Embedded Finance 🔷 APAC Banks 🔷 Trust and GenAI🔷Public Digtial Infrastructure and inclusion🔷APAC Mobile Economy takes off!

1. Embedded Finance the New Paradigm

2. APAC Banks: Transform or Bust

3. Trust and Generative AI

4. Digital infrastructure and inclusion

5. APAC Mobile Economy

Today’s Art: Village and Town Corruption, Somphong Adulyasarapan, 1994

The beings with wild boar, dog, crow, and lizard skulls are hilarious. Even the trees upon which they sit are no more than mere stumps. In the future, their lives will crumble into nothingness. The skeletons in the painting are symbolic of the destruction and damage caused by the actions of an ignorant and avaricious society.

1. Embedded Finance The New Paradigm

Embedded finance as the new banking paradigm as banks struggle for relevance!

IBM and my old friend Paolo Sironi lay out the harsh reality that banks are at risk of if they don’t embrace embedding and the platform economy:

“The platform economy has transformed how consumers experience the digital world, with dramatic implications for financial institutions. Rather than going to the bank— physically or digitally—consumers and businesses want the bank to come to them. Institutions that don’t embrace embedded finance are at risk of losing relevance.”

To better understand embedded finance, IBM raises four key questions:

🔷 Are consumers ready to bank on the platform economy?

Yes, so much so that new digital conveniences eclipse band value and the stickiness of incumbents. Consumers will move their primary account if given: better customer service, the convenience of transferring money instantly, and frictionless mobile access.

🔷 Is embedded finance more than hype?

Yes, implementation has broadly begun. Overall, 71% of executives say their institutions are active in the embedded finance space, and 65% of those respondents say they have seen intermediate results. 10% say they’ve achieved the goals set at the start of the journey—and 22% indicate it is too early to tell.

🔷 Where can banks remove friction to accelerate transformation?

In the platform economy, slow and steady doesn’t win the race! Banks need improvement in four primary areas: Build faster (64%), Maintain better (64%), Integrate faster (60%), and Manage better (58%).

🔷 How can banks elevate their role?

Many agree that launching a non-banking platform-based business model—and leading the charge within the ecosystem—would be the most advantageous path forward. (This is also the hardest!!)

57% of executives say banks can get the most value from directly orchestrating retail- or small-to-medium enterprise (SME)-oriented ecosystems.

Thoughts?

👉TAKEAWAYS:

—Do you feel embedded services are coming fast enough?

—Embedded banking is a cultural and tech-driven process that will take some banks years.

—“Fail fast” is the new normal as banks have no time to waste.

