are coming! But AI is very limited in what it can do for payments! Yes, I said, “limited.”

What AI can’t do is change the “payment rails.” What is key is that when we talk about payments, we understand that AI sits above the payment rails in the tech stack. It potentially enables payments to become easier, but it doesn’t change how the money will be transferred.

Now, to the problem that JP Morgan doesn’t address at the same level of bluntness, I will. Modernizing a credit card network with high fees with AI is like putting a jet engine on a biplane built in 1930.

The analogy isn’t too far off for Apple and Google Pay, which both rely on card networks built in the 90’s. Sure, you can attach AI to them for convenience, but if the fees are the same, to what end? This is why AI is “limited” by the nature of the underlying payment rails.

So, the good news is that I think that AI will help drive payments to use NEW rails. Good examples are FedNow in the US, UPI in India, and Pix in Brazil, all of which will get a boost from AI-enhanced payments.

AI will also likely drive CBDC adoption because banks will need greater access to free instant payment once AI is fully rolled out. Credit card margins will simply be unsustainable in the age of AI!

Subscribing is free and no risk! You’ll be glad you did!

2. DeFi works for CBDC FX transfers!

Still think Defi is for crypto only? DeFi and wCBDCs join forces to create game-changing 24/7 instant FX.

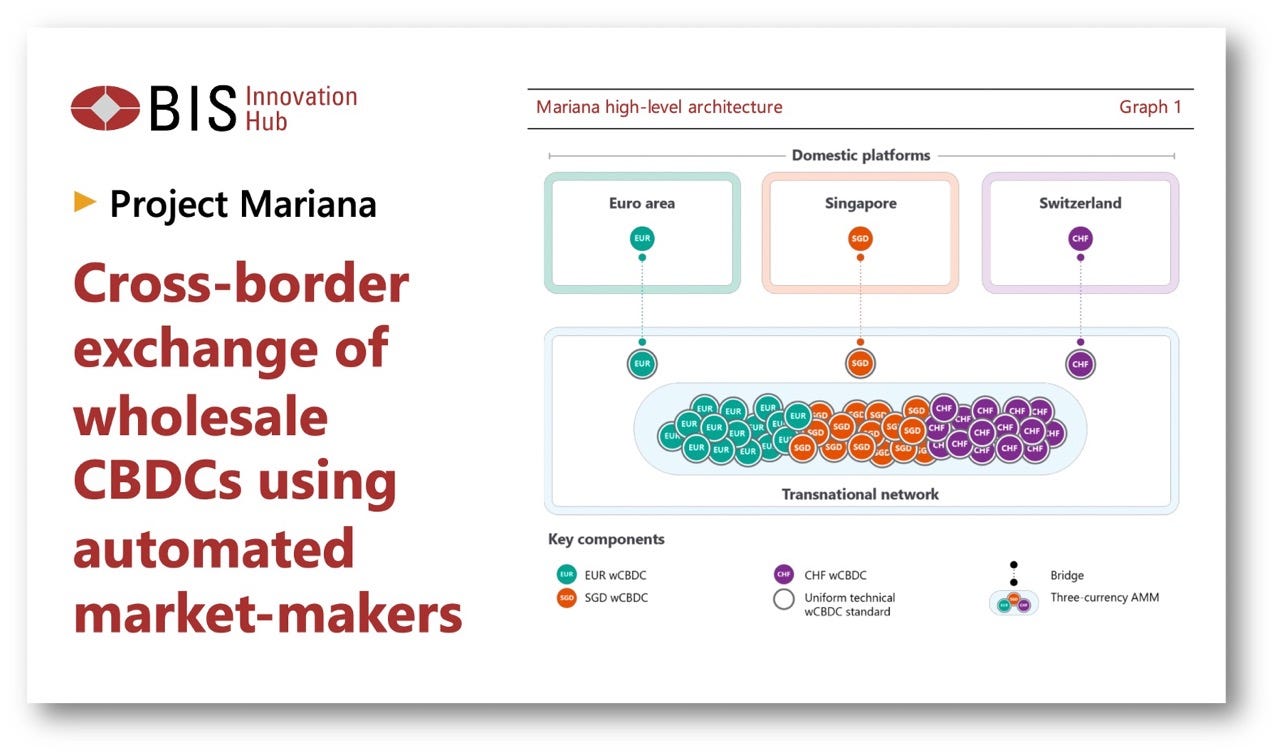

🔥This is very big!🔥 The BIS and the central banks of France, Singapore, and Switzerland just completed project Mariana, demonstrating a three-currency DeFi-based automated market maker (AMM) for wholesale (w)CBDC FX transactions.

👉TAKEAWAYS:

Potential benefits include:

🔷 Simple and automated execution of FX transactions.

In principle, it should be possible to integrate a Mariana-like AMM into cross-border payment solutions based on wCBDCs.

🔷 Instant settlement.

Safe and secure wCBDC transactions and eliminates settlement risk through PvP (payment versus payment). Overall, this may simplify risk management.

🔷 Transparency.

AMMs and the underlying blockchain technology may support transparency of market activity and thereby support market stability.

🔷 Collateral.

