Future Of Finance: Innovations in Web 3, Asian Rivals, and Dystopian AI In Banking

$1 trillion spent on GenAI with nothing to show?

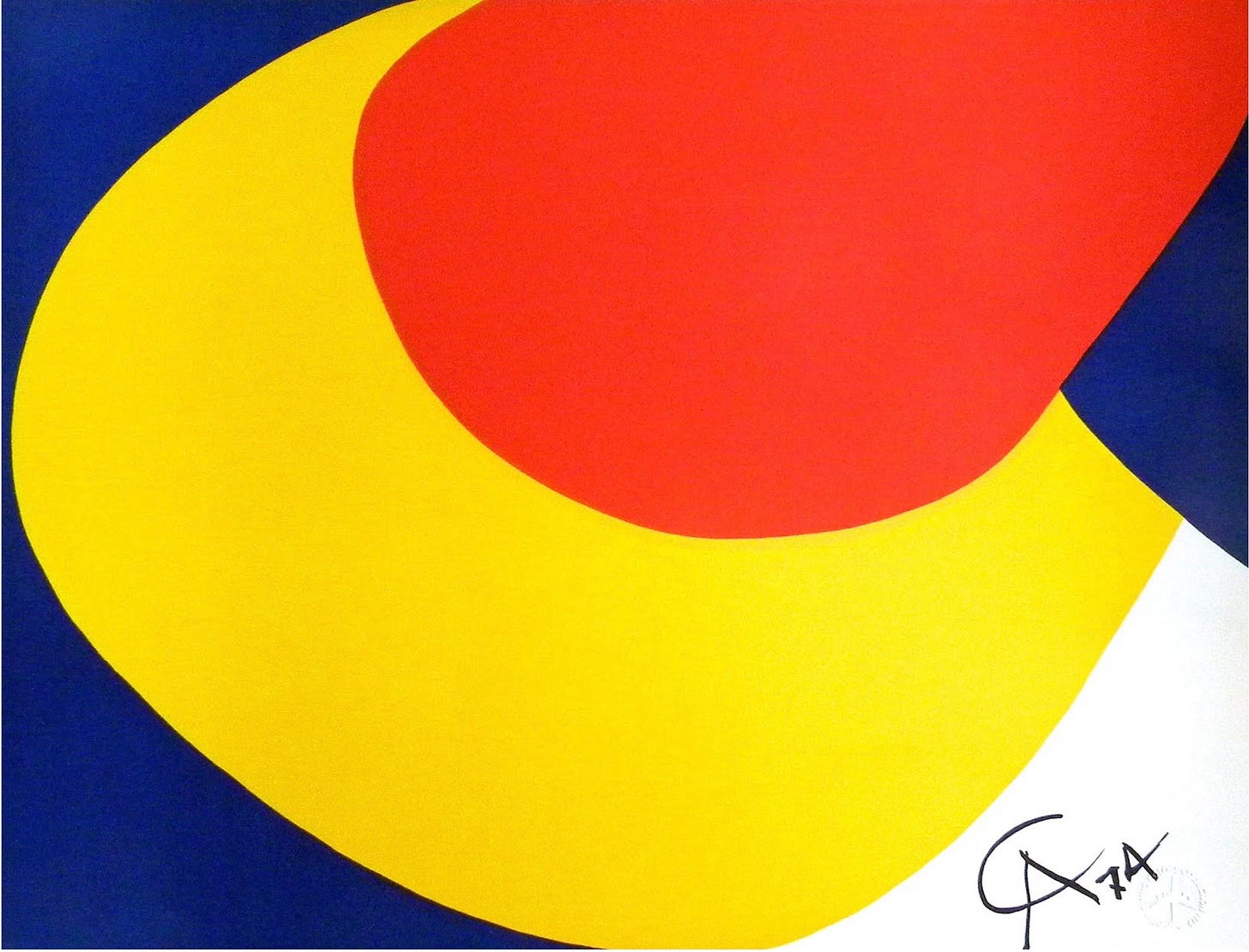

Artwork of the day: Convection (Sunrise in Yellow and Red), Alexander Calder 1975

Alexander Calder was an American sculptor known both for his innovative mobiles that embrace chance in their aesthetic; he also created paintings, jewelry, theatre sets and costumes.

Calder preferred not to analyze his work, saying, "Theories may be all very well for the artist himself, but they shouldn't be broadcast to other people.

This arrangement of bold colourful shapes has also been titled ‘Convection’. Convection is the movement of heat in gas or liquid where warmer parts move up and colder parts move down. Perhaps here the hot red could be rising like the sun through the cooler blue sky.

Subscribe now. What are you waiting for?

Why today’s stories matter

Today’s stories matter because they all give you a peek into the future of finance and banking.

That future is mostly bright and most of today’s stories point to a future where asset movements and banking will be much easier and better than they are now.

