Financial Services in Flux: Tokenization, DPI, and GenAI

Financial services are changing. Will you adapt or be left behind?

Artwork of the day: “Crayon House Foreclosure” Banksy, 2011, Los Angeles, US

The work features a girl who has just drawn a crayon house, only to find a workman had boarded it up.

The artwork elicits a range of emotions, from curiosity and introspection to a sense of unease and vulnerability. Banksy's use of graffiti and street art techniques adds an element of urban grit and rebelliousness, challenging conventional artistic norms and pushing the boundaries of artistic expression.

I picked today’s art as it shows the role of art during societal changes. I wonder if fintech will inspire any artists.

Dear friends help spread the word by sharing this newsletter!

👉Once again, I’m trying to cut down the length of this newsletter to make it shorter, and improve readability. Mobile readers should like this. The downside is that my graphs/images don’t get shown and the story summaries are shorter.

Let me know what you think: 👇

Why today’s stories matter:

All of today’s stories show a financial services sector in transition, and anyone who thinks that transition will be easy is kidding themselves.

From tokenization to a push for India-style digital public infrastructure and GenAI used in wealth management, all show disruptive changes in how financial services are provided.

The problem is that the changes are so profound they won’t be easy, even for people in tech, as the Tech Trend report clearly shows.

The big question arising from today's articles is not "Do we have to change?"

We clearly do, technology demands we move forward.

The question is, "How fast can we change without breaking things?”

Check out today’s 🔥MUST READ🔥 report from Harvard Business Review on Generative AI.

Tokenization: The New Rails of Finance Are Coming

Tokenization is no longer just a buzzword—it’s ready to become the backbone of modern finance. This insightful piece from OMFIF highlights how tokenization is transforming the financial landscape, with industry leaders and the former head of the Bank of England championing its potential. Are you ready for the disruption?

India achieved in 9 years what would have taken 50 without Digital Public Infrastructure

India’s Digital Public Infrastructure (DPI) is a gift to the world and can promote productivity, inclusivity and sustainable growth. It has irrefutably bettered the lives of hundreds of millions of people and brought the nation forward by decades. The title above is not an exaggeration!

The Future of Financial Advice: Digital Trends and Human Touch

Financial advice is going digital and, at the same time, shifting to meet changing demographics and different ideas of what investment goals are and what constitutes advice. Financial advice is no longer about your broker taking you to lunch! In fact, between robo-advising, hyper-personalized digital offerings, and social media “influencers,” that mo…

Top Tech Trends Report Reveals a Boom for Tech But a Surprising Bust for Jobs

McKinsey shows what tech matters most for companies in 2024 and why for, for many tech employees, tech was a bust in 2023 despite a boom. This is a great read, but it is important to understand that it is not like other tech trend reports that are trying to find the next big thing.

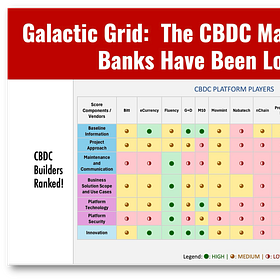

"Galactic Grid:" The CBDC Matchmaker Central Banks Have Been Longing For.

Central banks often struggle to find the right technology partners to work with when building a CBDC. That’s why Chavanette Partners launched the “Galactic Grid,” which connects central banks with building partners to reduce the hassle of finding vendors. So what does it do?

Weekend Read: Generative AI: Insights You Need From HBR

"Business is changing, Will you adapt or be left behind?

HBR's tagline for this report seems to sum up nicely why this made the weekend reading list.

The report is a compilation of eleven articles exploring GenAI, and the articles have something for everyone.

The chapters are short, punchy and 100% practical. Each ends with a "takeaways" section.

👉 Chapters that I enjoyed:

3: A Framework for Picking the Right Generative AI Project

7: Generative AI Has an Intellectual Property Problem

8: AI Prompt Engineering Isn’t the Future (This one is particularly interesting.)

11: The AI Hype Cycle Is Distracting Companies (Machine Learning works now and isn't hyped!)

Join our community by subscribing. You’ll be joining an exciting journey down the rabbit hole to our shared digital future—you’ll be glad you did!

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

What’s in it for you if you subscribe?

Don’t fall behind! Expert insight on our shared “cashless” future that focuses on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion, all delivered directly to your inbox weekly;

A unique point of view directly from Asia focuses on how the region is “leapfrogging” the West in payments, AI, and digital services. It’s a message that’s often controversial and does not conform with mainstream outlets;

All of the latest “digital dollar” and “digital euro” developments are analyzed in detail. CBDCs are no longer theoretical but coming soon;

In-depth analysis of how our AI revolution impacts finance and will change how we interact with financial services.

Perspective on how the world of finance is bifurcating into US and Chinese systems right before our eyes and what this means;

Trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics & open-minded crypto-holders daily!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!