Banks' Stunning Innovation Failure: Up To 50% Face Demise

Client loyalty and AI are driving fundamental market changes for banks

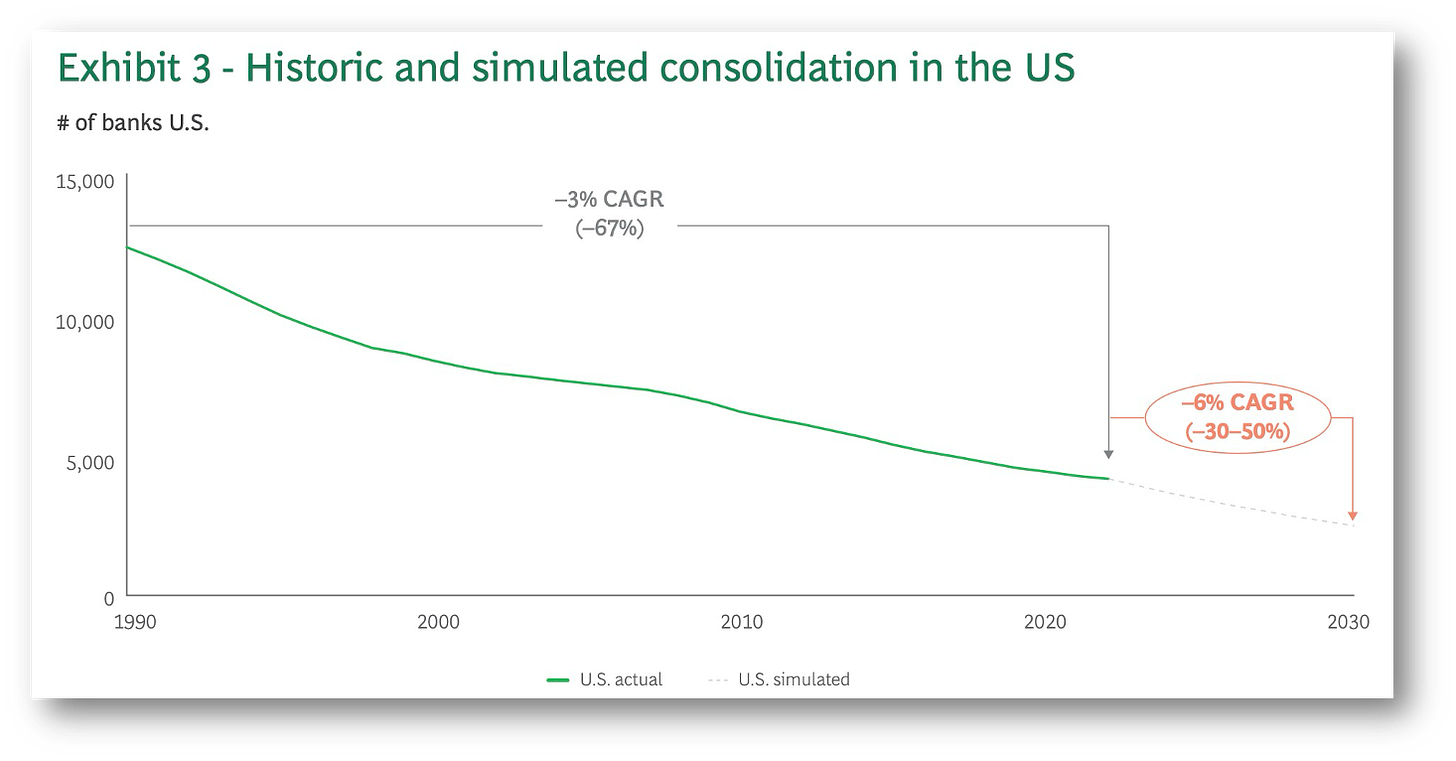

Banks’ continued failure to innovate puts them at risk of losing out in a $1 trillion “re-alignment” of bank P&L set to claim 30% to 50% of today’s banks as victims by 2030.

Driving these changes are two new realities: client loyalty continues to fall as money becomes ever easier to move and an AI-driven cost implosion.

Banks that don’t jump on these trends and innovate will be unable to compete as the gap between digital haves and have-nots becomes untenable.

👉TAKEAWAYS

🔹 What if Banks Fail to Innovate by 2030? If we extrapolate these trends and banks do not prioritize a step change in innovation rates, the profitability of the retail banking industry could suffer significantly.

🔹 Fintechs to Slowly Win Market Share in Developed Countries Despite difficulties in gaining market share, digital challengers threaten incumbents by achieving operational excellence, capturing active clients, and achieving healthy income per client and per product.

🔹 Successful Ecosystem Players Will Remain an Exception Prime examples of successful ecosystem plays involving banks tend to be found in less developed countries. We expect this trend to remain largely intact, as preconditions for success are often unmet in developed countries.

🔹 Big Tech Will Not Become Dominant Banking Players Despite some attempts by companies such as Google, Apple, and Microsoft to partner with banks, we do not see these players launching their own banks in developed countries. Regulatory hurdles are too high and the ROE too low to be attractive for these companies.

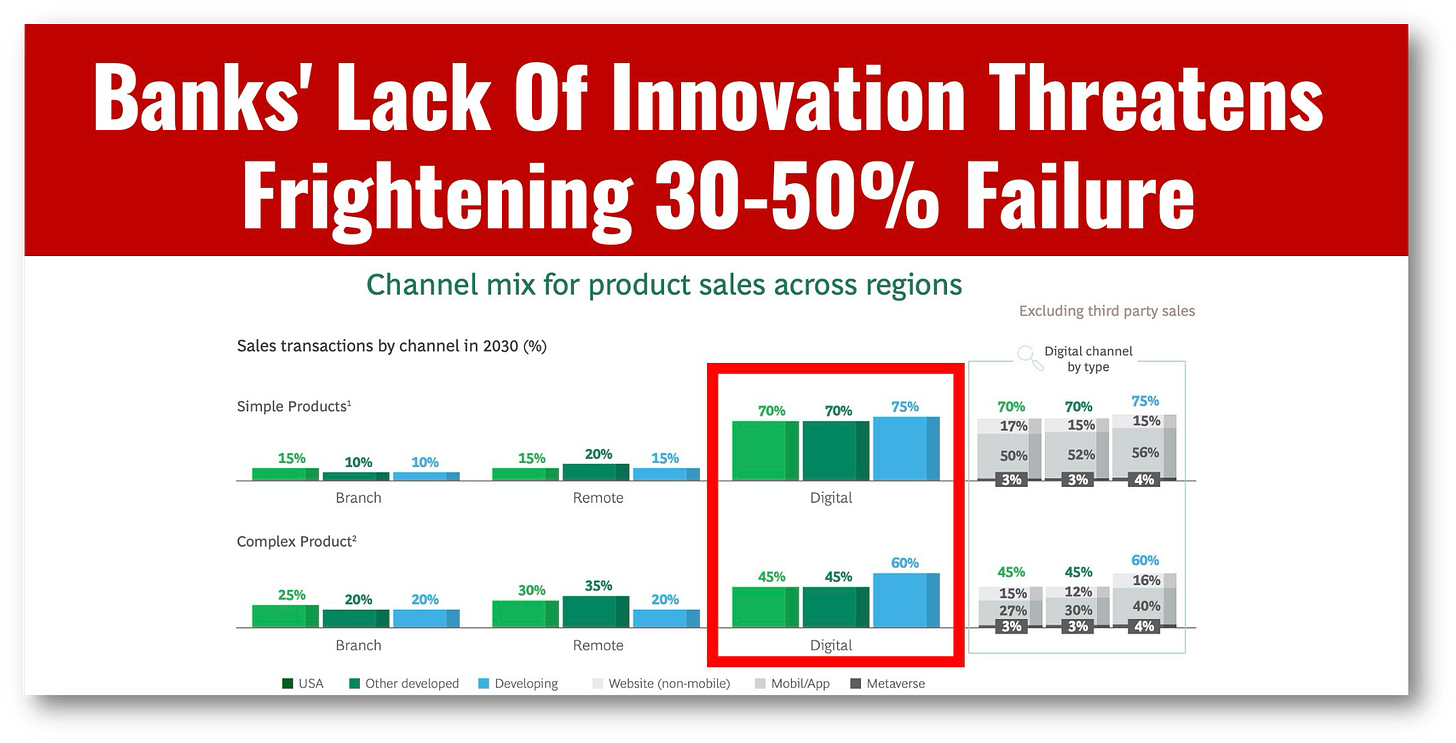

🔹 Banks must re-build their sales infrastructure in line with increasing client preferences for digital and remote channels. We expect banks to close approximately two thirds of their branches in the US and other developed countries while simultaneously building out their digital and remote sales capabilities.

🔹 Banks must try harder to attract and retain more mobile clients. Strategic marketing efforts will be crucial, as will remote hubs that are adequately staffed to handle higher outbound call volumes that drive cross-selling among existing and prospective clients.

🔹 The unit cost implosion will shrink back-office costs. In the US and other developed markets, operating costs will likely be cut by 40% to 50% compared to the business-as-usual scenario, driving down costs by ~$80 billion overall.

👊STRAIGHT TALK👊

It would be easy to pass off this BCG report as “fear-mongering” on the part of BCG to scare banking clients into becoming customers.

While BCG certainly wants new clients, in this case, ringing the alarm bell is very much warranted.

Their warning that “the gap between leaders and laggards will widen” is something I’ve been saying for more than a year, and BCG’s estimate that 30-50% of banks will close seems on-target.

The warning that banks need to get busy innovating or get busy being bought out is real, and every indication is that banks are failing the innovation challenge and, even worse, ignoring their customers’ needs.

This will not end well for many banks, but at least they’ve been warned.

See the article below to see just how badly banks ignore their customers:

Please restack!

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!