Bali Ha'i with G20 announcement of ASEAN regional QR Code payments that won't use US dollars

A big win for QR codes, a small step toward US dollar independence

The biggest fintech news of the week got almost no coverage as Southeast Asian nations announced a plan at the G20 meeting for a regional QR code payment system within the year that will not use the US dollar!

Indonesia’s presidency of the G20 is bringing fintech front and center! Indonesia is running a national financial inclusion campaign with the goal of reducing the unbanked population from 66% to under 20% by 2025.

A big announcement at the G20 meeting in Bali by finance ministers! By November five of the region’s largest economies, the Philippines, Malaysia, Indonesia, and Thailand will sign an agreement to integrate their mobile real-time payment systems. This will make cross-border transfers far more efficient and promote trade within ASEAN nations.

In 2020, the estimated total GDP of all ASEAN states amounted to approximately 3.08 trillion U.S. or a bit less than 3% of global total GDP.

Singapore is a model of what cross-border mobile payment linkages between fast payment systems will eventually look like. Singapore’s mobile real-time payment system “PayNow” now has connections with instant payment systems in India, Thailand, the Philippines, and Malaysia. These systems make remittances and e-commerce a breeze. Remittances from Singapore sent within ASEAN are approximately US$3 billion annually.

The network is now expanding between ASEAN nations in a drive to bring down the costs of money transfer within the regions. This is seen as critical for worker’s remittances, tourism, e-commerce and post-covid recovery in a region that was hard hit.

No US dollars needed

These payment systems will also provide a boost for international trade. The latest figures I could find were from ACI Worldwide and show that ASEAN nations saw total merchandise trade grow from US$1.2 trillion in 2005 to US$2.8 trillion in 2018, with a quarter related to intra-ASEAN trade. Growth in eCommerce has been even more pronounced, rising from US$11 billion in 2017 to US$24 billion in 2018, while the overall internet economy is projected to triple in size by 2025 and reach US$300 billion.

Payments on these systems will have foreign exchange handled by regional banks who will make direct exchanges between currency pairs without using the US dollar. Typically with most traditional bank transfers, the US dollar is used as an intermediary meaning that payments go from local sending currency into US dollars, then from US dollars to the local receiving currency. This makes transfers more expensive due to the costs of two foreign currency transactions with each transfer.

The desire to use local currencies and banks in this system is a clear sign of the region’s desire to reduce dollar dependence and reduce costs. Indonesia, now with the presidency of the G20 has been a vocal proponent of reducing dollar use and has switched some payments for trade with China to RMB.

Given the trade figures above there is under a trillion dollars in trade in play between e-commerce and merchandise trade. Realistically, if these payment systems could potentially carry 10% of these transactions it would make a roughly US$ 100 billion market within a few years of launch. Clearly, this is no threat to “dollar dominance” but it does show intent and I believe should not be taken lightly.

