Here's To More Tokenization and Programmability and Less GenAI Hype

GenAI Hype Killer: Study Shows Most Companies Not Ready

Artwork of the day: Ruehende Schiffe (Barcos en reposo), Paul Klee, 1927

The ingenuity of Klee's works and the apparent simplicity of their forms contradicted his intense mental focus on the search for a personal pictorial language.

Klee eventually invented his own color theory, centered on a six-part rainbow as a wheel. The color wheel is distinctly related to movement, and Klee placed the colors in relation to how they move and interact. The intense use of red, yellow, and blue in Ruehende Schiffe, was based on this system.

A childish insinuation remains in how the artist has concretized his mental image of the boats resting as an arrangement of triangles and semicircles that convey the idea of sails and barges in the water. How these forms –the boats – float one on top of the other also indicates their conception that the work of art is dynamic and that the space itself has a “temporal notion.”

Why this week’s articles matter:

The “dog days” of late August are a perfect time for “ships at rest” in this painting by Klee. For our newsletter, however, this week was busy with some astounding stories that make for great summer reading.

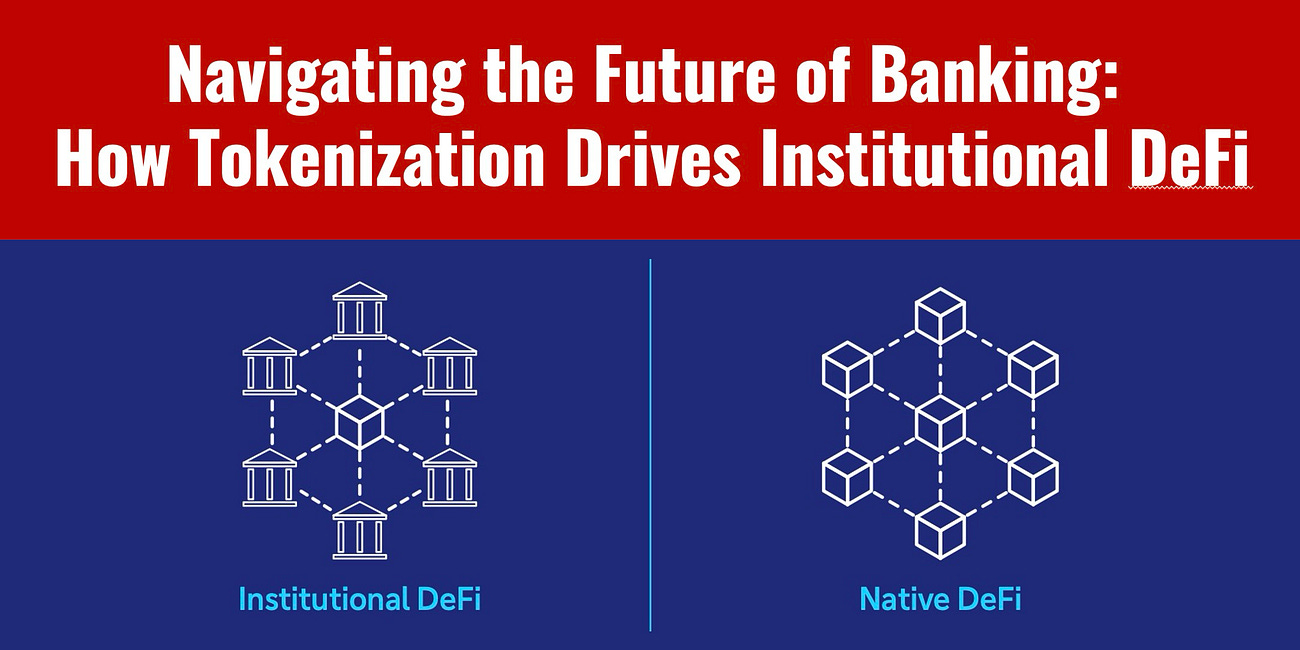

My first two stories are designed to be read together. The first discusses tokenization and institutional DeFi, and the second payment programmability.

These stories are related because, without tokenization, you can’t have programmability or DeFi. Both stories show how blockchain will be relevant for tokenization and payments in our future, even a CBDC future!

The next story shows how new payment technology will profoundly impact banks’ enormous $280bn payment revenue. Banks may not like it, but CBDC and tokenization aim to reduce these costs.

