Part 2: CBDC and FPS Aren't Rivals But Partners in Better Payments

CBDCs are more feature-rich with offline payments, smart contracts, and tokenization.

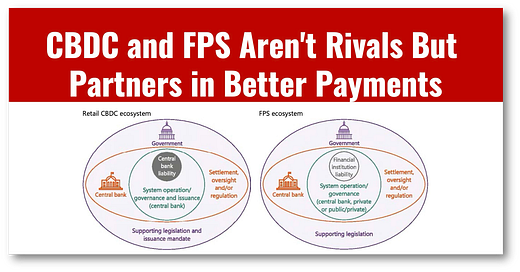

“If you have a fast payment system (FPS), do you need a CBDC?” The BIS answers that CBDCs and FPS have a complementary relationship and are more partners than rivals.

CBDCs and FPS both allow for fast instant payments, and there is ongoing tension regarding which solution is better. The BIS finds that neither solution is right or wrong and that they must fit each nation’s unique needs.

To make this discussion less theoretical, consider three nations with world-famous FPS systems: India, Brazil and China. All are developing retail CBDCs as a natural progression to existing FPS to increase financial inclusion.

In contrast, consider technologically advanced Singapore, which has a great FPS system and high financial inclusion levels. Singapore’s decision not to build a CBDC makes sense. What would it gain?

India, Brazil, and China found that FPS technology is limited in reaching their vast populations and that CBDCs are the only way to deliver greater inclusion through their unique ability to bring offline payments, programmability, composability, and tokenization.

What is clear is that there are a lot more FPS in operation in the world than CBDCs, which is leading central banks to lean toward interlinked FPS systems for immediate relief to expensive and slow cross-border transfers.

While FPS may be useful in the short term for cross-border transfers, its low transfer limits and reliance on banks’ fee structures leave users at the mercy of banks.

As I said in Part 1 yesterday:

“Support for FPS is the equivalent of supporting the application of a band-aid to a cross-border payment system that is gushing arterial blood.”

Two related reads that you shouldn’t miss:

Also see the IMF’s analysis which I believe to be superior!

👉TAKEAWAYS

🔹 The choice between a retail CBDC or FPS, or both, is very contextual and will depend on the market features, ecosystem and implementation choices made in the past.

🔹 At least some of the central banks interviewed do see a role for both retail CBDCs and FPS. About half of the respondents noted a potential role for both.

🔹 Success is more likely if the central bank is clear about the objective before embarking on the implementation journey.

🔹 Involving all relevant stakeholders early in the process can help to get their buy-in.

🔹 An effective communication strategy with end users is especially crucial. One could argue that end users (consumers and merchants) constitute the most critical set of stakeholders in a retail CBDC and fast payment ecosystem.

🔹 While both FPS and retail CBDCs can play a role in financial inclusion, complementary policies are still needed. No matter how well-designed a retail CBDC system or FPS is, they are not a silver bullet.

🔹 For central banks considering both a retail CBDC system and an FPS, compatibility and interoperability are key.

🔹 Setting the price of payment services involves trade-offs. Interviewees noted that for both retail CBDCs and fast payments, it is critical to get the pricing for end users and PSPs “right”.

🔹 For either a retail CBDC or fast payments, operational resilience and cyber security are key.

👊STRAIGHT TALK👊

The BIS did a reasonable job on this report, but while it mentioned the lack of competition that FPS may bring, it didn’t go anywhere near as far as the IMF did in calling out the problem.

The IMF statement (below) matches China's real experience with the “walled gardens” of Alipay and WeChat Pay. The BIS did a disservice by not highlighting this significant problem in the report:

From the IMF: “Private FPSs can in some cases limit competition as they might restrict market participation. Concerns of this type have underpinned recent decisions by the central banks in the euro area, Sweden, and the United States to have an active role in the operation of their FPS.”

The key to understanding the FPS vs. CBDC debate is to recognize that CBDCs represent a new branch of technology that brings with it unique capabilities and a “replumbing” of the financial system. Do not expect everyone to welcome this.

CBDCs pose much higher risks for central banks and require them to build technology to put them in the spotlight, but not all want to take that risk.

FPS may require central banks to repair some of their internal plumbing, but it is generally far less disruptive to the financial system than a CBDC and allows central banks to retain a lower profile.

Central bankers love FPS for this. It’s simply less work, and I fear many will pass on CBDC to take the easy route.

CBDCs are for the brave, ask India, Brazil and China!

Please share on Substack with a restack!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work. Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!

There's another factor here which is the issue of resilience of national infrastructure. By having the parallel systems that is, a faster payment system that runs through banking networks and a digital currency system that runs over the Internet, the overall resilience of the payment system (which is critical national infrastructure) is significantly enhanced. The core settlement networks can, and do, go down from time to time albeit rarely. The near infinite amount of money that would need to be spent to make such systems 100% reliable makes the relatively small amount to be spent creating a CBDC look like pretty good value for money.