But I did say mostly bright, meaning not always! I also show just how dystopian GenAI use in credit underwriting can get and raise real issues of whether GenAI can pay for itself.

The hard part will be getting to this new financial future. It will take a lot of work, and we’re in that uncomfortable transition phase right now.

🔹 Onyx by JP Morgan: Revolutionizing Social Commerce on Web 3

JP Morgan’s Onyx makes it clear that Web3, as it is now, is not fit for purpose! They want change but don’t tell us exactly how to do it.

🔹 GenAI: $1 tn Spent With Nothing to Show For It?

Talk about consequential? Goldman’s research shows that some are unconvinced that GenAI will be the big money maker that others claim.

Two stories focusing on Hong Kong:

🔹 Hong Kong: A Banking Innovator to Rival Singapore

I covered Singapore’s innovations last week, and this week, Hong Kong is in focus! The rivalry is fueling fintech innovation, and we should hope it never ends because we are all benefiting.

🔹 Visa's e-HKD Collaboration: Innovation or Eternal Fees?

Just because this is in Hong Kong doesn’t mean I like the idea! While it is a great example of tokenization’s potential, we can do better than having Visa run it!

🔹 The Dystopian Potential of GenAI in Credit Underwriting

So what if our AI future is not as bright as it’s made out to be? In this article, I share one GenAI prompt that should terrify you!

🔹 ‘Future-proofing’ banking is a myth: Lessons from boxing

No bank is 'future proof.’ It just doesn’t work that way.

Share Cashless, because it’s more beautiful than ever!

I just overhauled the newsletter's main page. Check it out on richturrin.substack.com. It is much easier to see what I’ve been writing about and looks more professional.

You may also note that I’ve changed Cashless's ”tagline” to emphasize “Fintech at the speed of Asia,” which I think nicely captures the essence of the newsletter.

I’m telling you this because these revisions make this the perfect time to share Cashless with your friends or colleagues! Every share is appreciated!

Onyx by JP Morgan: Revolutionizing Social Commerce on Web 3 Beyond Traditional Crypto Markets

Onyx by JP Morgan wants in on the “social commerce” market, which is valued at over $1 trillion and expected to grow 600% by 2030. Social commerce is the process of buying, selling, and marketing products and services on social media platforms. Thanks for reading Cashless: Fintech, CBDC and AI at the speed of Asia! Subscribe for free to receive new posts…

GenAI: $1 tn Spent With Nothing to Show For It?

“Tech giants and beyond are set to spend over $1tn on AI capex in coming years, with so far little to show for it. So, will this large spend ever pay off?” Goldman Sachs has a great analysis that asks fundamental questions about when AI will pay off with pro and con sides represented.

Hong Kong: A Banking Innovator to Rival Singapore

Hong Kong’s Banks are “laying the groundwork for the future of banking,” and if you look carefully at what they’re doing, it is every bit as innovative as that in their neighbor and competitor, Singapore! Most importantly, what isn’t happening is that Hong Kong isn’t dead or dying as reported by some irresponsible journalists in the West.

Visa's e-HKD Collaboration: Innovation or Eternal Fees?

Visa’s collaboration with HSBC and Hang Seng Bank in Hong Kong shows how tokenized deposits and the digital Hong Kong dollar (e-HKD) can save time and money in payments, but there’s a BIG catch! First, even though I do not like this solution, it shows how Hong Kong continuously pushes the boundaries of fintech innovation. So, hat’s off to Hong Kong and…

The Dystopian Potential of GenAI in Credit Underwriting: All You Need to Know in One Prompt

Using GenAI in credit underwriting will be much harder to implement than McKinsey thinks, and I can already hear the cries of digital dystopia! AI is great at credit underwriting, and GenAI’s cousin, “machine learning,” has made billions of credit decisions in China for Ant’s Mybank and Wechat’s WeBank since 2015!

Why ‘Future-Proofing’ Banking is a Myth: Lessons from KPMG and Boxing

This is a solid weekend read from KPMG that tries to "Future-Proof" banking, which I believe is impossible.

Here's why. Consider a banker responding to a management consultant survey in 2021 about their biggest concerns. Would GenAI have even been on the list?

Unlikely! This illustrates how disruptions in banking will continue to hit banks where they least expect it.

Innovation, technological disruptions, regulations, and risk in banking are a lot like boxing.

Yes, methodologies like KPMG's can help coach a bank and teach it to take and throw punches.

But KPMG isn't in the ring and can't help banks take the pain, outsmart a competitor, or deal with intense pressure—all of which are needed to win matches.

Boxers and bankers know that the knock-out punch always comes from where you least expect it.

Join our community by subscribing. You’ll be joining an exciting journey down the rabbit hole to our shared digital future—and you’ll be glad you did!

Subscribing is free, but I am increasingly honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

If you like what I write, and this newsletter has created value for you, and want to support my independent writing with a paid subscription, you have my heartfelt thanks!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!