Show me the Money: Where is AI's Astonishing ROI?

Early surveys suggest AI's ROI is still lacking.

Thanks for reading the “Cashless” newsletter, an insider’s view on Asia’s fintech, CBDC, and AI for financial services professionals, policy-makers, and fintechs. Subscribe for insights, latest news, and emerging trends straight to your inbox every Sunday.

Topics:

AI: Show me the Money

NVIDIA REPORT: AI To The Moon In Financial Services

Slow AI Adoption: Blame The Leaders Not AI's Poor ROI?

Visa: the Victim of the Money Movement Revolution, Not the Revolutionary

The Quantum Economy: The Next Big Thing In Finance

Dear readers,

Are you wondering when the massive AI investment will turn into profits for those rushing headlong into the AI revolution? I am, too, and so far, the early results are mixed.

That’s why, for today’s art, I chose a drawing by MC Escher for its conflicting message of black and white birds flying in what appears to be the wrong direction. This week, two reports on AI’s ROI seem to be in equal conflict.

I hope you enjoy this week’s stories and if you’re not a subscriber, please hit the button below:

AI: Show me the Money

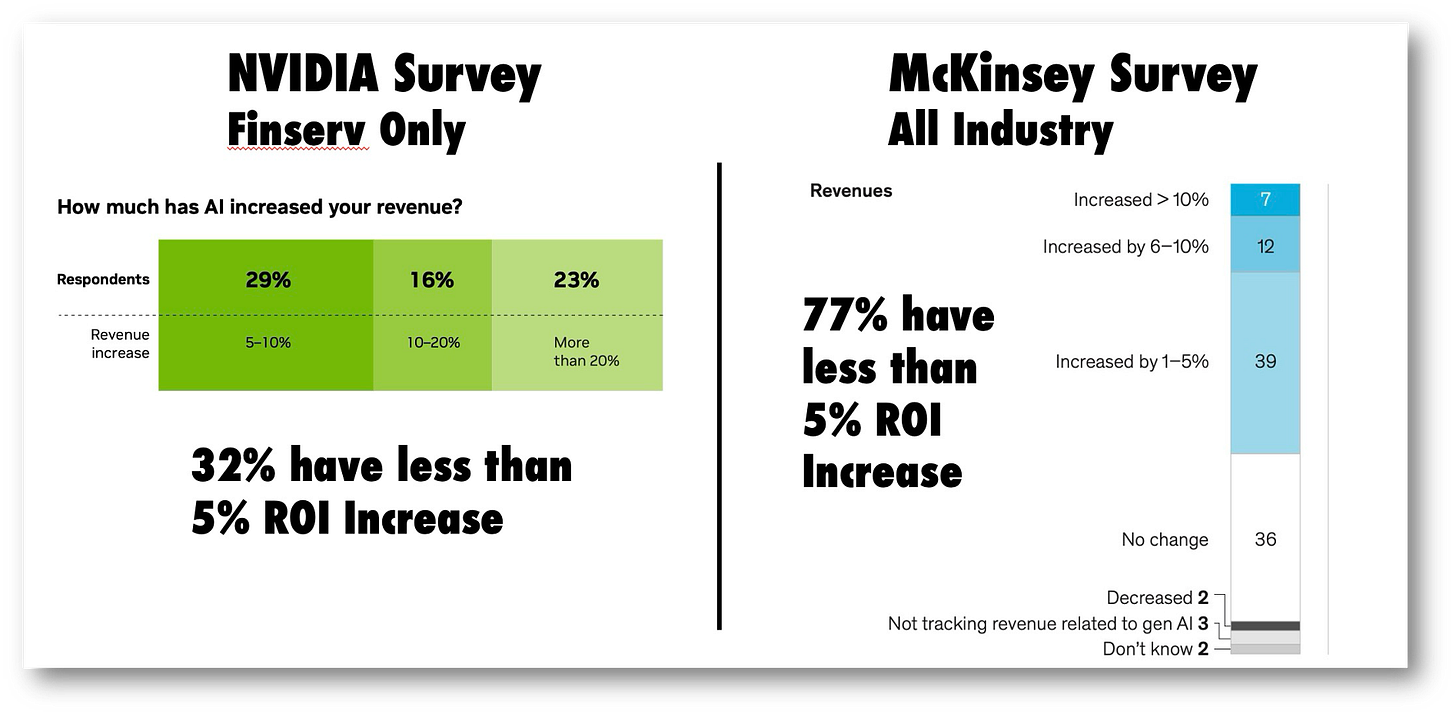

This week, two surveys provided conflicting views of AI’s ROI, which I summarized in the table below.

