The Future of Generative AI🔺Australia and the UK want CBDC Innovation🔺CBDC in Asia, "one-size-doesn't-fit-all🔺Embedded finance, nightmare or dream?

BRICS+, gold, dedollarization, chip ban, and AI race with China!

1. The Future of Generative AI

2. Australia’s RBA wants CBDC innovation

3. Bank of England wants CBDC "platform model.”

4. CBDC in Asia, not “one-size-fits-all”

5. Invisible embedded finance dream or nightmare?

6. BRICS+ and dedollarization! What you need to know.

Today’s artwork: Elvis Presley, Ralph Wolfe Cowan1976/1988

Elvis Presley released hundreds of records throughout a career that spanned slightly more than two decades. He also starred in thirty-one feature films and two documentaries. He was photographed throughout his career, and images of him on film are part of the American visual experience. However, the King of Rock and Roll only sat for one portrait painter—Ralph Wolfe Cowan. Elvis sat for Cowan in 1969, and Cowan produced the portrait of Elvis that hangs today at Graceland.

1. The Future of Generative AI

Are you ready for a Generative AI future that is an AI-fueled high technological free-for-all?

A great report by Creative Dock outlines all the potential scenarios for Gen AI adoption in Society and 30 GenAI trends to watch!

What I enjoyed most about this report were the GenAI scenarios for 2026 that ask a fundamental question about the interaction between progress in AI regulation and AI models. (See above or chart pg 11)

The scenarios are:

🔷 Scenario 1:

Society Embraces Generative AI (High AI progress, high regulation progress)

Society has embraced AI with open arms, becoming an integral part of daily life. AI systems seamlessly integrate into various sectors, enhancing efficiency, productivity, and consumer experience while adhering to robust regulatory frameworks.

🔷 Scenario 2:

The AI Hibernation: Highly regulated, dormant AI (Low AI, high regulation)

Maximized regulation of the development and use of generative AI technology has led to slow progress in the field. Generative AI systems are limited to specialized applications, and the potential benefits of the technology are not fully realized.

🔷 Scenario 3:

The AI Cessation: Society Rejects AI (Low AI, low regulation)

Society has rejected AI due to incapacitated regulations, which results in limited technological innovation and progress. Potential misuse and inefficient generative AI leads to public mistrust.

🔷 Scenario 4:

Technological Free-For-All: Unregulated High-Tech AI (High AI, low regulation)

Minimal regulation as regulators fail to adapt quickly to rapid AI advancement. With rapid technological innovation in Generative AI use cases and systems, the adoption and potential misusage of the technology is expected.

Which are you betting on? For me, it’s the technological free-for-all that seems the most likely!

Regulations remain hopelessly behind the advances in GenAI, and I can’t see that changing. AI advances are far faster than Moore’s law for chips: “computers get 2x faster every 2 years,” and I wouldn’t bet on that stopping.

Thoughts?

👉TAKEAWAYS:

—GenAI is here, but I feel this is just the beginning!

—Our AI future is not predestined, but I bet it will be a free-for-all.

—Why? Take a good look at crypto!

—The genie is out of the bottle; there is no going back!