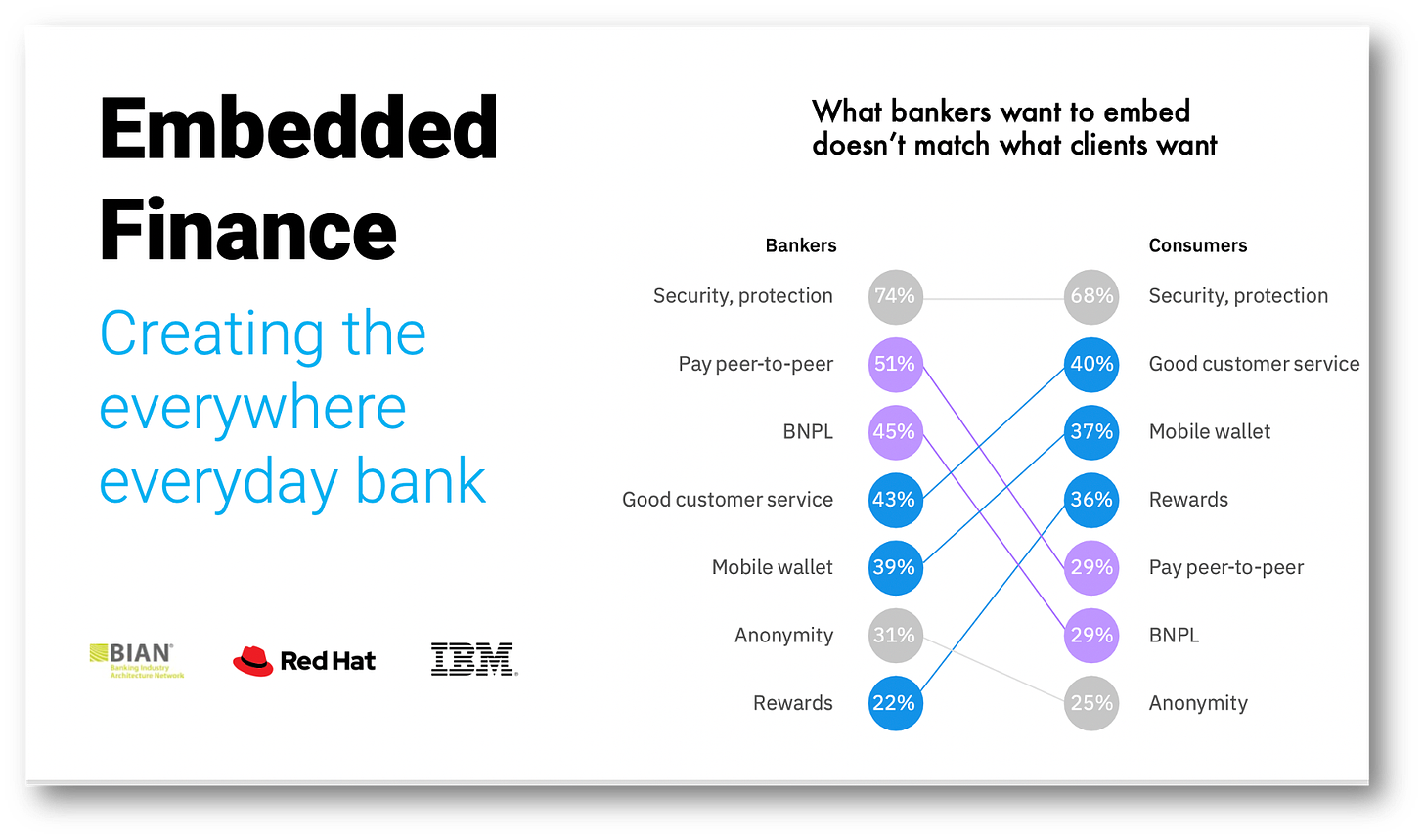

—Banks are still behind on understanding clients' needs

—Ethical issues abound. Just because you can embed doesn't mean you should!

2. APAC Banks: Transform or Bust

APAC banks face “transform or bust” and are now on the bleeding edge of transformation.

EY’s APAC team shows why APAC banks are fighting for their lives to be transformed. That means a real battle for customer excellence, with customers who are increasingly demanding of their digital services!

Never forget, with payment platforms chipping away at bank loyalty throughout APAC, if they don’t get digital services from their bank, they’ll simply get them somewhere else!

The APAC-specific findings reveal banks focusing in three areas:

1. Rethink transformation ideation and investment: Define and execute a bold vision.

🔥 MUST READ🔥 EY’s statement on rethinking transformation goals is a masterpiece!

🔥 Banks must also look beyond their hard numbers and consider new measures for economic success. While quantitative, financial metrics for assessing the performance of transformation initiatives are crucial, they should be evaluated in combination with qualitative assessments. These include anecdotal perspectives from customers or employees involved in the transformation to provide nuances and context that are often missed in the financials. This helps ensure that transformation isn’t just a cost item, but a means to innovate quicker, faster, penetrate new markets and drive customer experiences. 🔥

2. Redefine transformation: Put customers at the heart of this change.

As APAC banks digitalize distribution channels, their intent is to increase emphasis on self-serve and digital platforms, while conversely reducing contact channels (in-person and by phone).

Meanwhile, 90% of APAC banks say that they are leveraging open banking!

3. Reposition for agility at scale: Revamp team structure and technology.

Incumbents typically dedicate 15-20% of operating expenses to technology, with 40% seeing automation as the most effective method of cost transformation.

Thoughts?

👉TAKEAWAYS:

—APAC banks are in a fight for their life with digital upstarts.

—From neobanks to payment platforms, they are challenged to update or die.

—Many won’t make it. APAC's banking scene has a lot of “digital have-nots” who will become merger victims.

— EY’s emphasis on “looking beyond the numbers” is a masterpiece!

—Banks can win with numbers this year and lose clients the next!

3. Trust and Generative AI

Generative AI needs to break through the trust barrier, which is harder than the hype makes it sound!

Deloitte's excellent paper doesn’t just talk about Generative AI (Gen AI) trust but also maps the specific “trust domains” that organizations must contend with when deploying GenAI. It isn't impossible but it won't be easy!

GenAI trust domains:

🔷 Fairness and impartiality

Limiting bias in AI outputs is a priority for all models, whether machine learning or generative. The root, in all cases, is latent bias in the training and testing of data. Organizations using proprietary and third-party data are challenged to identify, remedy, and remove this bias so that AI models do not perpetuate it.

🔷 Transparent and explainable

Given the capacity for some GenAI models to convincingly masquerade as a human, there may be a need to explicitly inform the end user that they are conversing with a machine. When it comes to GenAI-derived material or data, transparency and explainability also hinge on whether the output or decisions are marked as having been created by AI.

🔷 Safe and secure

Powerful technologies are often targets for malicious behavior, and GenAI can be susceptible to harmful manipulation. One threat is prompt spoofing, tricking the model into divulging information it should not.

🔷 Accountable

With more traditional types of AI, a core ingredient for ethical decision-making is the stakeholder’s capacity to understand the model, its function, and its outputs. Because an AI model cannot be meaningfully held accountable for its outputs, (REALLY?) accountability is squarely a human domain.

🔷 Responsible

Just because we can use GenAI for a given application does not always mean we should. Indeed, the sword of GenAI cuts both ways, and for all the enormous good it can be used to promote, it could also lead to significant harm and disruption.

🔷 Privacy

As with other types of AI, the organization needs to develop cohesive processes for managing the privacy of all stakeholders, including data providers, vendors, customers, and employees.

Thoughts?

👉TAKEAWAYS:

—“Trust domains” are an excellent tool, but do you feel they fix GenAI's problems?

—How will GenAI be explainable when it is a “black box.”

—Will users know when GenAI is hallucinating?

—Gen AI is great. Fix it first and tone down the hype!

4. Digital infrastructure and inclusion

The G20 takes on the "culture wars" with a call for “Digital Public Infrastructure!”

No less than the G20, which is hardly a “communist organization,” makes the case for “Digital Public Infastructure” to increase financial inclusion and productivity.

Even better, the G20 gives case studies that show that DPI works! 🔥 These case studies are simply wonderful! If you read nothing else, scroll through the beige boxes with examples.🔥

“DPIs are generally understood as interoperable, open, and accessible infrastructure supported by technology to provide essential, society-wide, public and private services digitally such as identification, payments, and data exchange.”

Don't get comfortable.

If that sounded good so far it’s the public part that is where the problem starts:

“Public benefit: DPIs are labeled “public,” as they have been designed to allow equal, non-discriminatory access in accordance with specified governance rules. The “public” in DPI also indicates their focus in advancing public policy objectives, such as economic welfare, financial inclusion, enhanced competition, and innovation.”

The very notion of DPI is abhorrent to some and is now firmly part of the “culture wars.” The best example of this comes from the response to both CBDC and Digital ID, which are both DPIs. Claims abound that they represent digital dystopia or a general repudiation of the free market.

The great reset?

This makes the G20’s call for the advancement of DPI likely to cause a stir in some circles. If the G20 report were put into a cover with the WEF logo, there would certainly be claims that DPI is a means of promoting “the great reset.”

This is where the examples of DPI in action in this paper are so powerful. Take Singapore’s Digital ID “SingPass” as an example, the benefits are clear, and Singapore has not descended into dystopia.

Coming from the G20, I hope the call for DPI should be considered credible.

We can hope, right?

Thoughts?

👉TAKEAWAYS:

—Do you feel that DPI is the key to our future?

—Adoption of DPI is not a government overstep, but prudent government for a digital era.

—Many will see this in terms of “culture wars,” and frankly, that is saddening.

—That the G20 is behind this DPI push should help with credibility but I fear the dividing lines are already drawn.

5. APAC Mobile Economy

5G is "rocket fuel" 🚀 for APAC’s mobile economy!

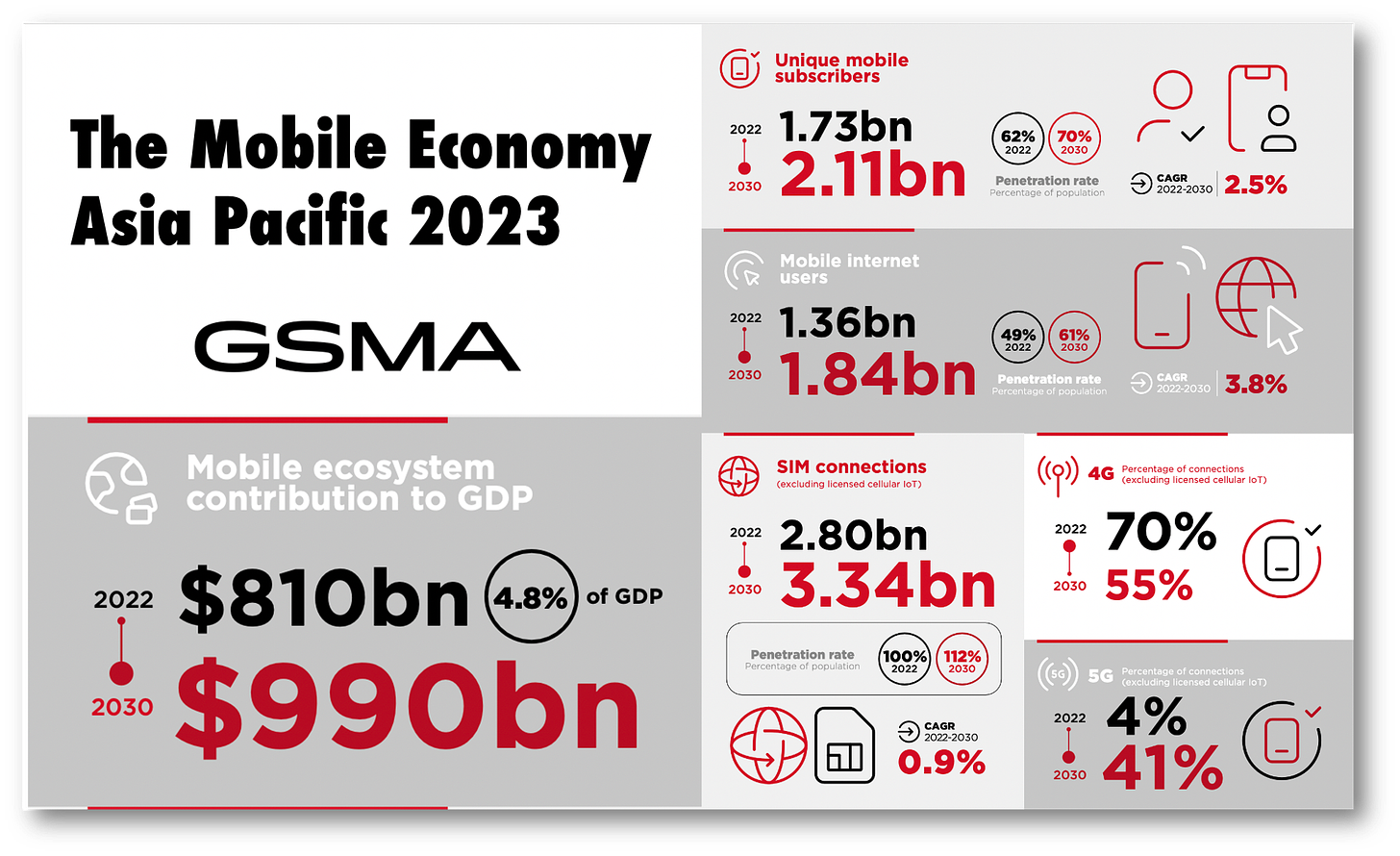

GSMA’s astounding report on APAC’s mobile economy shows that in 2022, mobile technologies and services generated just under 5% of Asia Pacific’s GDP – a contribution of $810 billion of economic value added.

If that isn’t jaw-dropping enough, check out these figures on the chart above that show mobile growth in the region.

For those who think that 5G is unnecessary or a frivolity, think again. 5G is the number one key trend shaping the mobile ecosystem in APAC.

🔷 5G moment builds:

“5G will underpin much of the innovation and new services on mobile-based platforms in the coming years, helped by the rapid rollout and adoption of the technology in the region. Asia Pacific is home to pioneer 5G markets, such as Australia, Japan, Singapore and South Korea, where the technology has become mainstream. The region also has some of the fastest growing 5G markets today, notably India, which is set to add tens of millions of 5G connections in 2023.”

🔷 Mobile is fuelling fintech

"Regionally, Asia Pacific has one of the fastest-growing fintech industries, including massive mature markets such as India and emerging ones such as Vietnam and Indonesia. The continued growth in the fintech sector, especially since the Covid-19 pandemic, has improved financial inclusion in the region, increasing mobile money accounts, point-of-sale terminals, and B2B sales."

🔷 The rise of generative AI

"Mobile operators have utilised AI for a while now to varying degrees. However, the emergence of generative AI has pushed the envelope on AI capabilities and thrust AI technology into boardroom conversations globally. Operators will use advanced AI models like ChatGPT beyond network functions to deliver a smarter and more personalized customer experience."

Thoughts?

👉TAKEAWAYS:

—Does anyone still feel 5G is a toy or unnecessary?

—5G is like rocket fuel for APAC economies.

—Mobile services dominate in emerging and developed APAC.

—The question now is only how fast APAC can install more 5G.

—Industrial 5G for smart factories and logistics is expanding.

—India, Japan and South Korea are working on 6G!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

About the technical aspect of future development of AI in the USA, this video was fascinating:

https://www.youtube.com/watch?v=7KJibx077bE ( Anastasi In Tech with CEO Andrew Feldman)

FYI: AI was also part of the G20 declaration:

https://www.g20.org/content/dam/gtwenty/gtwenty_new/document/G20-New-Delhi-Leaders-Declaration.pdf Page 24 nominal (27 real)

Among others it says: "[We] Will pursue a pro-innovation regulatory/governance approach that maximizes the benefits [of the shareholders] and takes into account the risks associated with the use of AI."

That translates to: "Let the developers have a reckless competition first. Then we will see if we need to or even can 'regulate' something later, after the damage is done."