CBDC SPECIAL: Nations with Fast Payment and Banks Can't Live In Denial

Banks Must See Fast Payments and Quantum Computing as Opportunities, Not Threats.

Art of the day: Cat and bird, Paul Klee, 1928

Cat and Bird is a 1928 painting by Swiss-German painter Paul Klee. It was made while Klee was a teacher at the Bauhaus Dessau. The painting depicts the wide face of a stylized cat with a small bird perched on its forehead.

Klee made many paintings and drawings depicting cats, the most well-known being the current. The little bird on the forehead of the cat is actually meant to be inside the cat's head; it can be assumed that he is dreaming of potential prey. In the painting, the bird only plays a minor role; the undisputed main character is the cat, whose face overwhelmingly dominates the format.

Today, like the cat with birds on its mind in this painting by Paul Klee, I’ve got CBDCs on my mind. The reason is a trio of great reads on CBDC and faster payments.

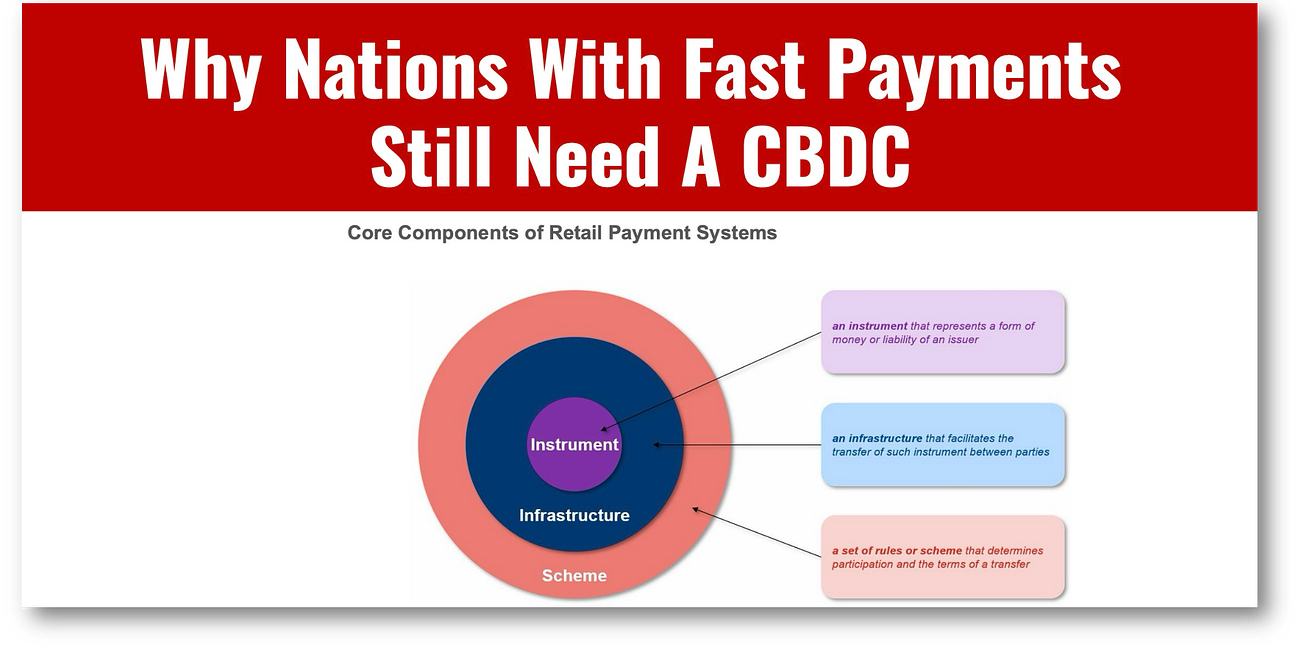

First, the IMF has a paper that clarifies why nations with fast payment systems still need CBDCs. The best evidence in support of the IMF comes from China, Brazil, and India, all of which have award-winning faster payments and are still pursuing CBDCs.

This leads us to Banks that are still living in CBDC denial. Most loathe CBDCs because they see them only as an attack on their card business and have failed to put together a strategy on how they can use CBDCs to innovate and keep clients happy.

CBDCs are, of course, part of a global transition to Faster Payments, which are truly revolutionizing finance. The problem is that once again, banks are not on the cutting edge of the transition. You’re not surprised are you?

Finally, two fascinating stories that are not about CBDC.

First, we will look at blockchain interoperability and how it’s proving harder to achieve than initially thought. Second, we look at the threats and opportunities of quantum computing.

I hope you enjoy today’s stories! Thanks for subscribing and if you enjoy my newsletter please share it with a friend.