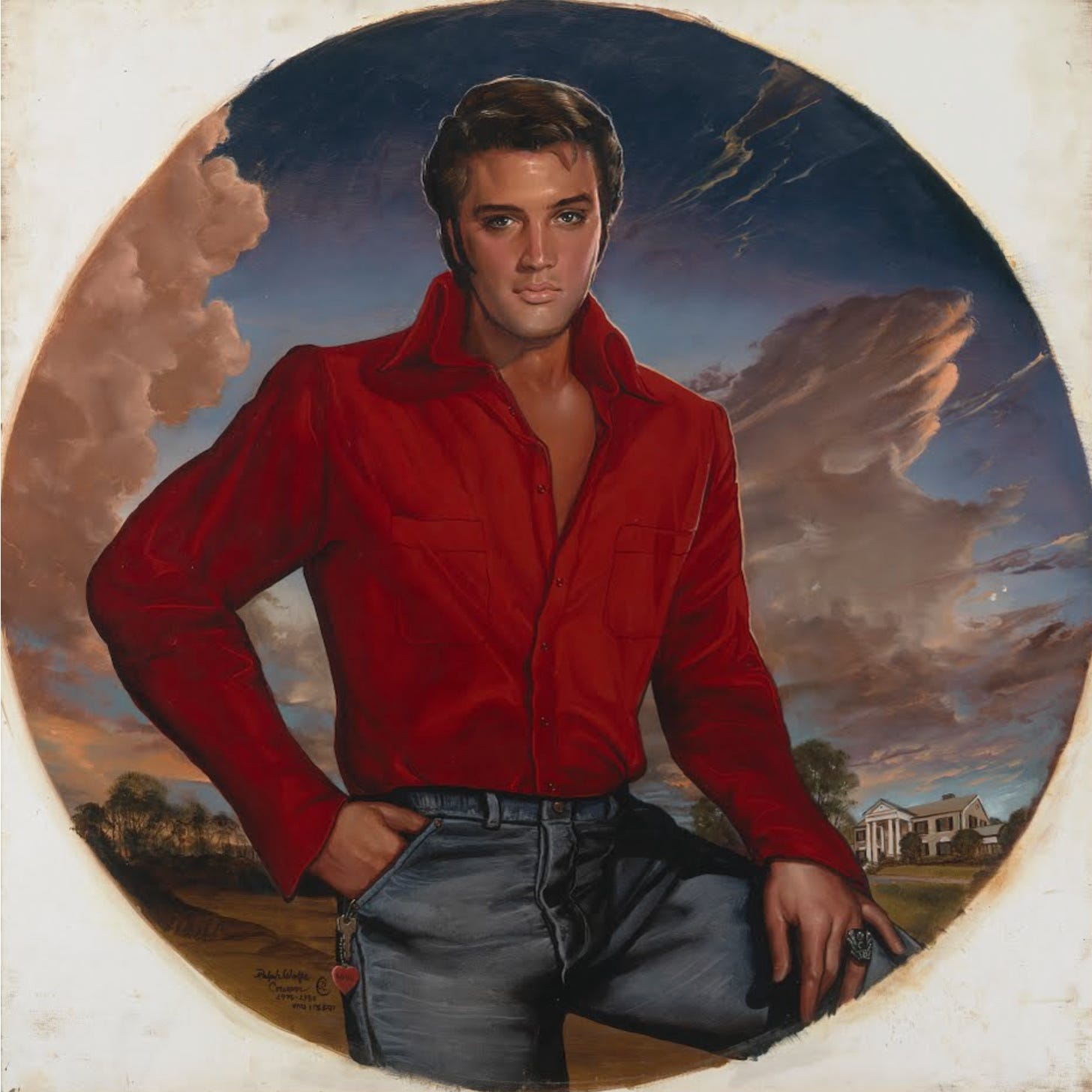

2. Australia’s RBA wants CBDC innovation

Australia’s RBA wants CBDC innovation in smart payments, tokenization, inclusion and new digital money!

The Reserve Bank of Australia (RBA) just wrapped up a CBDC pilot program that was an absolute model of practicality, collaboration, and innovation!

My congratulations to the RBA team and all participants! Be sure to say hello!

In short, the RBA set up a test CBDC and asked innovators in banking and crypto what they could do with a tokenized CBDC with smart contracts.

What I love about this approach is that it opened the doors to innovators, and eventually, 16 firms with great ideas participated.

I also just wrote Monday about the Bank of England talking about CBDCs spurring innovation! I think the innovation message is finally catching on!

In the end, the four key themes are:

1️⃣ Enabling ‘smarter’ payments.

Smart contracts, can allow complex transactions, such as multi-party or multi-stage payments, to execute automatically and simultaneously, reducing the need for costly reconciliation processes and the risk of failed transactions.

2️⃣ Supporting innovation in financial and other asset markets.

Exploring the tokenisation of financial and other (real) assets on distributed ledger technology (DLT) platforms, with CBDC being used in the ‘atomic’ settlement of transactions.

