Digital Wallets Explode: 4.2 bn, Half The World, and Surging

APAC dominates digital wallets and e-commerce, showing how the future is now!

Thanks for reading the “Cashless” newsletter, an insider’s view on Asia’s fintech, CBDC, and AI for anyone striving to understand “the Asia Century.” I’m Rich Turrin, and these are my hard-hitting insights designed to educate and inform. Subscribe to get these emerging trends directly in your inbox every Sunday. Every week, I scan thousands of articles to find only the best and most valuable for you. Subscribe to get my expertly curated news straight to your inbox each week. Free is good, but paid is better.

Topics:

Digital Wallets Explode: 4.2 bn, Half The World, and Surging

APAC Dominates The World in Digital Wallets & E-Commerce—The Future Is Now

JP Morgan's 2025 Emerging Technology Trends: All GenAI, All the Time

Emerging Economies Trust AI More than Developed

Bonus Read: MIT Risk Repository: Revealing The AI Risks You Need to Know

Happy Sunday or Monday to you all!

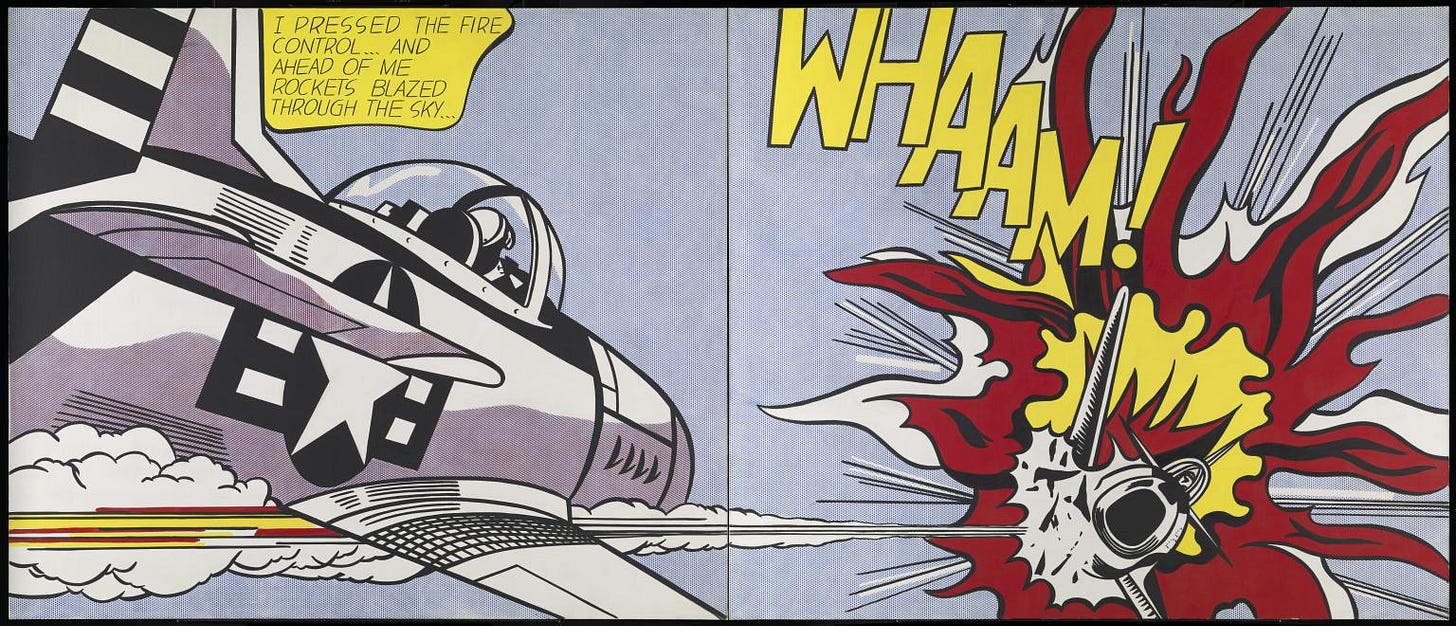

Today’s artwork, “Whaam” by Roy Lichtenstein, was chosen to convey the explosive growth of digital wallets to an astounding 4.3 billion in our first article. The airplane that is in flames represents credit cards!

With more than half of the world’s 8.2 billion population using digital wallets, I’d say this is a “Whaam” moment as payments go digital and people go “Cashless” across the globe.

And the growth isn’t showing signs of stopping, with estimates that the world will have 5.9 billion digital wallets by 2029.

Regular readers will know that APAC dominates the digital wallet and e-commerce space. Still, they may not fully understand the relative scale of APAC’s e-commerce market compared to other regions.

Asia’s share of global e-commerce revenue is a “Whaam” worthy, 57% compared to 20% for North America and 15% for the EU.

What makes this big percentage even more astounding is that APAC’s GDP per capita figures are a fraction of those of the US or EU, yet it still dominates e-commerce revenue. And no, it isn’t just because of large populations.

Next, we jump to JP Morgan Chase’s (JPM) Emerging Technology Trends Report. The report is poorly titled as it talks about “Trends” in the plural form when they should have said “Trend” because it is about one topic, GenAI.

In all seriousness, if you read no other document about AI and banking this year, make it this one - it’s that good!

Trust in AI is fragile. Interestingly, a massive global KPMG survey shows that people in emerging economies trust AI more than in developed economies. This large gap in trust levels challenges the notion that AI will reach scale in developed economies before emerging ones.

Our bonus read is a paper by MIT that categorizes and labels the myriad risks associated with AI. While most AI users genuinely want to manage AI risks, how can they manage them if they don’t know what they are?

This paper is an essential read, but not an easy one, so I give specific guidance on how to read it.

Thanks once again for reading. I appreciate each and every one of you opening your inbox for me!

Rich

PS

Thanks for sharing with your friends! It’s a great way to say thanks.

Digital Wallets Explode: 4.2 bn, Half The World, and Surging

Nothing in the world....is so powerful as an idea whose time has come, not even Visa or Mastercard

There are now 4.3 billion digital wallets and 8.2 billion people on earth, meaning that more than half of the world now has a digital wallet.

If that doesn’t shock you into believing in digital payments and going “Cashless,” nothing will. Even more shocking is that by 2029, we are expected to have 5.9 billion.

The reality is that digital wallets are an idea whose time has come, and nothing can stop them, not even the ever-powerful Visa and Mastercard.

APAC Dominates The World in Digital Wallets & E-Commerce—The Future Is Now

Cards are being left in the dust globally

APAC is dominating the world not only in e-commerce payments made with digital wallets at 70% of the region’s total, but also in total e-commerce revenue at 57% of the global total as cards retreat globally. APAC is showing the West its future.

First, let’s examine Asia’s remarkable share of global e-commerce revenue, which accounts for 57% compared to 20% for North America and 15% for the EU.

JPM's 2025 Emerging Technology Trends: All GenAI, All the Time

JPMorganChase (JPM) is renowned for its use of AI. If you read no other document about AI and banking this year, make it this one—it’s that good!

JPM’s 2025 Emerging Technology Trends is poorly named, as the report isn’t about “trends,” plural, but is 100% devoted to AI and contains use cases that are nothing short of state-of-the-art.

Emerging Economies Trust AI More than Developed

Don't discount the fact that AI may scale faster in emerging economies.

KPMG’s massive 48,340-person survey, conducted in 47 countries, reveals a tremendous gap between developed and emerging economies in AI adoption, training, and emotion, with emerging economies taking the lead!

In many AI measures, including the most critical, trust, emerging economies are beating developed economies, where it is being feverishly deployed.

Bonus Read

MIT Risk Repository: Revealing The AI Risks You Need to Know

AI Risks are real, and MIT's AI Incident Database now has over 3000 real-world examples of AI systems causing or nearly causing harm.

So, how do we manage AI risk if we don't know what they are?

That's where the MIT Risk Repository comes in. It seeks to create a coordinated and consistent methodology for categorizing AI risk.

Sounds dry? Not in the least. I dare you to go to the taxonomy presented in Table 6, page 34, for a good overview of AI's dark side.

Skim through the deeper explanations of AI Risk starting on 36 for an even more sobering read, then finally head to pages 62, 63, and 64.

That's how I recommend reading this document.

I admit this isn't an easy reader, but it is worth your time!

Hot Topics for Premium Subscribers only

Imagine having someone combing through thousands of articles, over 50 RSS feeds, and 25 meticulously crafted Google searches—all to handpick the absolute best reports, just for you.

Each week, I distill this ocean of information into five concise, high-value reports, sharing the most essential knowledge you need to stay ahead.

But that’s not all. I also collect additional exclusive, hard-to-find gems, which I put in the section below—all in PDF format with my brief expert commentary.

To download them, no corporate email is required, no searching, and no links to other places are required. With a paid subscription, these insights are just a click away.

Here’s what you’re missing out on this week in the Premium Subscriber-only section below:

BCG: AI Agents, and the Model Context Protocol

Due to the rise of AI agents, OpenAI, Microsoft, Google, and others have adopted Anthropic’s open-source “Model Context Protocol” (MCP).

Graph LLMs: AI’s Next Frontier in Banking and Insurance

PWC examines AI and sees the rise of Graph Language Models (Graph LLMs), which promise to uncover the nuanced relationships that drive deeper insights and more accurate predictions.

Neobank Valuations

This is another grey market paper for premium subscribers only. Just a few years ago, I confess that I joined others in questioning neobank profitability. While still an issue, many neobanks are now profitable with sky-high valuations. Check out how leading global neobanks compare.

And that’s just three of six reports. You’re also missing the infamous Chart of the Day, which today covers “Falling GDP Growth Forecasts for 2025 .”

Keep reading with a 7-day free trial

Subscribe to Cashless: Fintech, CBDC and AI at the speed of Asia to keep reading this post and get 7 days of free access to the full post archives.