Innovation Crisis: The US and Its Banks Under Fire

No, GenAI will not "change everything" in payments.

Thanks for reading the “Cashless” newsletter, an insider’s view on Asia’s fintech, CBDC, and AI for anyone striving to understand “the Asia Century.” I’m Rich Turrin, and these are my hard-hitting insights into what’s going on behind the news. Subscribe to get these emerging trends directly in your inbox every Sunday. Here from LinkedIn? Welcome and subscribe to beat the algorithm!

Topics:

US Banks' Fintech Surge: A Lifeline for Survival

Stanford: 10 Great Emerging Technologies and a US Innovation Crisis

GenAI’s Role in Commercial Payments: Big Impact, No Miracles

Responsible GenAI: The Ultimate Playbook For Managers

The Top 10 Security Risks AI Agents Face Now

Drawing The Line: Setting Healthy Relationship Limits With AI

Welcome back!

This week's reading lineup includes fintech, innovation, payments, and AI, so there is something for everyone!

It’s a great mix, and our first two stories show two slow-motion crises surrounding innovation, or more precisely the lack of it.

Innovation is a big problem for banks and, interestingly, the US innovation ecosystem, which is losing in competition with China. The US banks have an easy fix by partnering with fintechs. The US government has no such easy fix and will have difficulty jump-starting an innovation system that takes years to build.

These are big enough problems to make us all long for the “childhood joy” represented by Jeff Koons’ balloon dog above!

We then move on to payments and bust the myth that AI will “change everything.” AI can’t change payments, but it can change everything surrounding them. Don’t get me wrong; this is big but does little to change how we pay.

AI articles are everywhere these days, making outlandish claims of increased productivity and promises that defy logic.

That’s why my final three articles focus on the most important part of AI, building responsible AI. The promises made for AI are all meaningless unless your AI is built to be responsible from the start. It can’t be bolted on at the end. It has to be built in.

These big concepts are often given short shrift by consultants and big tech who sell AI hype, not reality. That’s why I’m focusing on them.

Thanks once again for reading. I appreciate each and every one of you opening your inbox for me!

Rich

PS

Thanks for sharing with your friends! It’s a great way to say thanks.

US Banks' Fintech Surge: A Lifeline for Survival

Don’t mistake US banks’ fintech surge as a sudden love of tech. They are desperately trying to keep up with digital competition that is eating into their margins and emerging as a strong competitor.

The reality is that digital banks, or neo banks, have gained traction and are now setting the pace of digital services for all banks. This is incumbent banks’ worst nightmare come true and the cause of their crisis. Most incumbents thought neobanks wouldn’t profoundly impact them—how wrong they were!

Banks’ big fintech spending is a desperate attempt to stay relevant and hold onto market share as customers demand better digital services. Don’t expect this to end well for banks that are woefully behind. Note: I should send this to one of my US banks, which is just that.

Read where banks are spending in fintech: HERE

Stanford: 10 Great Emerging Technologies and a US Innovation Crisis

Stanford’s emerging technology paper is a great read. While the ten technologies capture the headlines, the paper’s discussion of the US innovation ecosystem is far more important.

When I say crisis I’m not exaggerating, here’s the innovation reality:

“For the first time, in 2024, the number of Chinese contributions surpassed those of the United States in the closely watched Nature Index, which tracks eighty-two of the world’s premier science journals.”

The US government must restart funding for innovation programs with a long delay before producing any innovation. This is a big job, and it’s hard to see where the government will find the cash when it focuses on reducing expenses.

Distilling the US innovation challenge into a binary China vs. US competition is precisely the wrong approach, but sadly, that seems to be the focus for now. Innovation is global, and the more collaboration there is, the better for us all.

Read this important report: HERE

GenAI’s Role in Commercial Payments: Big Impact, No Miracles

HSBC looks at the role of AI in commercial payments and does a great job of showing where AI will make its mark. Unsurprisingly, its top two use cases are customer services and operations.

This is significant because HSBC knows more about commercial payments than most consultants or big tech. So, their rather muted support of AI making big changes in payments themselves is significant and stands in contrast to consultant and big tech proclamations that AI will “change everything.”

The way so many reports claim that AI will make big changes in payments really bugs me. Most have no proof that AI can achieve these changes; worse, they almost never distinguish between payment support and payment rails.

Read more on how GenAI will have a big impact but not “change everything:” HERE

Responsible GenAI: The Ultimate Playbook For Managers

I rarely recommend readers download and save papers, but I do with this one! If you’re building with GenAI, this no-nonsense, practical guide might help you in the future.

This guide will help you build responsible AI. Its many key questions are distilled into concepts that are easy to understand and communicate. One day, they might be useful for discussing with others.

Some readers may think, "Oh, we have a team of AI people looking at this, and that’s their job.” My response: “No, AI responsibility is everyone’s job.”

Read here for why complacency on Responsible AI is so dangerous: HERE

The Top 10 Security Risks AI Agents Face Now

I love this report because it shows how to break an AI!

The reality is that AI's top security risks go far beyond traditional hacking into a system, but focus on how people interact with the AI.

These security risks show that some AIs can be broken by simply interacting with them in a maliciously misleading discussion. That’s why many of the top 10 risks have suspiciously human-sounding names, such as “memory poisoning” and “hallucination attacks.”

Read more on how to break your AI: HERE

Drawing The Line: Setting Healthy Relationship Limits With AI

All relationships have limits and AI is no different.

For example, what is your "intolerable risk threshold for deception" with your partner?" Is it more or less than you'd be willing to put up with your AI?

This isn't an imaginary concept. AI deceives, and different thresholds of acceptability will apply depending on the job it is asked to do.