3️⃣ Promoting private digital money innovation.

CBDC could potentially promote interoperability and uniformity of new forms of private digital money, such as tokenized bank deposits and stablecoins backed by high-quality assets. (I see this as the least likely that the central bank will pursue of the four.)

4️⃣Enhancing resilience and inclusion in the digital economy.

Providing households and businesses with an alternative way to make payments, including the ability to make offline electronic payments in scenarios where electricity and/or telecommunication services were unavailable, for instance, following natural disasters. And serving the unbanked!

Thoughts?

👉TAKEAWAYS:

—The RBA did a great job on this model CBDC pilot done in collaboration with innovators.

—The four areas RBA will work on make perfect sense and are not rocket science. (They should have hired me! I could have told them months ago!)

—RBA made a strong statement that innovation matters! It does!

—A CBDC is "years away" for the RBA, but now they know WHY they need one!

3. Bank of England wants CBDC "platform model.”

Bank of England goes all in for innovation with the digital pound and the platform model!

I love this paper by the Bank of England (BoE) because it looks beyond buying coffee to the innovation that a digital pound platform can create.

The key word is platform, and with it comes public-private partnerships to spur digital pound innovation. The BoE will enter the platform economy with Google, Apple, and others

While the BoE rightly claims other CBDCs, like the digital euro, may see themselves this way, the BoE is the first to come out and acknowledge it. Kudos to the BoE.

So what is a digital platform?

Digital platforms bring together two or more market actors and grow through network effects and are broken down into three types: Innovation, Transaction, and Hybrid.

🔹Innovation platforms: facilitate the development of new, complementary products and services, such as PC or smartphone apps, that are built mostly by third-party companies. Products are complementary in that these innovations add functionality or assets to the platform, which is the source of network effects.

🔹Transaction platforms: intermediaries or online marketplaces that allow participants to exchange goods and services or information. The more participants and functions available on a transaction platform, the more useful it becomes.

🔹Hybrid platforms: Combine the two approaches above. This is precisely where the digital pound will sit.

The digital pound will have to be an innovation platform in that it attracts ecosystem partners for great uses, while it is also a transaction platform in need of Amazon's flywheel effect.

I would say that the digital pound leans more toward being an innovation platform since it will rely on third parties to make the killer use cases that spur use.

The BoE gets that the digital pound will ultimately be used in a world where “machines will pay,” the fourth industrial revolution is underway, and we are bravely building the metaverse, and it will take a platform to do it all.

I feel that the BoE gets it, and you?

Thoughts?

👉TAKEAWAYS:

—BoE is astute in seeing the digital pound as a digital platform.

—The digital pound will be tremendous for fintech innovators.

— The BoE envisioning digital pound as a platform is a crucial first step.