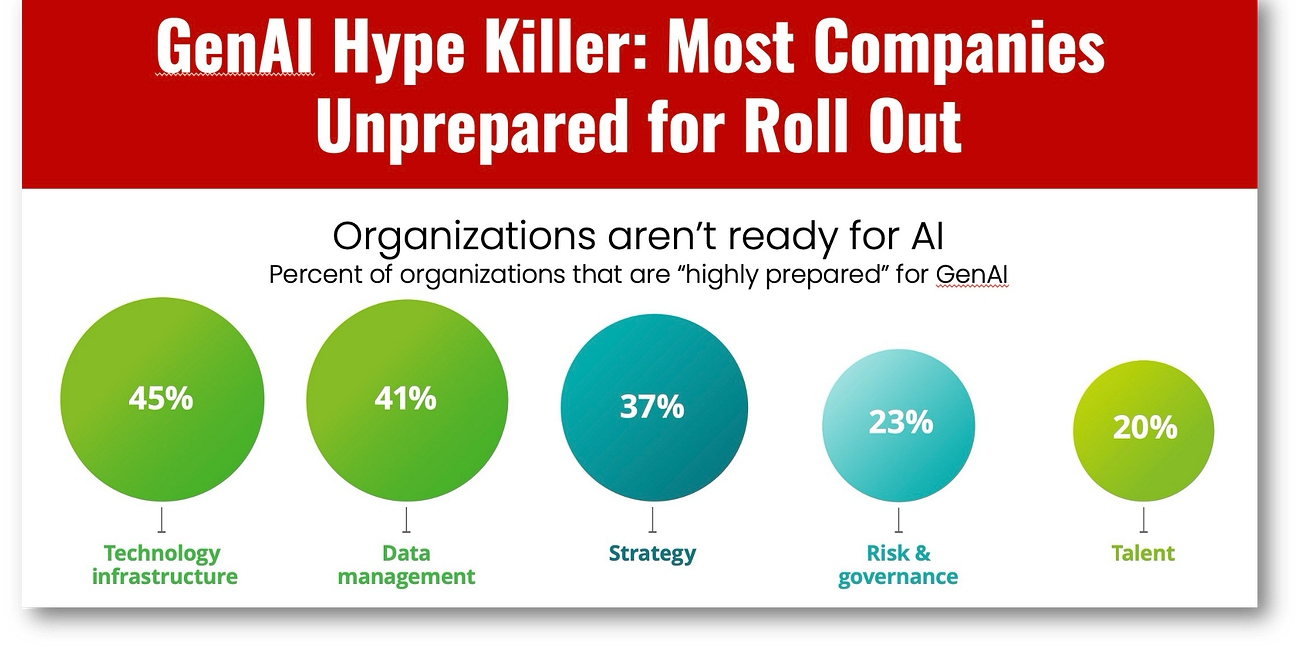

Next, we have two GenAI stories that combat GenAI hype. The first goes directly for AI hype by showing how most companies are unprepared to put GenAI applications into production. The second is far scarier and shows how AI is not considered the number one global risk! If that doesn’t surprise you, nothing will.

Finally, a great read from MIT on how hybrid cloud is critical for AI deployment. This is not for geeks, but it will help all readers understand how technically complicated the GenAI transition is.

I hope that wherever you are, you are enjoying the last days of summer!

Navigating the Future of Banking: How Tokenization Drives Institutional DeFi

Institutional DeFi is coming and will be a natural step following the broader adoption of tokenized assets.

The IMF Decodes Programmable Payments: Balancing Risk and Reward

The IMF likes programmable payments and wants them to go mainstream!

Real-Time Payments to Slash $280B in Bank Payment Revenue

Real-time payments (RTPs) are coming for banks’ US$280B in payment revenue, made on a predicted payment volume worth US$290T by 2030.

GenAI Hype Killer: Most Companies Unprepared for Roll Out

Kudos to Deloitte for publishing a survey that shows, in shocking detail, just how unprepared the majority of corporate users are for GenAI.

AI Is Now the Number One Global Emerging Risk

Gartner lays out the World’s emerging risks and finds that AI takes the top spot!

The Only Way Banks Get GenAI is with Hybrid Cloud!

Great read from MIT on Hybrid Cloud and this is not for geeks but for anyone working in fintech or financial services who wants to use GenAI!

Last weekend I ran the headline "No Cloud, No AI." Frankly I should have written: "No Hybrid Cloud, No AI"!

First of all what is Hybrid Cloud?

❝A hybrid cloud is a computing environment that combines an organization's internal IT resources with third-party cloud provider infrastructure and services.

It can include a combination of private clouds, public clouds, and on-premises data centers, allowing data and applications to be shared between them.❞

This matters because most incumbent banks have only pushed a very limited amount of their data services to the cloud.

When I sold the cloud to banks for IBM, most didn't want to risk their data to the cloud because of security concerns but would use it on a case-by-case basis.

Now, virtually every incumbent bank runs a hybrid cloud system, with some data on-premises or on its servers and others in the cloud.

The problem is getting the right balance.

Finding this balance is tricky because 54% of organizations surveyed had 2 or 3 different cloud providers.

So, a typical bank pursuing GenAI is now being asked to add another cloud supplier for GenAI or connect data distributed across multiple cloud sources to a GenAI.

If this sounds tricky, it is!

To make matters worse, in the last few years, many banks have complained to their cloud providers that the savings, or at least the low cost of moving to the cloud, were never realized.

This is causing some banks to pull back from cloud migration, and who can blame them for not wanting to pay big tech?

So, banks and big tech are battling a war over data. This is why today's article made the "Weekend Read" List!

More articles that matter:

The decade of digital dollars: Unlocking economic efficiency with stablecoins Link

What Does De-Dollarization Mean for Commodity Prices? Link

China EV-Maker BYD Weighing Up Three Sites for Mexico Plant. With NAFTA, these EVs will have a direct path to the US market. Link

Ranked: The Countries That Added the Most Gold Reserves (2013-2023)

Gold is taking on new relevance with gold prices peaking amidst high demand from central banks looking to hedge war, gov't debt, and diversify, which is code for dedollarize. Chart below

You made it this far, so subscribe! Here are the six benefits waiting for you when you subscribe:

Save time: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

Profit by knowing the future: Get real payback from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West that shows you the future;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Manage your personal AI Risk: Don’t be disrupted; be the disruptor. In-depth analysis of how our AI revolution impacts finance so that you can be in front of this great transformation, not behind it;

Stay objective and avoid hype: My writing doesn’t follow corporate diktats. It’s a message that doesn’t conform with mainstream media and is gritty, practical, hype-free and, on occasion, controversial;

Stay safe: My writing is trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily.

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing and help keep it flowing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!