Mobile payments are changing our world and are a geopolitical tool, while banks aren't fast-tracking their AI future!

The PBoC illustrates how to use China's digital yuan!

Artwork of the day: Uemura Shoen: Flame, 1918

The trailblazing Japanese painter Uemura Shōen was one of the first Japanese female artists to paint professionally.

Despite being known for works of beautiful women bijinga (Ukiyo-e beauty portraits) Shōen reportedly said "Never once did I paint a work with the expectation that it would be a fine work as long as the woman depicted was beautiful. My earnest hope is that all my works are like fragrant jewels, always with a sense of fresh purity, never with even an iota of the vulgar".

Uemura's 1918

Uemura's 1918 work on the theme of jealousy, Honō (焔, Flame), depicts an ikiryō (living ghost) incarnate in jealousy without compromising dignity. It is considered to have raised the standard of nihonga, a Japanese painting style that uses organic pigments, mineral pigments, and ink on silk or paper.

This week we have three stories about our changing world of payments and two that show how our GenAI future may not be coming as fast as predicted!

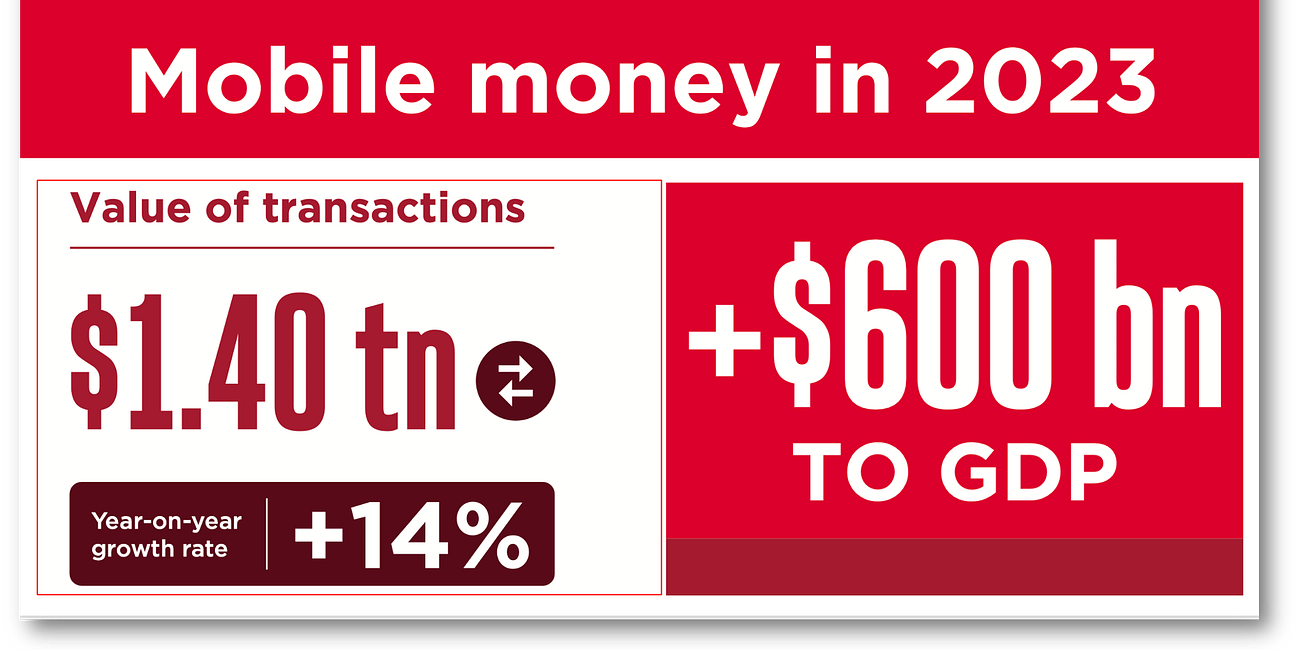

Mobile money boosts GDP 1.5%!

Mobile money is a global sensation with double-digit growth, but it is far more than just a payment! It’s now become a geopolitical tool or force!

Hong Kong Monetary Future is Digital!

Hong Kong's acceptance of CBDC, Stablecoin, Crypto, and Tokenized Deposits shows what our monetary future will look like. It’s your wallet, so spend the digital currency of your choice! And it will beat rival Singapore to the punch!

China’s e-CNY for Tourists

This fabulous infographic shows how China’s e-CNY works in both online and offline versions! It is a must-read as it shows how much work goes into making the digital yuan the world’s first large-scale CBDC.

Banks aren’t fast-tracking AI

I cover GenAI stories weekly, written mainly by consultants that show a rosy AI future. In reality, banks aren’t embracing AI as fast as consultants would have us believe!

GenAI will not magically personalize banks!

Following the story above, many in banks believe that GenAI will miraculously personalize bank offerings. Nothing could be further from the truth, and Mastercard shows how it's done.

Have you shared “Cashless?”

Please share this newsletter with friends, colleagues or social media!

Every new subscriber helps motivate me to create even better newsletters for you!

Thank you in advance for sharing!

Mobile Money Hits $1.4tn in Transaction Value And Boosts GDP By 1.5%

Mobile money is a GDP booster! Surprised? Don’t be! Countries with mobile money systems added $600 bn to GDP, which is the equivalent of increasing GDP by around 1.5%! That’s good for everyone! The mobile money-GDP relationship is clear: “Between 2013 and 2022, a 10-percentage point rise in mobile money adoption was found to have increased GDP by 0.4% -…

Hong Kong's Monetary Future: CBDC, Stablecoins and Tokenized Deposits

Hong Kong embraces a digital currency future to guarantee its role as Asia’s premier financial center! What makes Hong Kong’s efforts so special is that they promote Stablecoins, CBDC, Tokenized Deposits, and even Crypto. Hong Kong has wisely taken an agnostic position toward digital currency, saying, “If you can pay with it, we’ll take it!”

How To Use the Digital Yuan, Not Just For Tourists!

The PBOC just published the best guide yet on how to use the digital yuan or e-CNY and there are so many types of wallets it’s mindblowing! This guide outlines how the e-CNY works and can be connected to foreign Visa and Mastercard. American Express need not apply!

Banks Fear Fast-Tracking AI; 52% are Falling Behind

The American Banker surveyed 127 senior bankers in the US and got a fascinating view of the AI world, slightly different from the hype we get from consultants. I wrote a book about innovation, and bankers are among the world’s worst, so expecting them to embrace AI enthusiastically is unrealistic.

Banks Fail at Personalization: Mastercard to the Rescue, not GenAI!

Banks are failing to personalize their services and blame the data. Mastercard (MC) is an expert at personalization and says banks just don’t get it! Banks have done a terrible job of personalization—in fact, they’re so bad at it that MC is calling out their failure!

UN adopts first global artificial intelligence resolution to ensure AI is safe

https://news.cgtn.com/news/2024-03-23/UN-adopts-first-global-artificial-intelligence-resolution-1scjv22nwWc/p.html