2025 Tech & Fintech Trends: AI The New Creator of A Modern World

China's AI fever, and why the digital yuan CBDC is banks' "last chance."

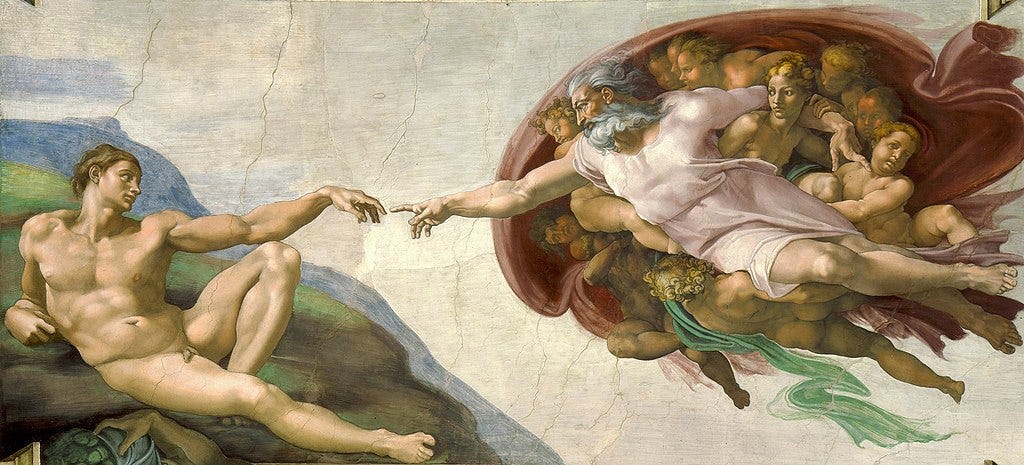

Artwork of the day: The Creation of Adam, Michelangelo, 1512

The Creation of Adam (Italian: Creazione di Adamo), also known as The Creation of Man, is a fresco painting by Italian artist Michelangelo, which forms part of the Sistine Chapel's ceiling, painted c. 1508–1512. It illustrates the Biblical creation narrative from the Book of Genesis in which God gives life to Adam, the first man. The fresco is part of a complex iconographic scheme and is chronologically the fourth in the series of panels depicting episodes from Genesis.

The painting has been reproduced in countless imitations and parodies. Michelangelo's Creation of Adam is one of the most replicated religious paintings of all time.

The “Creation of Adam” is synonymous with creation, and it is appropriate artwork for today’s newsletter as AI dominates this year’s top trends in tech and fintech.

AI is the new creator, and while some may think saying that we are living through the AI renaissance may be a step too far, I think it’s upon us.

That may sound overly dramatic, but I assure you it’s not. AI profoundly impacts virtually every technology trend in this week’s reports, allowing for new innovation and discovery.

For those expecting me to quell AI hype as I’m prone to do on these pages, fear not; I haven’t given up! That is why I warn readers to “consider the source” with a wonderful paper from Capgemini addressing AI’s future.

Yes, AI hype is a problem, but a bigger problem is not acknowledging AI’s role in creating a new world. You can believe both and be logically consistent.

Leaving AI behind, we look at how regulatory and market drivers perform in promoting open banking. Most of us would bet that regulatory control would be the surefire winner between the two; if so, your bet would lose money!

Finally, here are two fascinating stories from China. First, how China’s consumers are more excited about AI than anywhere in the world, and why China’s banks desperately need the new digital yuan.

These stories are connected because they show how Chinese people love new technology and believe it can improve their lives. That is key for the adoption of AI and the digital yuan.

Enjoy the newsletter!

If you enjoy this newsletter, subscribe, share, or buy me coffee!

Top 15 Tech Trends to Watch in 2025

CBInsights' tech trends report for 2025 is here and always a welcome read!

Top 10 FinTech Trends to Watch in 2025

This Top 10 FinTech Trends to Watch list will be the first of many as we approach the end of the year. Fortunately, Juniper’s is a solid read with some downright amusing highlights!

The Future Of AI: Expert Insights From Industry Professionals

This read is epic and covers AI from virtually every angle. It doesn't shy away from AI's problems and is a credit to the author, Capgemini.

🫡 I salute Capgemini for producing excellent research covering everything from AI to payments. Their reports are simply some of the best in the business. Did you hear that, McKinsey?👂

Remember as you read this "tome" that all the people interviewed are in the AI business.

They are not disinterested or objective. They want you to see the bright future of AI that they see.

That isn't all bad. We can learn a lot from them, and their optimism is contagious.

That said, remember that this document might minimize the pitfalls, trials, and difficulties many will face on the road to AI adoption.

As always, be alert for hype while absorbing the message that AI is transformative.

Driving Open Banking Growth: Regulations Or Leave It To The Market?

So, what’s the best way to promote open banking regulation or market forces? The answer is unclear because while open banking is a global movement, achieving it requires local action.

China Is More Excited About AI Than Any Other Nation In The World

There is more to the AI tech war than meets the eye, and China’s consumers are the most “excited” about AI among 21 nations surveyed by BCG.

Digital RMB: Cheap At Any Cost And Chinese Banks' Last Chance

S&P Global has an interesting analysis of China’s digital RMB that talks about costs but completely misses the point as to why the digital RMB is Chinese banks’ last chance!

Things that matter: (Soon for subscribers only)

Today’s focus is on de-dollarization, as I’ve collected a number of interesting resources that are worth reading. My next book will be about how CBDCs and digital technology will contribute to de-dollarization. I admit writing is going very slowly!

I will make this section for subscribers only in the next few weeks. That seems to be the best compromise between keeping my writing accessible and trying a bit harder to get paying subscribers.

I don’t want to cut anyone off, but I want to nudge people toward paying for a subscription. That’s also why I have the new buy me a coffee button!

Read this from the head of Malaysia’s central bank as to why he is interested in BRICS and dedollarization. Malaysia doesn’t hate the US but does want to look out after its own interests. You’ll NEVER see this in the Financial Times or Wall street Journal: HERE

From the CFA Institute, learn why debt is a problem and that a tipping point may someday occur: “The Dollar’s Exorbitant Privelege”: HERE

The House of Commons Library on BRICS: The BRICS group: Overview and recent expansion HERE

From ING Bank: De-dollarisation: More BRICS in the wall HERE

A very thoughtful podcast with my friend Kathleen Tyson: “Can BRICS de-dollarize the financial system? HERE

Please share the love on Substack with a restack!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!