NVIDIA’s survey of finserv participants showed that only 32% of respondents had an ROI on AI of less than 5%. Next, we have a survey by McKinsey for all industries, which showed that 77% of respondents had an ROI on AI of less than 5%.

Which is right? Probably neither. NVIDIA’s survey either shows that finserv is miraculously better at adopting AI than the industry overall, as McKinsey’s survey shows, or that NVIDIA stacked its numbers.

In the end, we can’t know which survey more accurately reflects AI’s ROI, but if I were a betting person, I would say that NVIDIA is overly optimistic. For all of its flaws as a management consultant, McKinsey likely captured a more accurate market state.

The takeaway is that there is still no big payoff for early AI implementations, regardless of whose numbers you believe.

This shouldn’t deter AI investment, but it should dispel the hype and suggest that, like other new technologies, AI will take a while to turn a profit.

NVIDIA REPORT: AI To The Moon In Financial Services

This leads us to NVIDIA’s report on AI in FinServ, which shows that business is booming. While that is undoubtedly true, one must wonder if NVIDIA’s report is overly self-serving.

Still, with all the money pouring into AI, I have to ask a fundamental question about finserv and banks in particular: Are they robbing Peter to pay Paul?

Banks aren’t known for being able to juggle multiple innovation efforts, and with vast resources pouring into AI, I wonder what other key technologies are being abandoned or short-changed. Read more about the state of AI in finserv: HERE

Slow AI Adoption: Blame The Leaders Not AI's Poor ROI?

Now, we turn to McKinsey, whose ROI figures were buried on pages 31 or 45! I accuse McKinsey of “burying the lead,” and I think most fair-minded readers will agree that it’s big news when 77% of those surveyed showed an AI ROI of 5% or less!

The results are so contrary to McKinsey's message of tapping into veins of AI gold that burying these results on page 31 was the only way to downplay them.

Interestingly, McKinsey accuses industry leaders of not being proactive enough with AI, as though they are upset that their AI consulting revenue is behind schedule!

McKinsey’s report is a fun read, and their blaming management for the delay in AI rollouts smacks of desperation: HERE

Visa: the Victim of the Money Movement Revolution, Not the Revolutionary

Visa did a great job covering the “Money Movement Revolution” in a paper that is not new but nonetheless inspired me to write.

Throughout the paper, Visa accurately outlines the changes impacting its payment universe but fails to acknowledge how each change is causing it to lose out to low-cost, Real-Time Payment digital wallets.

It’s a fun read, and I show how Visa is on the losing side of this revolution and blithely telling investors none of this matters: HERE

The Quantum Economy: The Next Big Thing In Finance

I mentioned above robbing Peter to pay Paul with an AI investment. One area in banks that is likely not getting the money it needs due to AI investment is quantum computing.

Quantum suffers from being the revolution that is always coming next year, so I understand why bankers are hesitant to invest in it.

The problem is that all new digital infrastructure being built now is required to be quantum resilient. So ironically even if quantum computing isn’t mainstream yet being quantum-proof is. Read on: HERE

Hot Topics for Subscribers only

What you’re missing in the section below:

Goldman Sachs on DeepSeek

The path to GenAI value

Digital payments in the EU

AI-related electricity consumption

McKinsey on Embedded Finance

Dear paying subscribers,

Thank you for subscribing. I hope you enjoy this content, and if there’s anything you want to see more or less of, please let me know!

Goldman Sachs shows that the new reality of DeepSeek hits hard: “The main near-term risk to GDP is that more efficient model training and declining compute costs could lower AI-related capex.”

McKinsey talks embedded finance in a solid read that has great charts showing how mobile wallets and changing channels are disrupting the EU market.

IBM Global outlook for banking is a solid read, but I can’t help but wonder if their emphasis on AI in banking is far too self-serving. It is as though no other technology matters.

Are you ready for the binary big bang? This is a great read for those willing to read something a bit philosophical about our AI future. Accenture says that: “Every company must be prepared to forge a new technological footprint, founded on AI—a unique DNA identifying and differentiating them as they launch into tomorrow’s technology landscape.” They are right!