Why Banks will NEVER have a Super App, and Their Relationship With AI is More Frenemies than True Love.

Central banks go full throttle on CBDC, and the BIS covers the latest design and legal issues.

Artwork of the day: San Giorgio Maggiore at Dusk, Claude Monet, 1908.

San Giorgio Maggiore at Dusk is a prime example of Claude Monet. Also occasionally referred to as Sunset in Venice, it was painted in the autumn of 1908 in Venice, where Monet and his wife Alice had traveled by their chauffeur-driven car.

The period in which Monet created this riverscape or seascape painting was when he began losing his eyesight from gray cataracts, which caused him to view life almost eternally through a fog. Adapting his style accordingly, Monet managed to forge one of the most enduring and unique views of a city that has been depicted incessantly over a period of seven centuries. Monet used vibrant blue, yellow, and red colors to depict the sunset.

Monet was particularly impressed by the Venetian sunsets, “these splendid sunsets which are unique in the world.” And also proclaimed that Venice was a city: "too beautiful to be painted"

Author’s note: My family is from Venice, so I love using paintings from Venice from time to time!

What’s inside this week:

Banks and AI are in the spotlight again this week as we try to get a clear-eyed glimpse of the future, unlike the painter Monet, who suffered from cataracts while painting this masterpiece!

I start with a bit of “myth-busting” as I am sick and tired of hearing banks referring to their apps as “superapps.” It’s not just banks that are guilty of this, and the term superapp is so overused that it has become a joke. Let’s look at what makes a real superapp!

The next two articles are devoted to AI and banks! The first two cover how AI is deployed in banks and whether it is true love for banks or something less. Then, there is a special read on AI deployment in Southeast Asian banks and how their customers are ready and willing to use AI.

While it may seem that AI is everywhere, it isn’t, and there is a growing AI inequality that will impact nations worldwide. What if AI’s legacy was to bring more inequality to the world, not less?

Finally, two great reads have central banks in the bullseye. The first shows how central banks are slow at AI and fintech but are going full throttle on CBDCs. Our final article covers the BIS’s latest writing on CBDC design and legal issues.

I hope you enjoy this week’s newsletter.

Readers like you make my work possible! Please consider a paid subscription, or if you’re a commitment-phobe, buy me a coffee.

Your contributions support independent writing that is beholden to no one! Thank you!

Why Banks and Big Tech Won't Crack the Superapp Code

The number of reports on superapps that all miss the main point astounds me, and while this one from Deloitte gets certain pieces, it drops the ball as they all do.

The Future of AI in Financial Services, Frenemies or True Love?

Great read by FinExtra that asks solid questions about how financial services can embrace AI given the challenges it poses. Will it be true love of frenemies?

Kudos to the authors for acknowledging the problems with everything from explainability to regulations.

You've heard these problems before, but the dispassionate way this report dissects them with quotes from real users in financial services who are actually deploying AI is what sets this report apart from the many others we’ve seen.

My take is that banks will consider AI a frenemy for years to come.