Why Nations With Fast Payments Still Need A CBDC!

The IMF shows why retail CBDC is more than another way to buy coffee as it answers the most asked question about CBDCs:

Banks Need a Competitive CBDC Strategy Now!

CBDCs are coming, and banks in the EU and worldwide would do well to have a CBDC strategy now or be ready to bleed customers later.

Instant Payments: A Startling Wake-Up Call for Traditional Banks

Banks are caught in a vicious circle of delaying the transition to instant payments, which in turn delays innovation and sends clients running to more nimble digital competitors.

Traditional banks are not fans of instant payments and who can blame them? Most banks see instant payments as a direct attack on their profitable card business.

The problem for banks is that with instant payment global growth at around 15% annually, clients across the globe will leave for fintechs or neobanks if they don't get them.

If there's any doubt about this, ask banks in China, Indonesia, or India how delaying instant payments worked out for them!

👉TAKEAWAYS

🔹 The switch to instant payments should be seen as an opportunity for wider systemic modernization to carry your bank into a fully digital future.

🔹 “Instant payments will deliver fully digital banking, including new products based on the ISO 20022 standard, new regulatory frameworks, and faster, smoother payment services.”

🔹 Examples of new product and service opportunities are emerging, include Request to Pay (R2P) and Verification of Payee (VoP).

🔹 “We believe the rise of instant payments will be genuinely transformative, challenging banks to reinvent their businesses for the digital era … banks have to change their infrastructure or

risk implosion.”

🔹 “Consumer demand, regulatory pressure and new data standards plus competition from neobanks, fintechs and Non-Bank Financial Institutions make wholesale change inevitable for banks.”

🔹 “Banks that have not yet embarked on full-stack transformations of their software architectures are going to find the management of instant payments impossible.”

🔹 “As instant payments become standard, banks will have to handle higher volumes of transactions at greater velocity than in any time in their history.”

🔹 “In more advanced markets, banks’ APP fraud liabilities are expected to rise to $5.75 billion next year.”

👊STRAIGHT TALK👊

Banks see instant payments only as a loss to their card business and are ignoring and delaying the innovation they can bring to bank services.

Ironically, the innovation side of instant payments is the only way banks can offset the inevitable losses to their card business.

This means that every day, banks delay enabling instant payments they are exacerbating their losses and furthering their obsolescence.

Am I too harsh on banks? Look at the US’s FedNow slow adoption as an example.

Too Many Blockchains Make Interoperability A Nightmare

Our blockchain future is proving more challenging to implement than many first thought, and interoperability is a key problem.

Interoperability is the ability of blockchains to communicate with one another and exchange data so that an asset on blockchain X can be transferred to blockchain Y.

The solution proposed by Sinapore's MAS is the interlinked network model (INM,) which allows the exchange of digital assets and currencies across network borders.

Each blockchain is a network with its own rules for internally verifying information and connecting via cross-network protocols.

That sounds good, but it is easier said than done.

Cracking interoperability is key. Without it, the inability to transfer assets between chains creates "liquidity fragmentation."

👉TAKEAWAYS

INTEROPERABILITY REQUIREMENTS

🔹 Flexible compliance: With global reach being a key benefit of tokenization, blockchain interoperability must be flexible enough to support diverse regulatory regimes.

🔹 Flexible security: Cross-network systems must be transparent for visibility into potential code faults, flexible to allow application-layer security policies that mitigate risk, and designed to enable those policies to be effective, should faults occur.

🔹 Privacy: Public blockchains sacrifice privacy for a decentralized verification model. INMs must be flexible enough to integrate systems that keep some transaction data private.

🔹 Risk Assessment: INMs involve increased complexity and a lengthened list of components that must be given appropriate due diligence prior to being fully utilized by financial institutions.

🔹 Transparency and Monitoring: Lack of transparency in some cross-network systems has recently emerged as a potential vector for money laundering.

🔹 Scalability: INMs face dual scaling challenges of emerging technology and the potential for explosive growth in transaction volume and the number of connected networks.

👊STRAIGHT TALK👊

Blockchain interoperability isn't a new problem and the crypto industry's solution was to build bridges, which were promptly hacked with billions of dollars in losses.

Banks watched this theft and focused on private blockchains to ensure better security.

Private chains don't solve the interoperability problem and can create even more liquidity fragmentation.

This is why the goal of connecting decentralized or private blockchains remains a problem worthy of solving.

Quantum is Now For Finance: Threat and Opportunity

Quantum computing is still “experimental,” and banks must be very aware of the risks and opportunities it will bring.

Readers like you make my work possible! Subscribing is free, and I operate by the “PBS model.” Like public broadcasting, everything I write is free, but if you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!