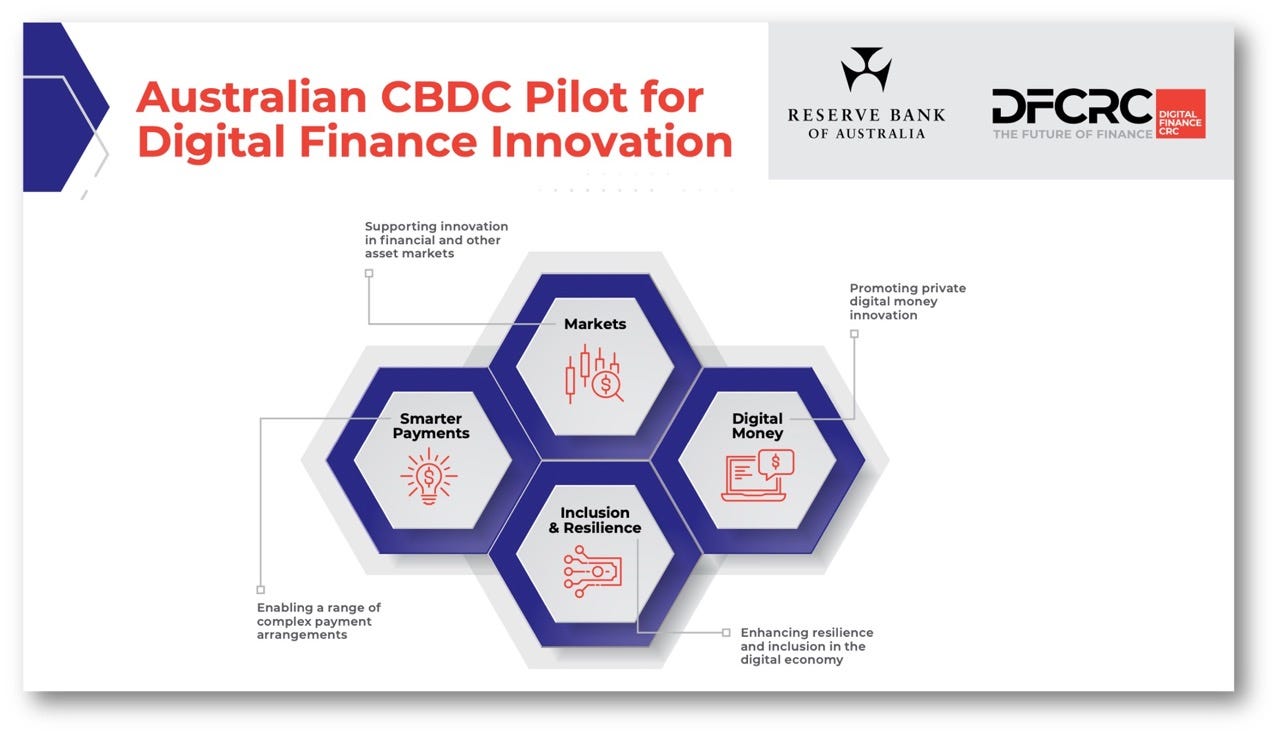

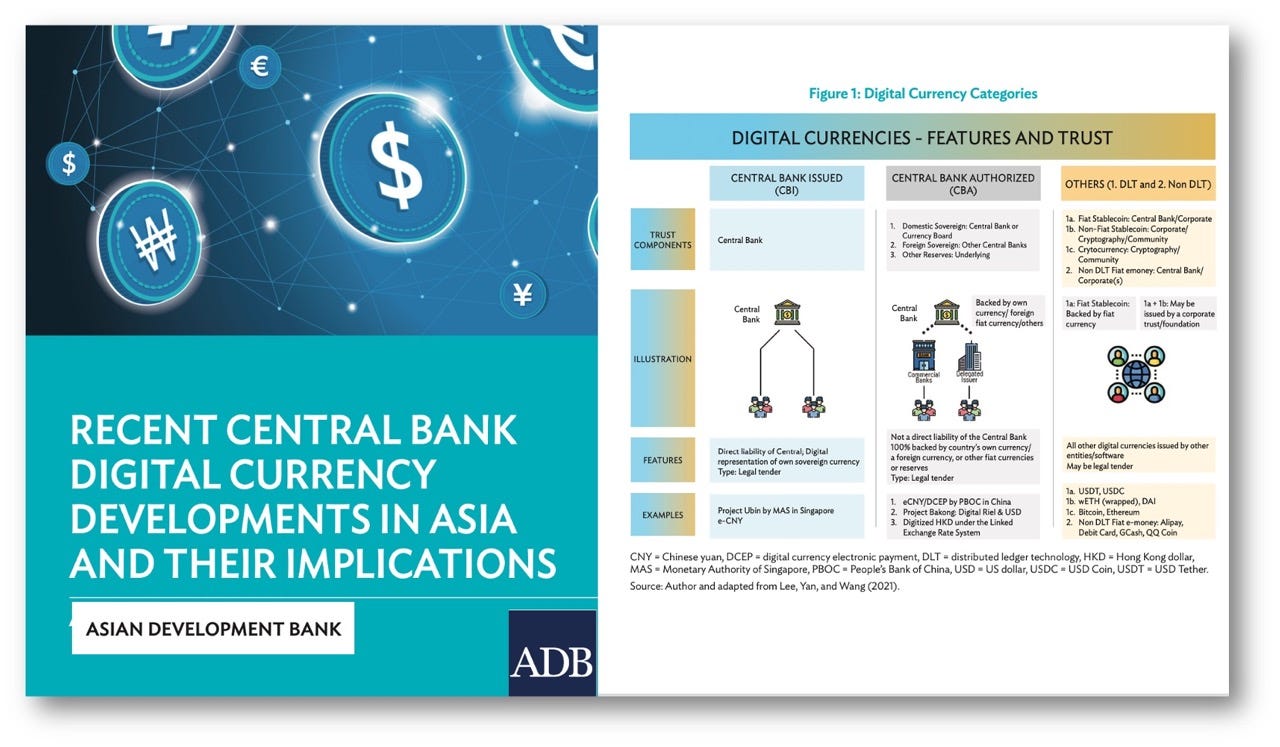

4. CBDC in Asia, not “one-size-fits-all”

CBDCs in Asia show that "one size does not fit all".

The Asian Development Bank (ADB) lays out the latest developments in CBDC that will impact development in Asia. It isn’t easy because the ADB has to look after nations in varying degrees of development.

Interestingly, Asia is an absolute CBDC powerhouse with many nations, rich and poor, looking to CBDCs for their future.

CBDC particularly entices developing countries in Asia as they see it as a way of unlocking their economic potential after watching the impact of instant payments on China and other nations. Some may actually “leapfrog” their developed neighbors!

Unique Asian developing economy risks:

🔷 Dollarization and “yuanization” may both lead to the unhealthy dependency of smaller economies relying on a major international fiat currency. CBDCs from larger economies might play a role in crowding out digital money from smaller economies. In particular, CBDCs backed by a single currency may lead to over-dependence.

🔷Sovereign or corporate stablecoins may make monetary and fiscal policies become less effective as the local currency is used less than foreign currency, rendering the local currency irrelevant.

🔷The high velocity and transmission speed are risk considerations for regional economies given past experiences of sudden capital inflow and reversals during the Asian financial crisis.

The ADB nails it by stating that the benefits for CBDC cannot be fully realized unless many of Asia’s shortcomings are addressed:

Greater and higher quality connectivity between economies through distributed computing and public digital infrastructure;

expanded global and regional trade and investment opportunities via digital access to capital and free trade; and