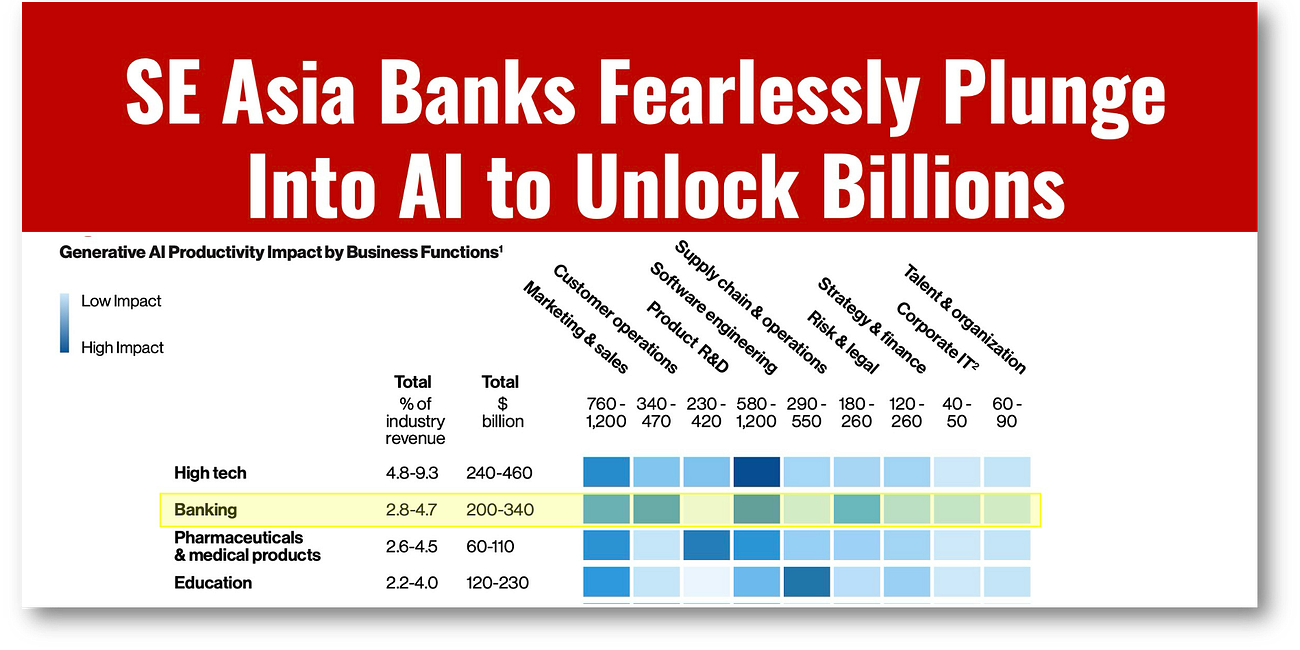

SE Asia Banks Fearlessly Plunge into AI to Unlock Billions

Southeast Asian nations want a piece of the $200-340 billion in productivity gains promised by McKinsey and are putting AI to work.

AI Inequality: 70% Of Nations Left In The Dust

BCG looks at 73 nations' level of AI readiness and finds that more than 70% are falling behind in AI and don’t have the ecosystem, skills, or R&D to compete.

Central Banks: AI and FinTech on The Rocks, CBDCs Set Sail

Central banks have never been known as innovation powerhouses, but their lack of preparedness for the fintech revolution remains a weak spot as does their lack of AI training.

Revealing The Key Challenges In rCBDC Design And Adoption

The BIS and seven central banks look at system design and legal issues surrounding retail CBDC and produce a great summary of the current CBDC thought.

Things that matter: (Soon for subscribers only)

I will make this section for subscribers only in the next few weeks. That seems to be the best compromise between keeping my writing accessible and trying a bit harder to get paying subscribers.

I don’t want to cut anyone off, but I want to nudge people toward paying for a subscription. That’s also why I have the new buy me a coffee button!

There’s a lot more changing in our world than AI. In “The Next Big Arenas of Competition,” by McKinsey, they cover eighteen future arenas that could reshape the global economy. The numbers are big with these 18 potentially generating from $29 trillion to $48 trillion in revenues by 2040. HERE

QR codes are not going away, in fact, they are more important now than they ever were! This report from MIT Technology Review highlights how they will be used for real-time consumer engagement. Now this is amusing to me because all of this is already being done in China, the home of QR codes! HERE

SWIFT throws banks under the bus for payment delays by saying, “It’s not our fault!” From the report: Today, 90% of all cross-border payments processed on the Swift network reach the beneficiary bank within an hour. So it couldn’t be any clearer that the delays are all the banks’ fault! Link to PDF HERE

The IMF calls out the risks that AI brings to capital markets and draws the same parallels with algorithmic trading I did just a few weeks ago. GO DIRECTLY TO PAGE 77 in this report for a great read on AI: HERE

AI hallucinates and gives the wrong answers but “retrieval-augmented generation” (RAG) will help! You’re going to be reading a lot about RAG soon, so start now with this report by McKinsey: HERE

Anyone who read my book Cashless knows this but the BIS proves it in this paper: “Retail fast payment systems as a catalyst for digital finance.” Yes, they are, and while the BIS proves it, many people in Asia have known this for years! HERE

Please share on Substack with a restack!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!