Surreal stories of CBDC, GenAI, Digital Remittances, and RMB e-Commerce

How surreal can our fintech world get?

Artwork of the day: “The Disintegration of the Persistence of Memory”, 1952 to 1954, Salvador Dali.

This painting is an oil on canvas re-creation of the Dali's famous 1931 work The Persistence of Memory.

In this version, the landscape from the original work has been flooded with water. Disintegration depicts what is occurring both above and below the water's surface. The landscape of Cadaques is now hovering above the water. The plane and block from the original is now divided into brick-like shapes that float in relation to each other, with nothing binding them. These represent the breakdown of matter into atoms, a revelation in the age of quantum mechanics.

Dali famously once said:

“The limit of stupidity is to draw an apple as it is. Just draw a worm, tormented by love, and a dancing lobster with castanets, and let elephants flutter over the apple, and you will see for yourself that the apple is superfluous here.”

Why today’s stories matter

There are days when only Salvador Dali's surrealism can truly capture the essence of this newsletter's stories, and today is one of those days.

Dali's ability to transform the familiar into the extraordinary resonates because that’s just what many of today’s stories do. They take familiar narratives and turn them into Daliesque melted clocks.

94% of Central Banks Exploring CBDCs!

This is surreal for me in a good way! When I started writing cashless, I never dreamed that CBDCs would have such explosive growth. This is great news and surreal only because it exceeds my wildest dreams.

AI in Finance a $170bn Profit Machine?:

I love CitiGPS reports; they are the gold standard for in-depth coverage of financial topics. Today’s is no exception, and I made it first on today’s list because it is that good. However, Citi succumbed to AI hype by using a $170bn headline number that wasn’t derived from research but from a survey! The report is fantastic, but don’t believe the number; it’s out of a Dali painting.

McKinsey: Tokenized assets are only a $2tn market:

McKinsey's low-ball number for the tokenization market is a bit surreal. With industry estimates up to $16tn, McKinsey undervalues tokenization’s potential. My mantra: “if it can be tokenized, it will be tokenized.”

Digital remittances reduce poverty:

This story is surreal because although this has been known for a decade, not enough is being done. Incumbents are slow to change.

Who wants to pay with RMB anyway?

E-commerce does, and the old adage that people won’t use RMB for payment has been proven false by international Chinese e-commerce operators like Temu and Shein.

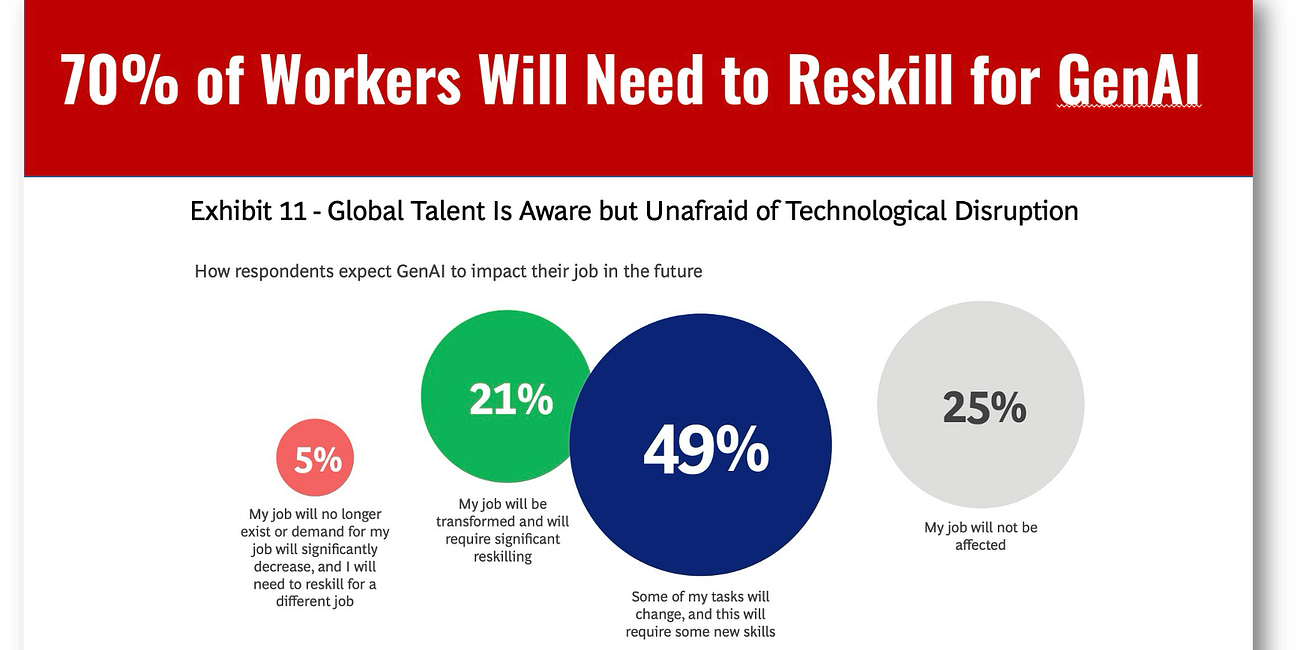

70% of workers will need reskilling with GenAI. Will they get it?

This story won the Melted Clock Award for surrealism. Seventy percent of workers relying on their employer for reskilling is fraught with risk and is the definition of surrealism.

Friends, if you like my writing here, do me a favor and share this newsletter with a friend. If you haven’t subscribed, take the plunge.

Special thanks to all of you who have subscribed and shared!

94% of Central Banks Exploring CBDCs, Interest in Wholesale CBDCs Beating Retail

The BIS’s annual central bank (c-bank) survey is out, and 94% of 86 surveyed central banks are exploring a central bank digital currency (CBDC). A full 31% of C-banks are now working on pilot-stage CBDCs. This trend is not to be underestimated. The Atlantic Council reports that these C-banks, now exploring CBDCs, collectively represent a staggering 9…

AI in Finance a $170bn Profit Machine?

Kudos to Citi, whose “gold standard” report on AI’s impact on finance foretells a near future in which AI may contribute a hefty $170 billion, or 9%, to global banks in a mere five years. Do you believe it? I don’t; the timing is too short, given how AI still lies and exhibits bias.

Tokenized Assets: Just $2 Trillion Market Size According to McKinsey?

McKinsey estimates that the market cap for tokenizations will be a mere $2 trillion by 2030! That’s “chicken feed” when you compare it to some of the more absurd market estimates we’ve seen that top $16 trillion! The reason the numbers diverge is simple, everyone is guessing!

G20 & UN: Digital Remittances REDUCE Poverty

Great read on how remittances significantly impact poverty and rural growth. This report, authored by the UN's International Fund for Agricultural Development (IFAD) with contributions from the World Bank, was launched on 16 June in celebration of the International Day of Family Remittances (IDFR)!

But who wants to pay with RMB? Everyone buying China's e-Commerce!

In a stunning development, the Chinese RMB surpassed the US Dollar in cross-border payments within the non-banking sector. And wait for it……it was all brought to you by fintechs! So, let’s be clear from the start: This is not the death, dethroning, or toppling of the USD. What it shows is that people will pay with whatever is “faster and cheaper” an…

70% of Workers Will Need Reskilling in Our New GenAI World. Will They Get It?

GenAI is changing the workplace, and what this BCG survey makes clear is that 70% of workers expect to require upskilling when GenAI hits. What BCG didn’t ask, but should have, is how many of these 70% will actually receive that upskilling from their employer.

Joining our community by subscribing. It will be an exciting journey down the rabbit hole to our future, and you’ll be glad you did!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!