What if an AI is looking after nuclear arms? Imagine how different the deception threshold would be for that AI compared to one in a bank marketing function.

This paper is not an "easy-reader." I suggest you skim it, stopping to read the bold sections and chapters that interest you.

Reading this will help you develop a new respect for choosing the right AI for the job and will make you think!

It provides exactly the kind of detail and thought process that most AI papers produced by AI consultants or Big Tech ignore.

Hot Topics for Subscribers only

What you’re missing in the subscriber-only section below:

What makes fintech grow?

GenAI & Financial Transformation ebook

Banking Trends 2025

Visa on Digital Payment Security

Chart of the day

Subscribe so you don’t miss out on more great reads and to help keep this newsletter coming!

What makes fintech grow?

The IMF asks a big question, and for those without patience, go directly to page 12 for the answer in the conclusion section! This is a nice research paper, and while it's not an easy read, it’s worth skimming over and its conclusions are priceless.

GenAI & Financial Transformation ebook

The Capco Institute of financial transformation put together this ebook with 16 articles over 130 pages. The articles are very high quality. The question is, which ones interest you the most?

Banking Trends 2025

This is a nice report by Infosys and Finacle on what’s happening in 2025. It's a solid read, and I didn’t write about it only because there was so much going on last week.

Visa on Digital Payment Security

Visa always makes me laugh. The company that allows people to take a card, tap it, and pay without any security measures decides to talks about security measures. Well, I’m glad we have some!

Chart of the day

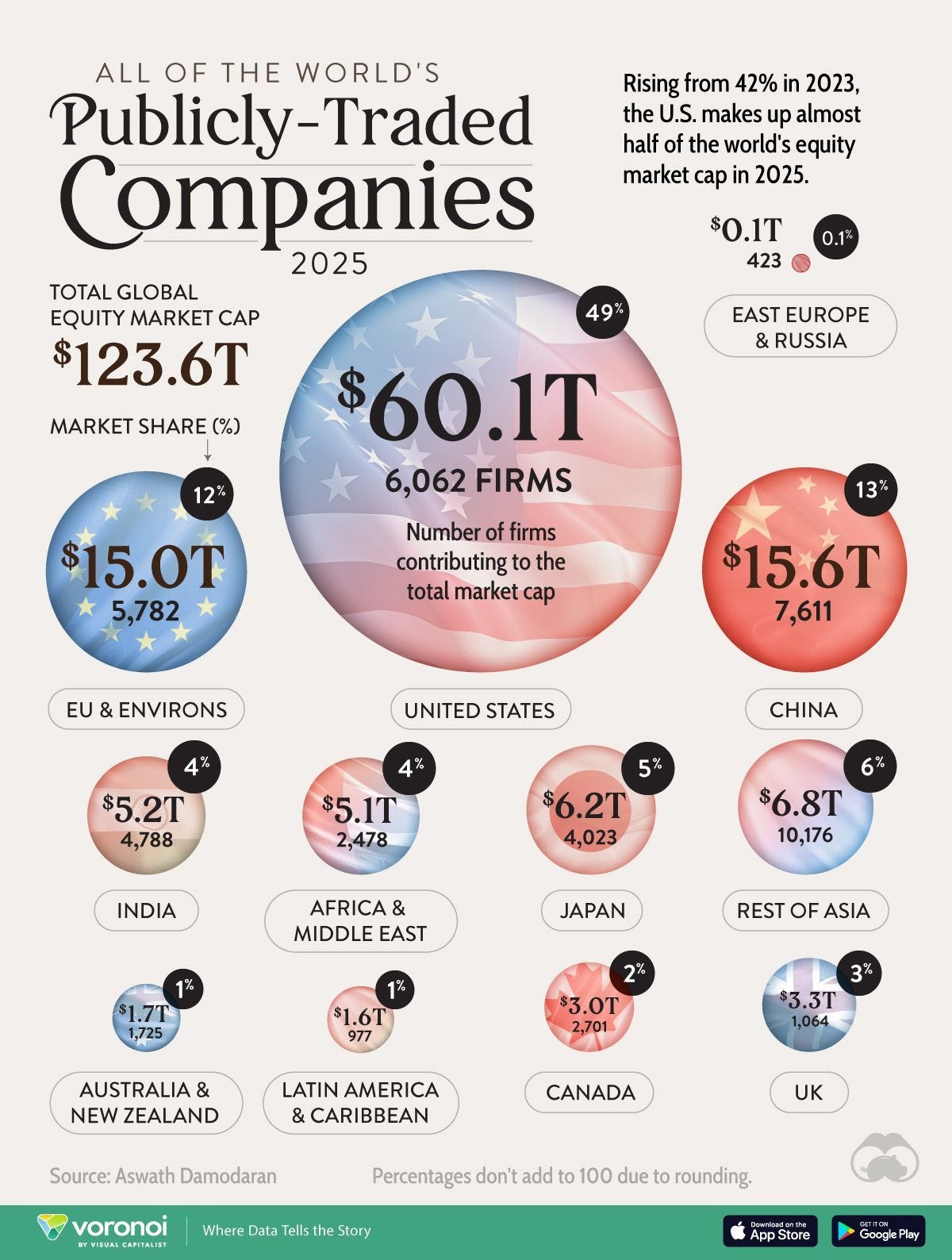

America’s dominance of the global stock market is unrivaled, and its share has only grown in the past two years. The S&P 500's outperformance has contributed to America’s leading position, averaging 14.8% compound average returns over the past decade.

Many regular readers know my fondness for writing about de-dollarization. When I write about de-dollarization, I usually focus on non-dollar use along trade corridors, which I think is practical. I never talk about the de-dollarization of finance and investment; this chart shows why!