LP tokens may offer new ways to utilise liquidity that is currently either pre-positioned or locked to support FX transactions and cross-border payments

👊STRAIGHT TALK👊

This news is BIG, very Big. Anyone out there in the banking business knows that it's not enough to simply send wCBDC effortlessly across borders. Market makers are required to help with the FX portion of transfers, and DeFi Technology is “made to measure” for this task.

DeFi in the crypto world has a bad reputation for extreme leverage and being more centralized than advertised. In short, it was hacked and crashed more than most crypto fans will admit.

That said, the underlying DeFi tech is quite good and when implemented in a stricter and controlled environment as with banks and central banks is likely to be a game changer.

I say game changer because it will allow for the automation of FX between nations.

We will now have 24/7 FX transfers with immediate settlement and lower risk to all. From a banker's perspective with immediate transfer, there is no counterparty risk!

Sound big? It is, and you are likely to see this “Automated Market Maker” tech deployed in some form sooner rather than later.

For those who haven’t followed the news (here), Hong Kong’s mBridge CBDC transfer platform is due to come online in 2024, and you can bet AMM tech like this is being considered.

3. How to manage Generative AI

Find out "HOW TO" manage Generative AI rather than have it manage you!

Gartner’s “AI Here and Now “ is a great read and grounded in practicality! It's a nice change as it is PRACTICAL and shows you how to balance the “Promises and Perils of AI.”

👉TAKEAWAYS: two articles are MUST READS!

🔴 4 Decisions to Make When Creating a Generative AI Policy: pg 26

What is our risk tolerance for use of generative AI?

What restrictions should we put in place to mitigate risks — and how will those differ for publicly available applications (such as OpenAI’s ChatGPT) versus generative AI models tailored to our business needs?

Who has the authority to make decisions on generative AI use?

What information do we have to share, and with whom?

🔴 Prepare for AI Regulation by Addressing 4 Critical Areas: pg 31

Be Transparent About AI Use

Risk Management Must Be “Continuous”

Governance Must Include Human Oversight and Board Updates

Guard Against Data Privacy Risks

👊STRAIGHT TALK👊

Kudos to Gartner for a Generative AI report that goes beyond showing us big numbers that are intended to scare us into buying their services!

For once, Gartner provides a “how to” guide that talks the reader through the major perils of using AI and how to manage them in order to attain AI’s promise.

Another thing to note is that Gartner's first chapter discusses balancing the environmental perils and promises of generative AI (pg 10). Note that Gartner puts sustainability in first place!

AI has a dirty secret that Gartner is brave to address! It recognizes that AI has a “consumption problem” with a high energy and water footprint. Kudos to Gartner for calling this out up front!

I suspect we will be reading a lot more about AI’s energy addiction in the coming months!

Subscribing is 100% free, you’ll be glad you did!

In the unlikely event you don’t like my newsletter, click unsubscribe at any time to “invite danger!”

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

A small startup in uganda www.clic.world has been building cross boarder and CBDC like solutions for years to deaf ears we are finally going live this quarter with one bank in Kenya and Uganda. All this excitement is old news but just confirms that the global investment ecosystem is missing out. The problems we are fixing in Africa are leapfrog problems just like digital payments we call Mobile money is only now coming to the west. Our hold back is colonial inherited legislation and international containment rules masked as AML.

On "How to manage Generative AI"

Only few will be lucky. And those lucky ones will be bought out very soon. Their good will be turned into bad and applied on a broader scale. The outlook is rather grave.

Until now, not even the comparatively simple problems with SPAM emails and propaganda BOTs on social media is solved. The Twitter-Files have shown us a glimpse of the evil use that actually happened and that did have global impact. But the bot-account problem is not even solved with twitter/X. And that is technologically rather simple. But none, not even Musk can solve it, being the owner of that X-monster. And people like Zuckerberg do not have the least intention to solve it, they rather produce more of it. I have seen too much of the Dilbert-style nonsense in the real world in order to believe in a good outcome. This system will simply destroy itself, and AI will be very helpful in this. Generative AI is trained with the sick stuff out there on the net. So, what do we expect? As it was said in the beginning of the computer age: Garbage in, garbage out.

We know that Bitcoin wastes the energy, which is the equivalent of the consumption of Denmark. Therefore, it should be shut down immediately. But do we control it in any way? No!

Anyway, nice move of Gartner to mention the energy problem. But, does anybody care? No!

If the power mongers would care about energy or environment at all, there would be no such thing as depleted uranium ammunition or wars like in Ukraine where they do their very best in order to heat up the planet with the enormous energy discharge of all those explosives. They do not even try to count it! Under such an evil rule, AI can not possibly do any good. People are not sane enough in general. Last Generation terrorists want to do good but create only misery, because they are severely sick in their minds. Generative AI can only amplify that which is there. It can not bootstrap us out of our own shit. As well, one could hope for aliens to supply us mystical technologies

https://en.wikipedia.org/wiki/The_Sorcerer%27s_Apprentice

or even better, pray to God directly.

But: https://www.youtube.com/watch?v=k1g8WCA7mJk

Unfortunately, the world has missed its opportunity to listen to Peter Sloterdijk in 1997

https://de.wikipedia.org/wiki/Regeln_f%C3%BCr_den_Menschenpark

And he was already 20 years late with this warning!