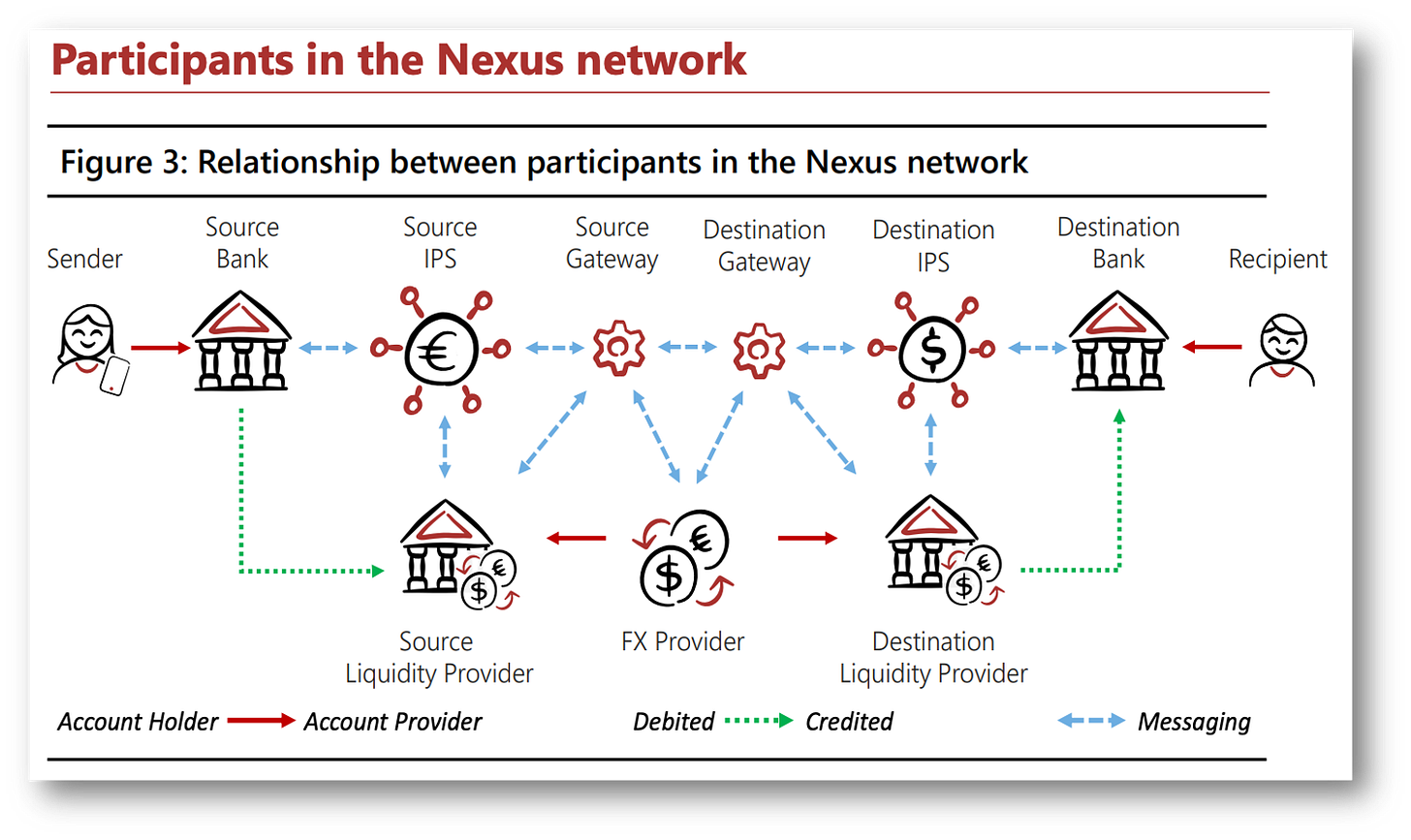

The BIS and Project Nexus

The blueprint for these transactions was laid out by the BIS in “Project Nexus” which shows how “fast” payment systems can be interlinked for fast inexpensive cross-border payments. A thorough discussion of Nexus is beyond the scope of this article but this video and a few diagrams should provide an overview.

Video explaining Project Nexus from the BIS, and link to Project Nexus documentation: here

From BIS: “Instant (“fast” or “real-time”) payment systems are now operational in around 60 countries, with others in development. Linking these IPSs together could enable cross-border payments from sender to recipient within 60 seconds in most cases.”

What makes Nexus unique is that it directly links instant payment services (IPSs) across borders to create interoperability and connecting payment infrastructures – rather than banks – across borders.

Foreign exchange on the Nexus platform:

“FX Providers are responsible for providing continuous quotes at the rate at which they are willing to swap one currency for another. Quotes can be updated as frequently (or infrequently) as the FX Provider wishes. Note that they do not provide quotes on single payments, and they are not asked to bid for specific payments.”

QR Codes win again

In a recent newsletter (here) I show how Alipay+ is also binding together the QR code payment systems within Asia to create an international network of users. I think both the Alipay+ network and the coming ASEAN networks show how important financial interconnectivity within the region will be. This is an area where “great minds think alike” as Alipay+ is also seeking to capture growing e-commerce and cross-border trade will be.

Credit card companies should be afraid of this trend. With QR-based mobile wallets winning the largest number of new users from the vast number of unbanked, and their razor-thin cash transfer costs it will be hard for card companies to compete. Credit cards are known for high merchant costs and their foreign exchange fees are feared globally. There is no way credit cards will ever recover business lost to these transfer systems whether Alipay+ or the ASEAN system.

Takeaway

The concept of a single ASEAN region connected by QR code payment is grounded in practicality as all ASEAN nations suffer from high levels of unbanked citizens and expensive money transfer.

Recent surveys of new users of cashless payments show strong adoption of mobile wallets with QR codes. Business that will be lost to card companies.

That the dollar is not required in these cross-border transfers is significant even if the dollar value is low. The intent of decreasing dollar use is real and must not be ignored.

ASEAN is a top trading partner with China, and it is likely that the digital yuan will also connect to this network someday. The digital yuan is already in trials with Hong Kong’s FAST payment system so the technology clearly exists.

Watch for more fintech innovation from the G20 with Indonesia’s presidency.

Author’s note:

"Bali Ha'i" is a show tune from the 1949 Rodgers and Hammerstein musical South Pacific. The name refers to a mystical island, visible on the horizon but not reachable.

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my best sellers on Amazon: