The IMF Decodes Programmable Payments: Balancing Risk and Reward

The future of finance and banking is programmability.

The IMF likes programmable payments and wants them to go mainstream!

Programmability is a key technology, and crypto, even with its failures, has made such a strong case for its use that institutional DeFi, a form of programmability, is coming to finance services.

More on Institutional DeFi:

The IMF framework for understanding programmability will help us understand this often confusing topic and why it is not without risk.

The paper is not an easy read. Skim the bolded sentences for a less detailed yet informative read!

I give a few practical examples of how this classification works below.

👉TAKEAWAYS

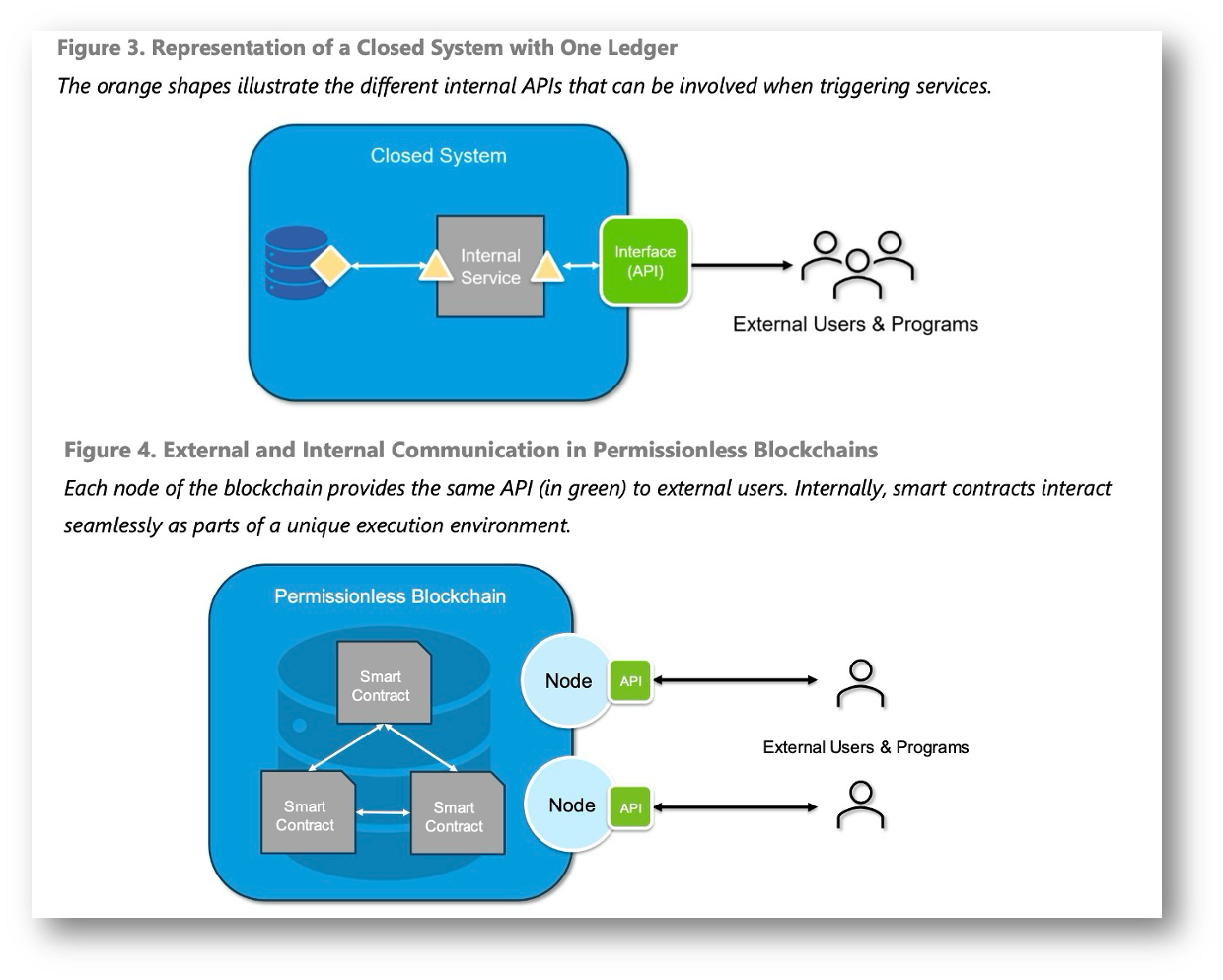

● Closed payment and settlement systems have limited options for programmability as they do not provide access interfaces natively.

● Open systems provide architectures designed for easy access by external participants, and often feature high internal programmatic capabilities

● External programmatic access, which is the ability for external participants to access the system data and functions with code,

● Internal programmatic capabilities, the extent to which internal execution of programs is supported and guaranteed.

● Hybrid systems aim to balance the characteristics of both closed and open systems.

● The first step toward hybrid models is the introduction of shared interfaces and coordinated ecosystems.

● Trade-offs: Programs do fail, be it due to software bugs, human errors, or the malicious intent of fraudulent actors.

● These technical failures can result in cascading effects throughout the financial system.

👊STRAIGHT TALK👊

The IMF's breakdown of programmability into open and closed payment systems, with an evaluation of external access and internal programming capabilities, is a practical tool that can be applied to real-world scenarios.

Let’s use the IMF’s framework on crypto and two CBDCs:

Ethereum: Open system, open external access and high degrees of internal programmability.

Digital Euro: Closed payment system, no internal programming capability.

Digital RMB: Open payment system, limited external programming access, and high levels of internal programmability.

The digital yuan is programmable, but access is tightly limited to companies that wish to run programs approved by a PBOC regulator to ensure that the programs are stable and appropriate. We haven’t seen many programmability examples in trials so far.

Crypto is a fully open system and has shown the risks of programmability. Tragic losses throughout the DeFi and DAO spaces are still the norm, with many attributed to hacked programmability.

This is why the IMF seeks a “hybrid” approach to programmability and why China’s PBOC strictly limits access to programmability.

Programmability is tech that will change our financial world. That said, it is such a powerful tool that the risks of an error or malware are enormous.

Programmability had tremendous risks and rewards.

Subscribe now. These benefits are waiting for you:

See the future: Profit from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing us the future;

Be independent: My message doesn’t follow corporate diktats it’s a message that’s often controversial and does not conform with mainstream outlets;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Understand AI: In-depth analysis of how our AI revolution impacts finance and will change how we interact with financial services.

Trust: My writing is trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!