increased and diversified regional public goods such as distributed ledger and blockchain for trade traceability, identity, supply chain financing, and tokenization of products and services.

Thoughts?

👉TAKEAWAYS:

—CBDCs are like made-to-measure suits tailored to the specific nation.

—Asian nations' issue of currency substitution through stablecoins and gaming revenue is unique and noteworthy.

—The real test will be linking these CBDCs into a regional system; look to Hong Kong’s mBridge for that.

5. Invisible embedded finance dream or nightmare?

Embedding finance so deeply it’s invisible; is that a dream or a nightmare?

Tonight a great read on embedded finance that envisions finance becoming invisible. I’m a strong proponent of embedding, but I've also seen how bad it can be for consumers.

That's why I raised whether invisibility is a “dream or a nightmare?”

🔥I want to challenge the perspective that “all embedding” is “good embedding.”🔥

The easiest example to pick on is Buy Now Pay Later (BNPL), the cause celebre of fintech for about the past two years.

With the launch of BNPL on Apple, it would seem that BNPL is "good embedding," and the argument is over. Maybe so, but it shouldn’t be.

Where embedding in loans fails:

❌A study just out this summer on BNPL in the UK found that:

“BNPL was having a negative financial impact on some users. 3 in 10 said they had experienced an issue when managing their BNPL spending – such as missing a payment, being charged a late fee, and falling behind on other payments or bills.”

❌Or the US’s Lending Tree:

The fact that 42% of BNPL users said they’d made a late payment was the most troubling and most shocking finding.

❌Or China: (loans not BNPL)

"China has over 40 million college students; many turn to online lenders for money. This resulted in a 2021 regulatory crackdown on net student loans deemed to entice students to borrow more than they can afford."

The debate goes far beyond whether I like BNPL, I do not, but it speaks to how embedding financial services is not always good for the consumer.

So that my message isn’t lost, let me clarify. I like embedded finance, but it is far from perfect.

My questions, and I confess I don’t have the answers are:

🔹 What are we embedding?

🔹 Who are we targeting, and is it suitable?

🔹 Can we mitigate the potential for harm?

🔹 Is the embedding so “transparent” that it misleads or missells?

🔹 Is buying a financial product too easy?

🔹 What duty of care is required?

How do you feel about embedding?

Thoughts?

👉TAKEAWAYS:

—Embedded finance is the future, I support it, but it may be more dystopian than we think.

—BNPL is the best example of an embedded product that does real harm.

—Sure, we can embed until it's “transparent,” but should we?

—What duty of care is required?

6. BRICS+ and dedollarization! What you need to know.

BRICS, dedollarization, gold, petrodollar, China’s RMB, chip ban, AI race, and more!

Thanks to David Oualaalou for a great interview on a live YouTube chat! I’ve often chatted with David, so we’re old friends! I love his questions because he asks about the geopolitics of tech, AI, chips, CBDC, and China!

Truth bombs 💣 and transcript:

4:30 What is fintech?

6:10 💣 Fintech is now a pawn in the great geopolitical game

8:00 Are we looking at a new BRICS currency? Yes, but it isn’t coming anytime soon!

11:00 Ten Years for a BRICS currency? Yes, that’s likely a good time frame. BRICS members are motivated.

15:00 One BRICS nation won’t accept the other's currency? Yes, India is now paying Russia in China RMB!

17:30 💣 Saudi Arabia, Oil and Gold?: Years ago, I would have told you you were nuts, but not anymore! Gold can’t be ruled out! Touching the petrodollar is like “throwing a spanner in the US system.”

22:00 Where does China’s yuan fit in?: This will likely increase RMB usage as it’s the best BRICS currency of them all.

25:20 Will the Chinese tie in digital RMB? China will start using the digital yuan for cross-border trade with Hong Kong in 2024 and likely with Russia in the same year.

27:50 Australia’s CBDC pilot? Yes, they did a great job and are with 113 nations and 95% of global GDP investigating CBDC.

30:00 CBDC pushback over personal money control? No, the central bank won’t be able to control your money or take away your guns!

35:00 💣 Chips and AI the China and US race? Breathtaking news out of China as Huawei launches the Mate 60 with China-made chips! China is making 7nm chips of the type that were banned! This shows how the chip bans are futile!

41:00 💣 Where is China vs the US in the AI race? The AI Race depends not just on Chips, but AI models, data, and willing users. China has data markets that will foster AI usage.

44:45 💣Much of the AI battle won’t be fought over chips but whether people trust AI and want to use the tech! Chinese trust AI more than Americans! China’s AI regulations also are important.

46:30 💣Elon Musk on algorithms? MUSK GOT IT RIGHT! China Algorithm laws came out of problems with workers! Algorithms must be controlled.

Thoughts?

🔺Please leave a comment, repost♻️ and like! One comment equals 10 likes, and it takes only 3 reader comments to boost this post 50%.

👉TAKEAWAYS:

—The world is changing more quickly than you think!

—Enjoy the chat!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

Rich (or is it now Rick? 😁),

Thank you for a wonderfully rich write-up and especially informative interview. Your extensive take on de-dollarization, the size of the BRICS economies and populations vs those of G7, the futility of microchip bans and their hurting of US and Taiwan economies, and especially on the fair use of AI laws in China and soon in EU vs no such laws on the horizon for the USA were eye-opening. It's pretty scary to see how China is slowly leaving the USA in the dust while our politicians on both sides of the isles continue to focus on identity politics and calling each other names ...

Since our world is in a state of multipolarity, those scenarios will have to be divided between the poles as well. For the Wild Wild West I agree with You about the likeliness of late low and inefficient regulations and a rather mixed and unpleasant way of the implementation of AI.

But in the "East", especially Russia and China, regulation and development of AI are already on a good way. This is another aspect of the rise of the east and the decline of the west.