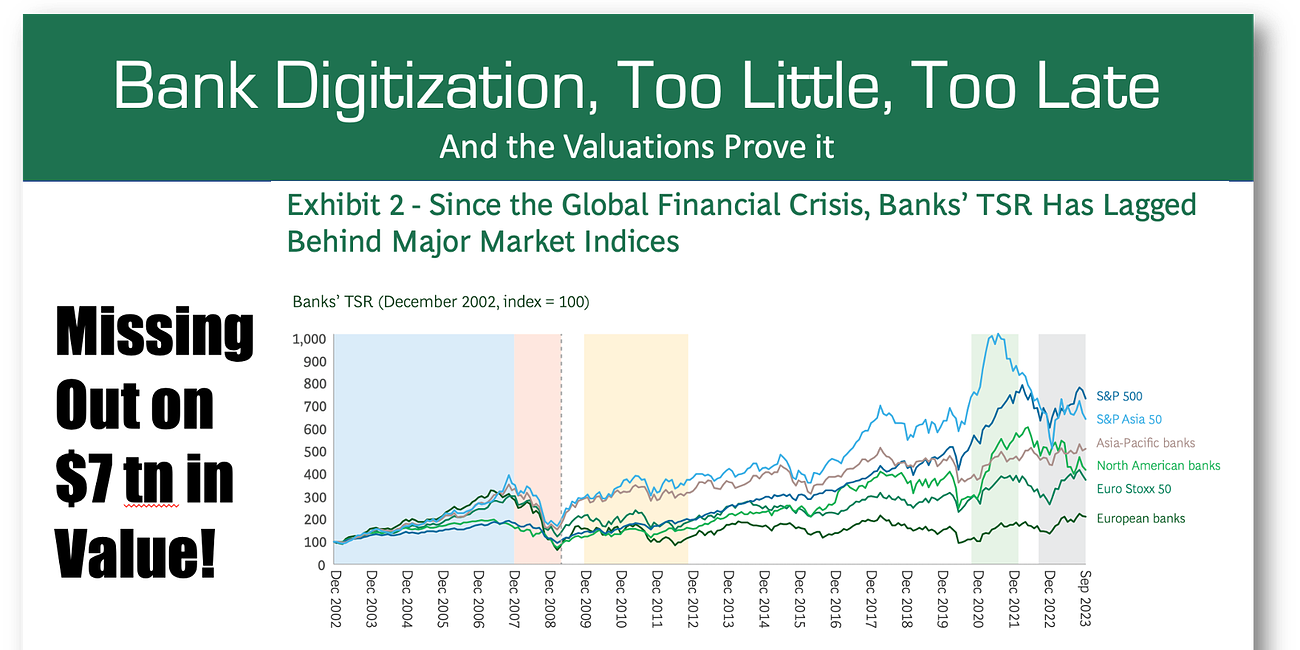

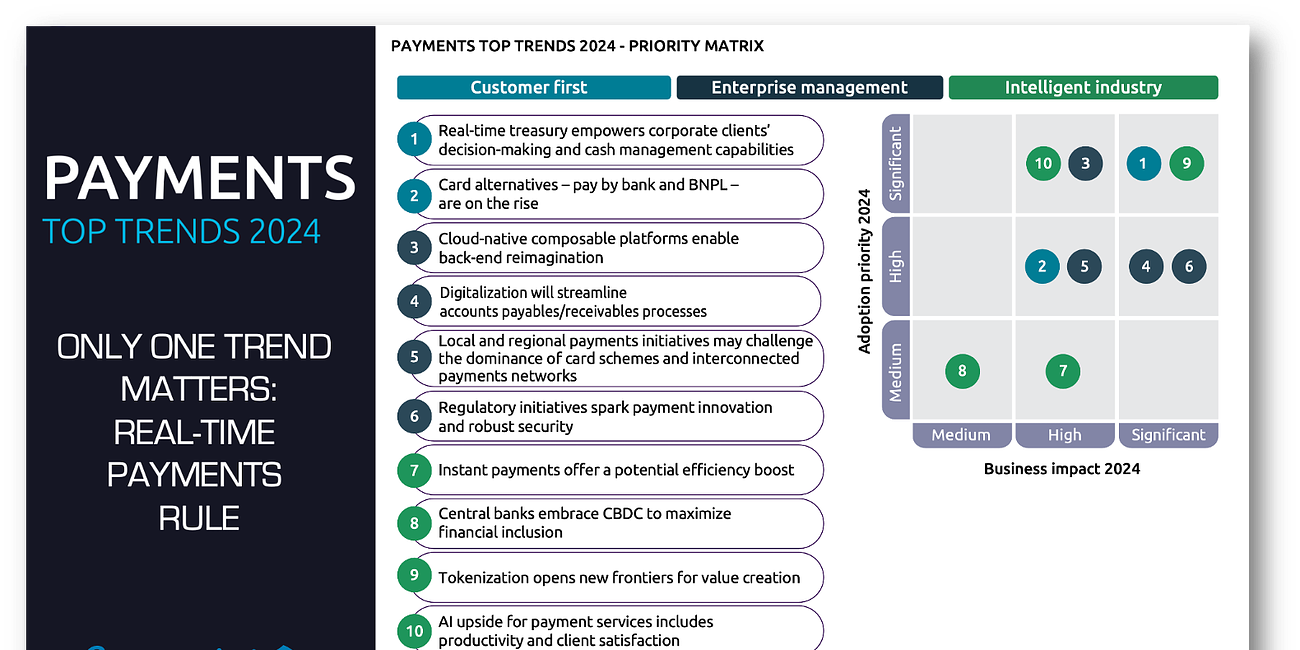

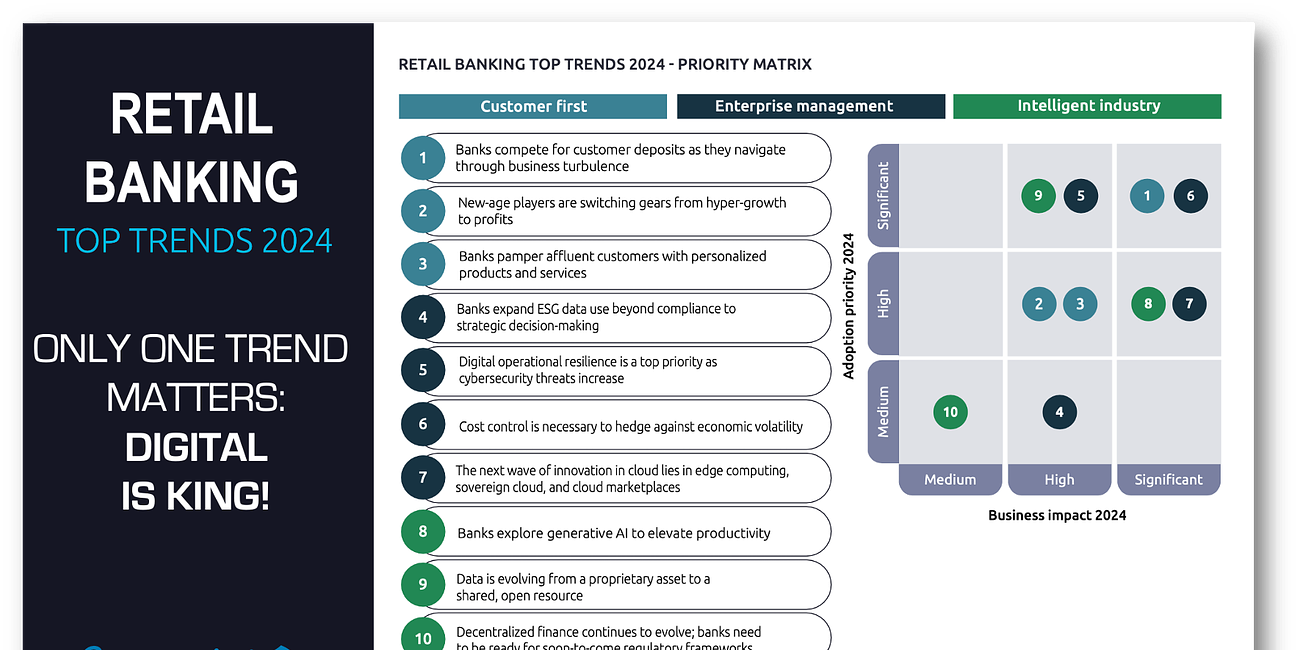

Change is coming faster than most think: AI to impact 40% of jobs worldwide, Banks struggle to get a digital edge, top trends in payments.

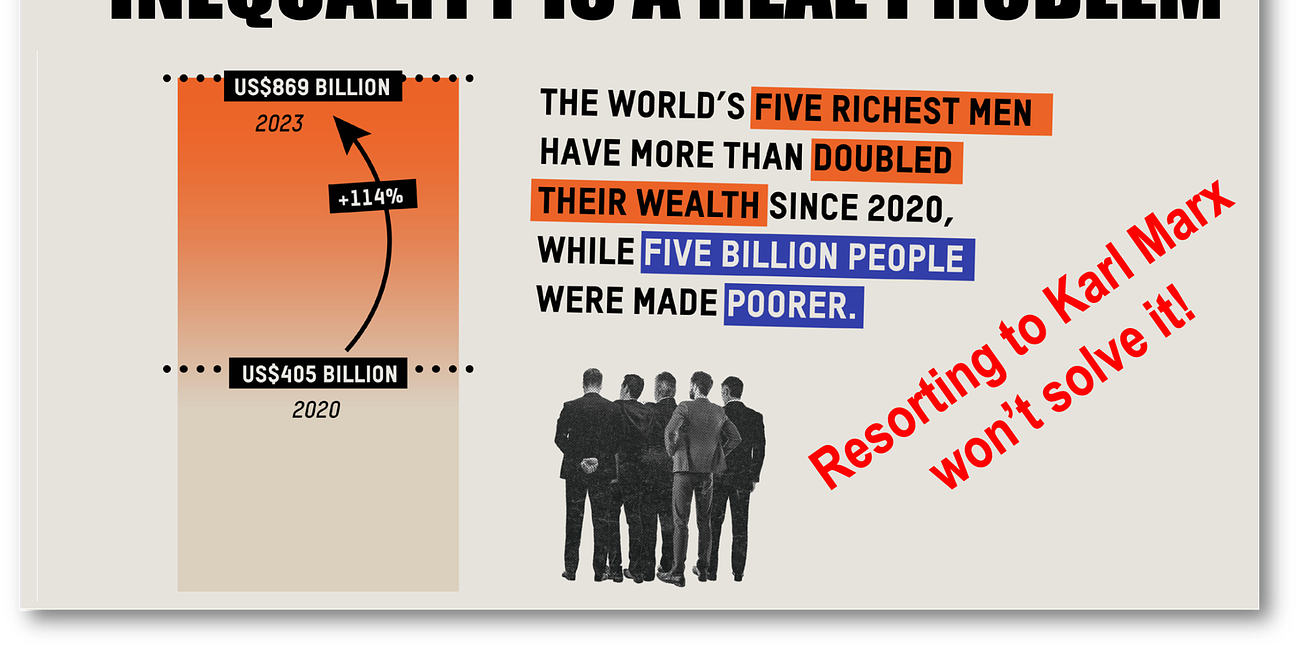

We are entering a time of digital "haves" and "have-nots" creating greater inequality

Artwork of the day: Portrait of Madame Matisse. The Green Line, Henri Matisse1905

While Portrait of Madame Matisse. The Green Line has many features that are instantly recognizable from the real world; it is not a naturalistic depiction of the artist’s wife. The green line dividing the face into two halves, cold and warm, contributes to a plane-like effect that makes the portrait mask-like and abstract.

A short note today as I’m on my way to my hometown, Pordenone, Italy. Expect shorter newsletters for the next month.

I picked Matisse’s modernist masterpiece for today’s art as his portrait has many features that are instantly recognizable from the real world, yet it is not a naturalistic depiction of the artist’s wife.

This is what our AI and digital future will look like, with some parts fully recognizable and others overtaken by AI and technology that will contribute something new and disconnected from the old. Like the painting above, a digital green line will divide our future.

Today’s newsletter shows how AI is upon us and will impact our jobs and how we relate to our banks and payments. It also will sadly create more inequality in our world, not less.

Like the green line divides Madame Matisse’s face, AI’s green line will dive our society into the digital “haves” and have-nots.” Two sides are opposing one another and like Mdm. Matisse, one warm, one very cold.

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Don’t be afraid to click!

1

Share